Leggi questo articolo in Italiano

Crypto investments: inflow “to the moon” pre-election U.S.

By Davide Grammatica

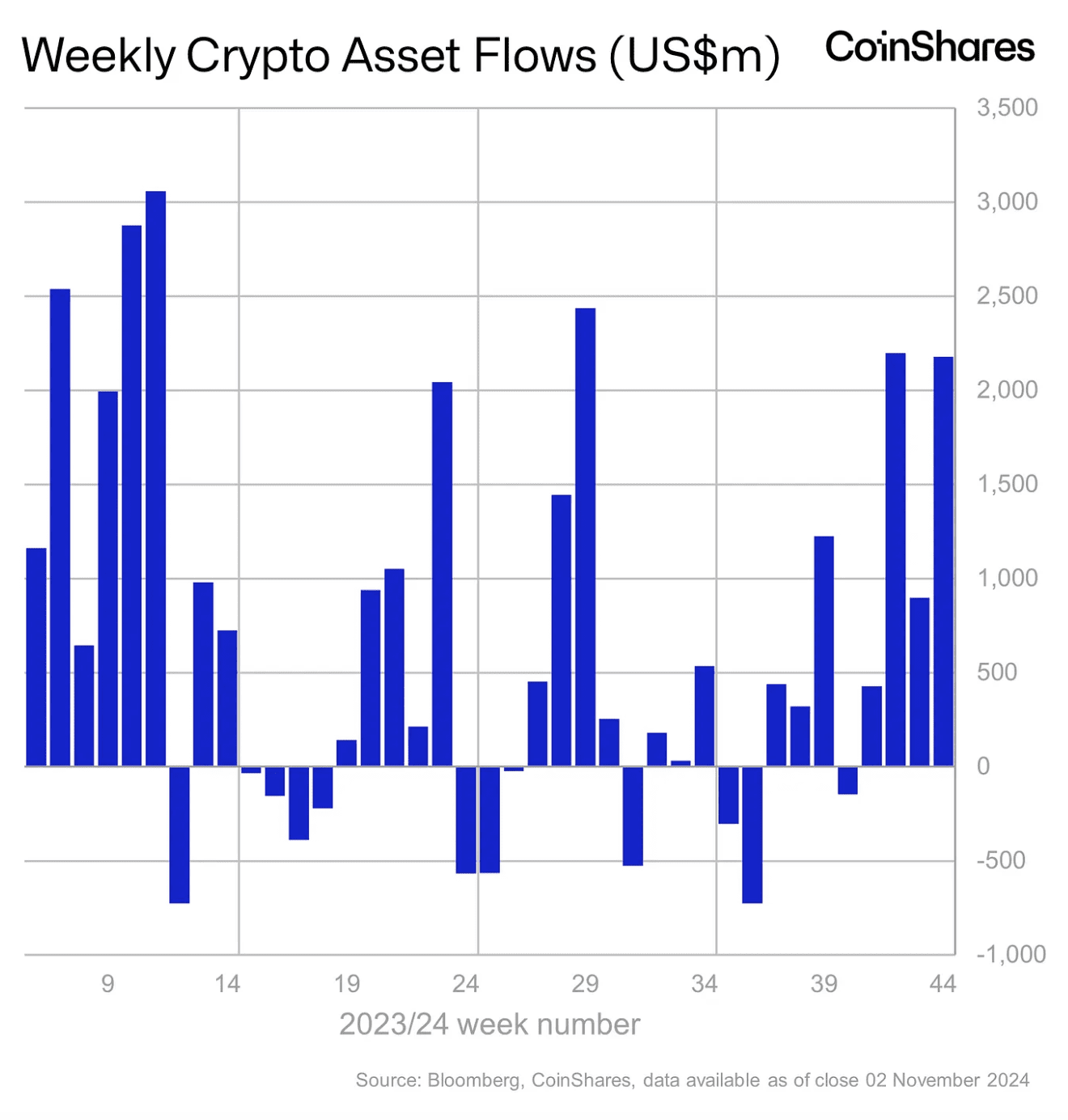

US election week opens on the back of record new inflows into crypto investment products: $2.2 billion in 7 days

Sector heats up just hours before US elections

The most important week in recent months as far as Bitcoin and its attempt to tap new ATH, opens with a strong institutional “push”, expressed in more than $2.2 billion inflow in 7 days via cryptocurrency investment products.

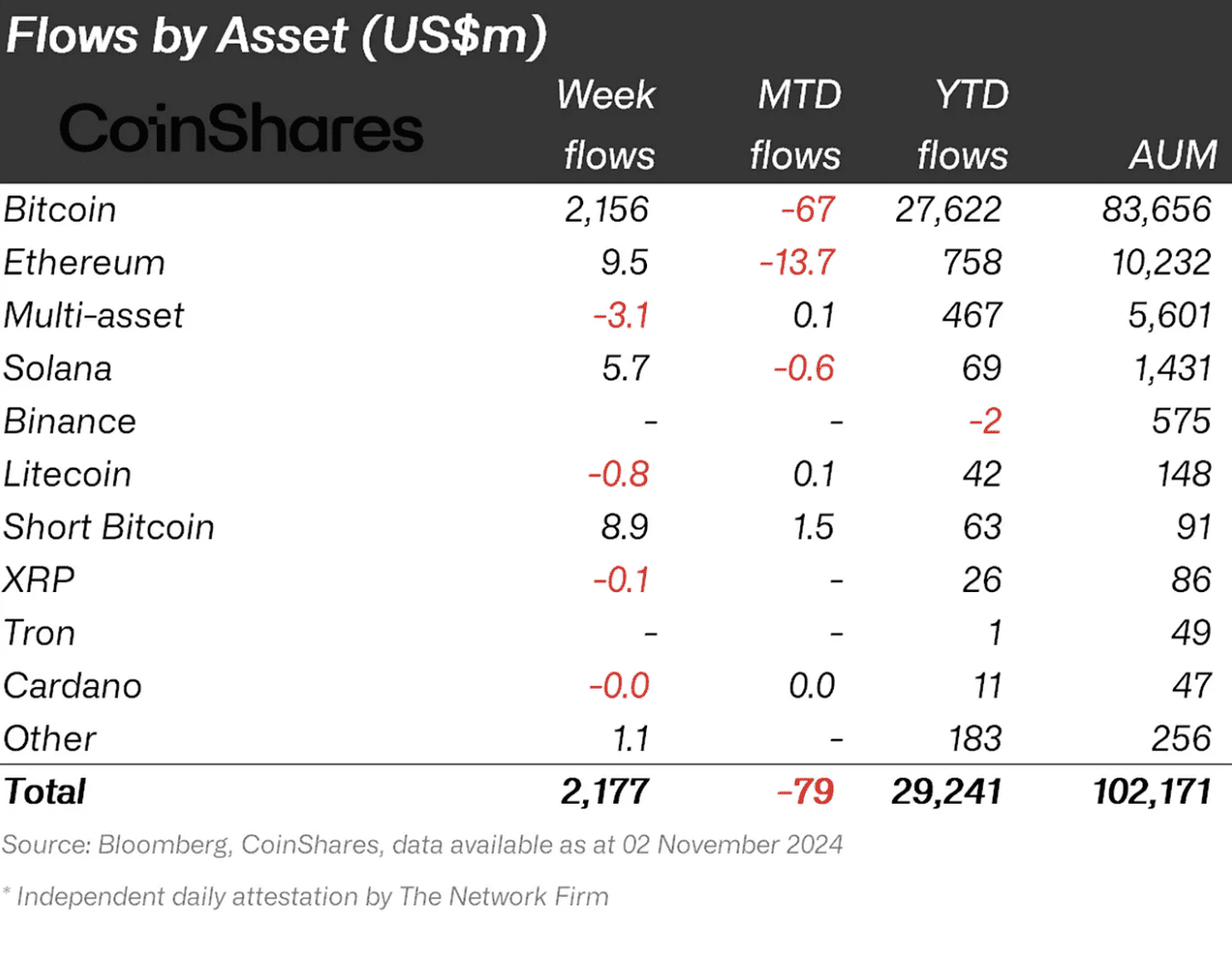

In the days when the U.S. elections may finally unseat BTC from the $68k to $70k price level, as CoinShares reports , total net-inflows in these products since the beginning of 2024 have touched $29.2 billion, for a total assets under management (AuM) worth over $100 billion. Similarly, trading volumes are also increasing significantly (up 67 percent on a weekly basis).

The euphoria around the elections means that the overall numbers are driven by what is happening in the U.S., with other countries’ numbers completely overshadowed. Indeed, the $2.2 billion inflow touched in the U.S. is incomparable with the $5.1 million recorded in Germany.

Altcoins give way to BTC

Benefiting from institutional action is, as we are wont to report, Bitcoin, which covers substantially all the capital inflow. And, as usual, it is always BlackRock ‘s IBIT that is the star performer in the BTC spot ETF sector.

Not keeping pace, albeit with $9.5 million inflow, Ethereum, which seems to suffer comparison not only with Bitcoin, but also with Solana, which without ETFs raises about $5.7 million.

The altcoin sector, while not in the spotlight at this time of great interest in BTC, continues to record “minor” inflow. Polkadot raises about $0.67 million, while Arbitrum $0.2 million. Negative, for once, multi-asset products, which lose $3.1 million.