Leggi questo articolo in Italiano

Crypto investments: inflow rides the “Trump trade”

By Davide Grammatica

In the wake of increasingly favorable US polls for presidential candidate Donald Trump, investments in cryptocurrencies grow

Last week's numbers

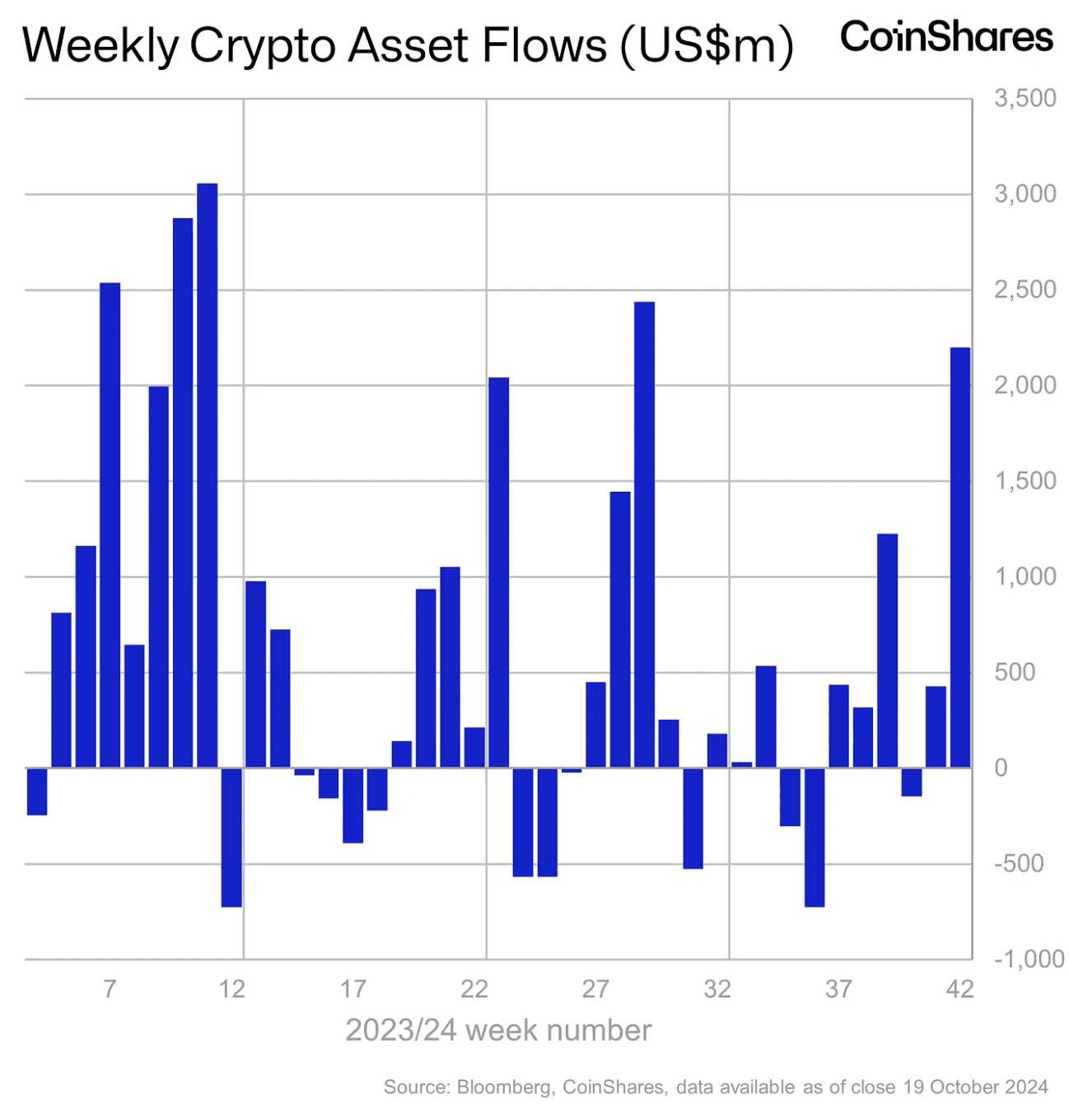

Investment products in cryptocurrencies, as usual CoinShares reports, recorded inflow of more than $2.2 billion in the last week. In reference to the approximately $400 million in inflows last week, this round marks the largest weekly increase since last July, at a time when Bitcoin seems to be finding more and more confirmation in its bullish set-up above $68k.

This scenario seems to stem, first and foremost, from polls regarding the upcoming U.S. elections that are increasingly favorable to Republican candidate Donald Trump. It is precisely the former president who is generally regarded as a political reference point for the crypto community, and an election by him is thought to foster the growth and development of the sector in the country.

At the very least, institutional investors seem to think so, due to an attitude that has led to a 30 percent increase in volumes and crypto assets under investment product management nearing the $100 billion mark.

That it is the U.S. that is driving its performance, then, is made blatant by performance in other countries, all of which are experiencing moderate outflows.

ETFs drive bullish sentiment

Bitcoin participates in total inflows with $2.13 billion, and, although contained, altcoin-related products also register inflow. Ethereum returns to the upside with $58 million in inflows, but Solana, Litecoin and XRP also report new inflows of $2.4 million, $1.7 million and $0.7 million, respectively.

Among ETFs, Blackrock ‘s IBIT once again certifies itself as being in a different league from the competition, and even Grayscale ‘s GBTC reports positive numbers.

It is negative unlike usual, however, the performance of multi-asset products, with $5.3 million outflow after 17 weeks of consecutive inflows.