Leggi questo articolo in Italiano

Crypto and Bitcoin investments: institutional investors in retreat

By Davide Grammatica

Crypto investment products recorded weekly outflows of $508 million: institutional investors remain cautious about Trump's policies

Last week's figures

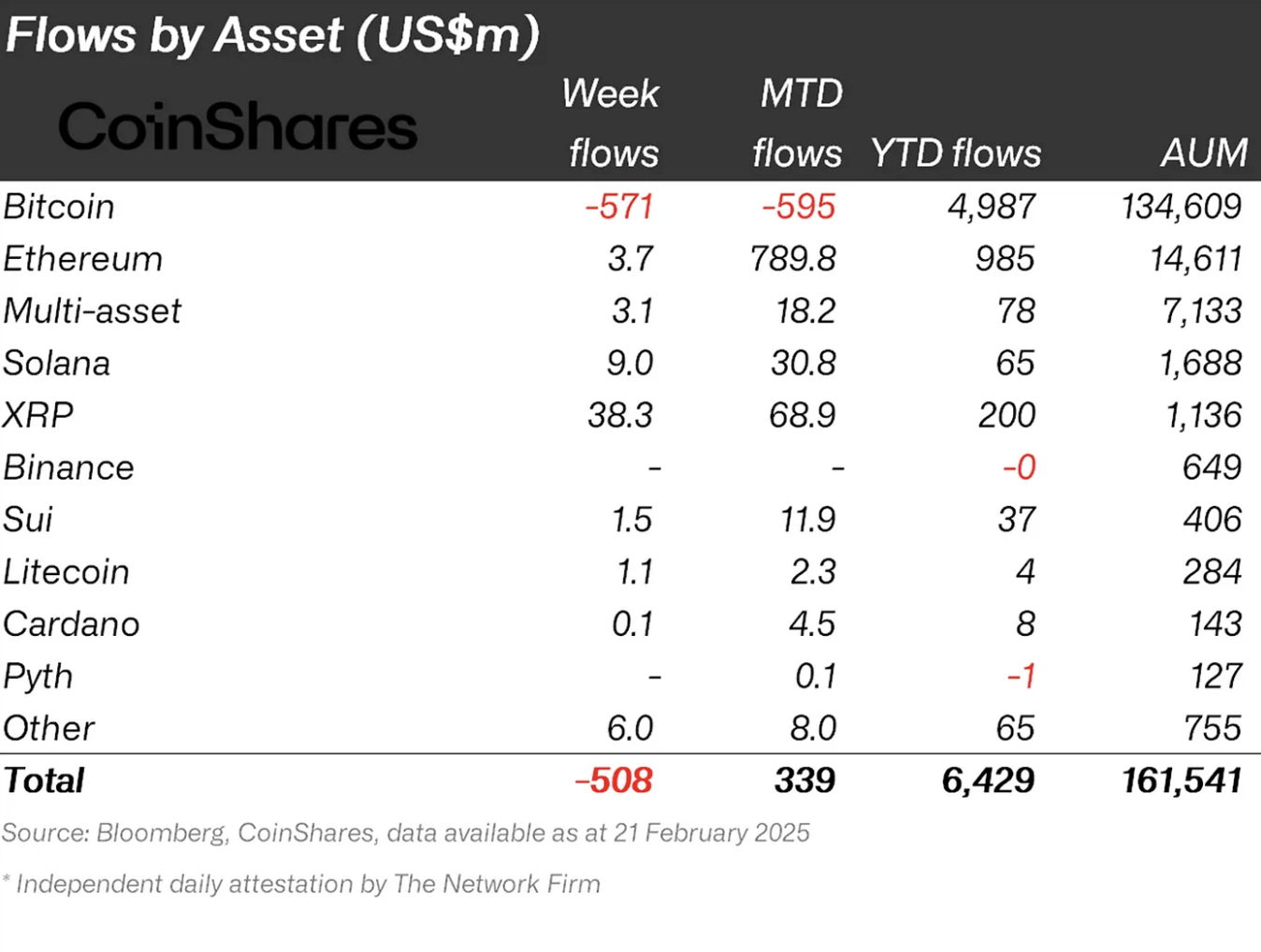

In the past week, cryptocurrency investment products have recorded a whopping $508 million in outflows. In the wake of a still unpredictable US economic policy, investors seem to be adopting a cautious approach, and this would have had obvious repercussions in the ETF sector.

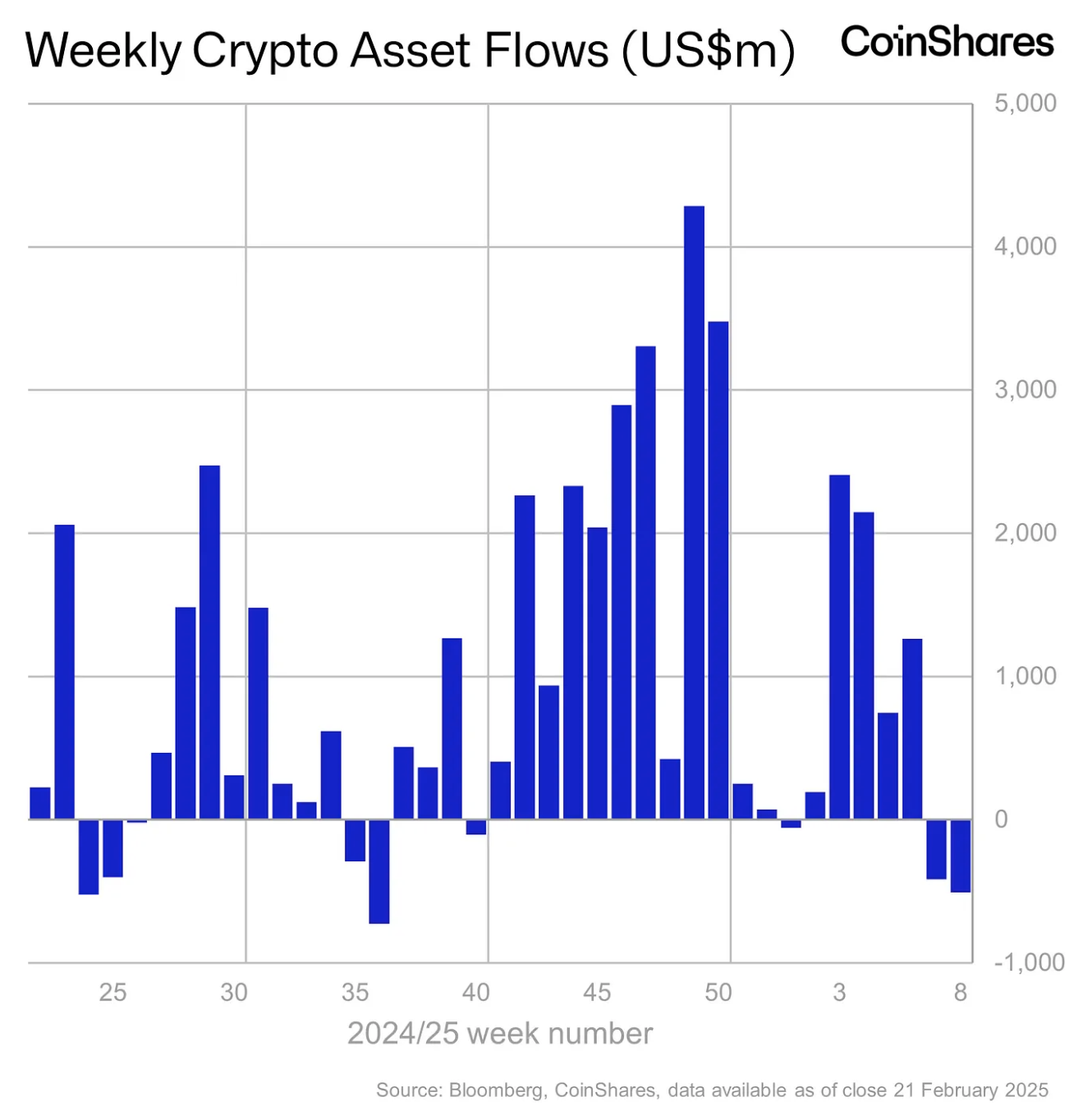

As CoinShares points out, this is the second consecutive week of outflows after a record cycle of 18 weekly sessions in positive territory, for a total of $29 billion in inflows. Clearly, a slowdown was bound to happen, and it coincided with increased uncertainty regarding the new US trade tariffs and its new monetary policy (which doesn’t seem to be curbing inflation).

Among other things, the volumes generated by products have also fallen sharply, from $22 billion two weeks ago to $13 billion last week.

The USA has the greatest impact on these figures, with $560 million outflow recorded in this area alone, while the European numbers remain positive, with Germany and Switzerland still recording inflow, $30.5 million and $15.8 million respectively.

Alts keep interest high

Only Bitcoin weighs on the balance sheet with $571 million in outflow, with an increase in attractiveness that also affected short products.

Surprisingly, many altcoins continue to record inflows. Among these, XRP in particular, with $38.3 million in inflow and a performance of $819 million since mid-November 2025. Solana and Ethereum follow closely behind, with 8.9 million and 3.7 million.

The ETF/altcoin narrative still seems to have traction with institutional investors, and the latest news from the Solana front seems to have reignited interest.