Leggi questo articolo in Italiano

Crypto investments: THIS macro data curbs inflow

By Davide Grammatica

Cryptocurrency investment products have seen a sharp slowdown to inflow in the wake of macro data from the U.S.

The data holding back investments

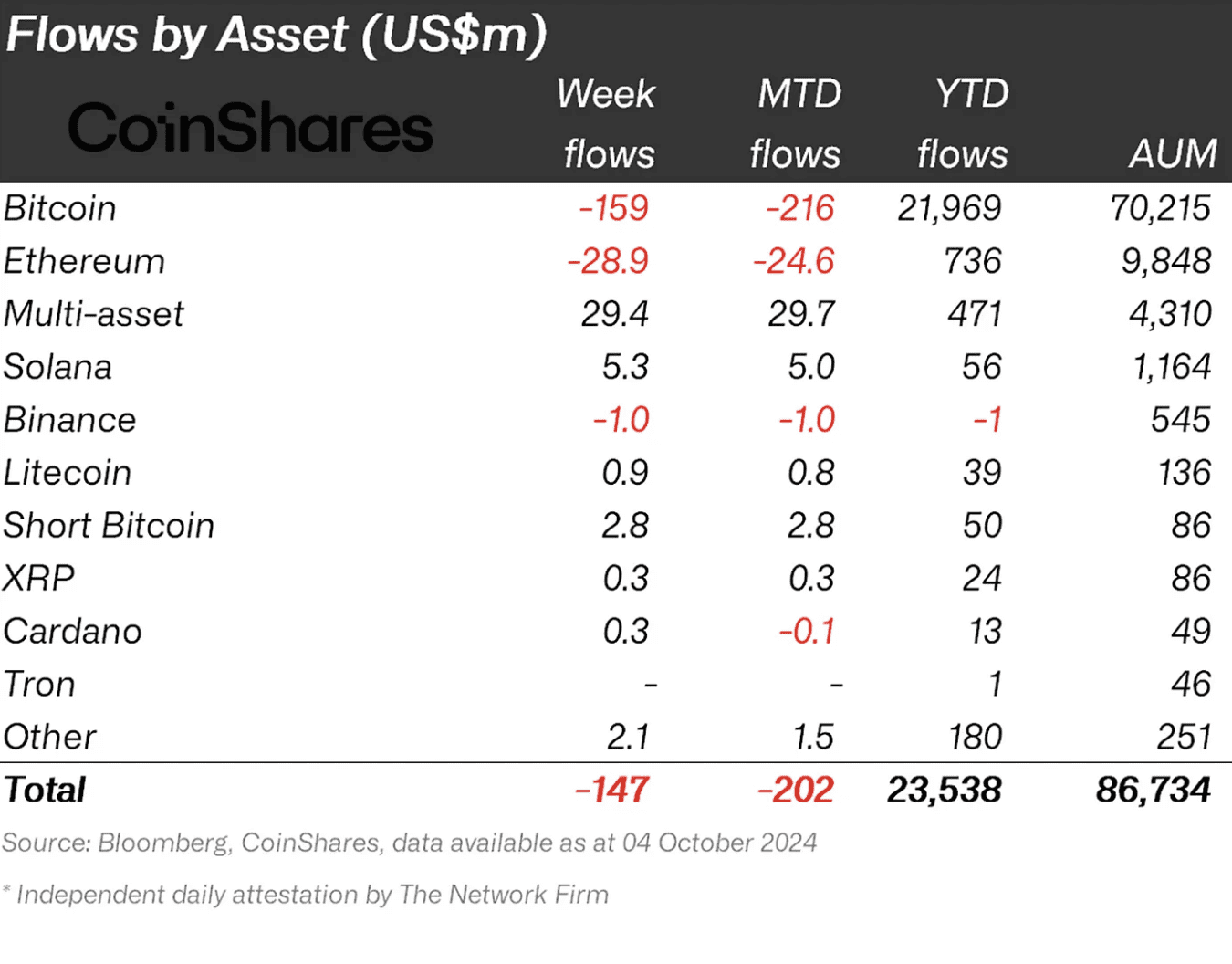

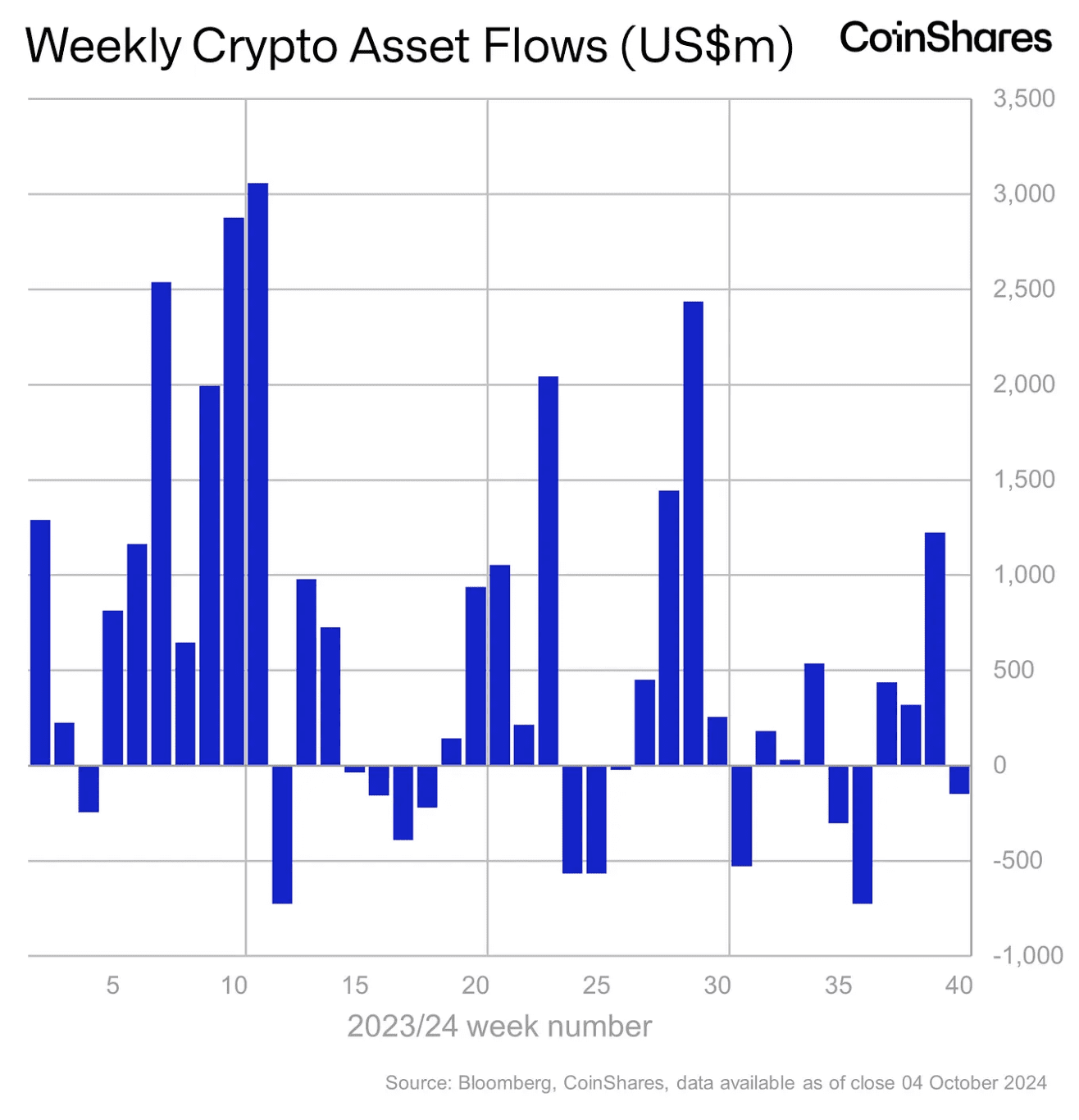

Over the past week, cryptocurrency investment products have experienced a sharp slowdown. As CoinShares reports , after a weekly round of more than $1.2 billion, the category reports outflows of about $147 million.

The reversal of the trend is due to a number of factors, but among the main ones are certainly the correction in Bitcoin ‘s price last week and the contraction of markets following the escalation of geopolitical tensions in the Middle East. And “stronger” than expected economic data in the US.

Better-than-expected U.S. unemployment data, especially, appear to have averted a new 50 basis point cut to interest rates. Investors have consequently taken a more cautious attitude especially with respect to “riskier” assets.

At least in the United States, since, in fact, in countries such as and Canada and Switzerland the trend continues to be positive, with $43 and $35 million inflow, respectively. On the other hand, the poor performance of U.S. products, starting with ETFs (only BlackRock‘s IBIT remains in the positive) has drowned the data from America, which marks outflows of $209 million.

Only multi-assets in positive

Bitcoin weighs on this figure with outflows of $159 million, but the trend does not spare other assets, starting with Ethereum ($29 million outflow).

Only the performance of multi-asset products remains positive, with inflows of $29 million and for the 16th consecutive week. Capital flows on other assets remain stable.