Crypto exchanges

To be ready to operate in the cryptocurrency market, we add another piece to the series of tutorials on exchanges: KuCoin.

In this article we will discover this platform in detail. Starting with the basics, we will go into more and more detail, exploring the various features offered. Upon completion, KuCoin will have no more secrets.

There is really so much to say: let’s not waste time and start this tutorial now.

Index

KuCoin exchange in brief

KuCoin has several years of experience on its shoulders, as it was born in 2017. Considering the crypto landscape, we can describe it as quite experienced, especially when compared to some competitors. Where is KuCoin based? Like many such entities, the exchange is based offshore, in the Seychelles Islands to be precise.

On the security side, so far, the platform has always managed to ensure the integrity of users’funds, having never suffered attacks.

As for capital reserves, which should always be kept an eye on after the events of 2022, KuCoin independently keeps its proof of reserve updated, which can also be verified through platforms such as Nansen.

In addition, an external audit is also conducted periodically; the results are published directly on KuCoin’s website. Regardless, caution is still urged to avoid leaving funds on custodial wallets provided by the platforms.

Turning to functionality, the exchange is rich in it and is a good choice for investors and traders with even very different objectives.

It starts from the classic spot market, all the way down to derivative instruments and trading using bots. KuCoin’s offer is therefore interesting and keeps up with the industry trend: to provide as many services as possible to the customer, so as to make his life easier (as well as to keep him within the platform).

What is KuCoin used for?

KuCoin is a centralized cryptocurrency exchange that allows you to buy and sell coins and tokens. This is possible both by starting with fiat currencies (such as euros) and by trading other cryptos.

In addition to this traditional marketplace, KuCoin offers several services that are also suitable for more experienced traders and users (even complex leveraged instruments are reached).

In general, it is difficult for users not to find what they need, because KuCoin is constantly being updated and the range of features increases following what the market demands.

"KuCoin brings most users together, from novice investors to experienced traders"

How to open a KuCoin account?

The operation is very simple: from the homepage of the website, click on the Register button and follow the quick wizard to complete the registration in a few clicks.

If you want, you can open your account through our KuCoin referral, which entitles you to a 10% discount on commissions forever, as well as the chance to win a prize up to a maximum value of $500. The prize is delivered after your first transaction or deposit with a minimum value of $50.

KuCoin is an exchange that does not require the KYC recognition process (just email), as long as you do not want to deposit or withdraw fiat currencies. This makes it great for those who want to trade cryptocurrencies, or trade, without having to provide any paperwork.

Of course, not doing KYC comes with limitations. For example, the daily withdrawal is set at a maximum of 1 BTC, which can only be raised by completing the procedure.

After enrollment, we recommend securing your account. To do so, follow the instructions in the video tutorial at the end of the article.

Well, let’s get to the action and find out how to proceed with the purchase of coins and tokens on this exchange.

How to deposit on KuCoin?

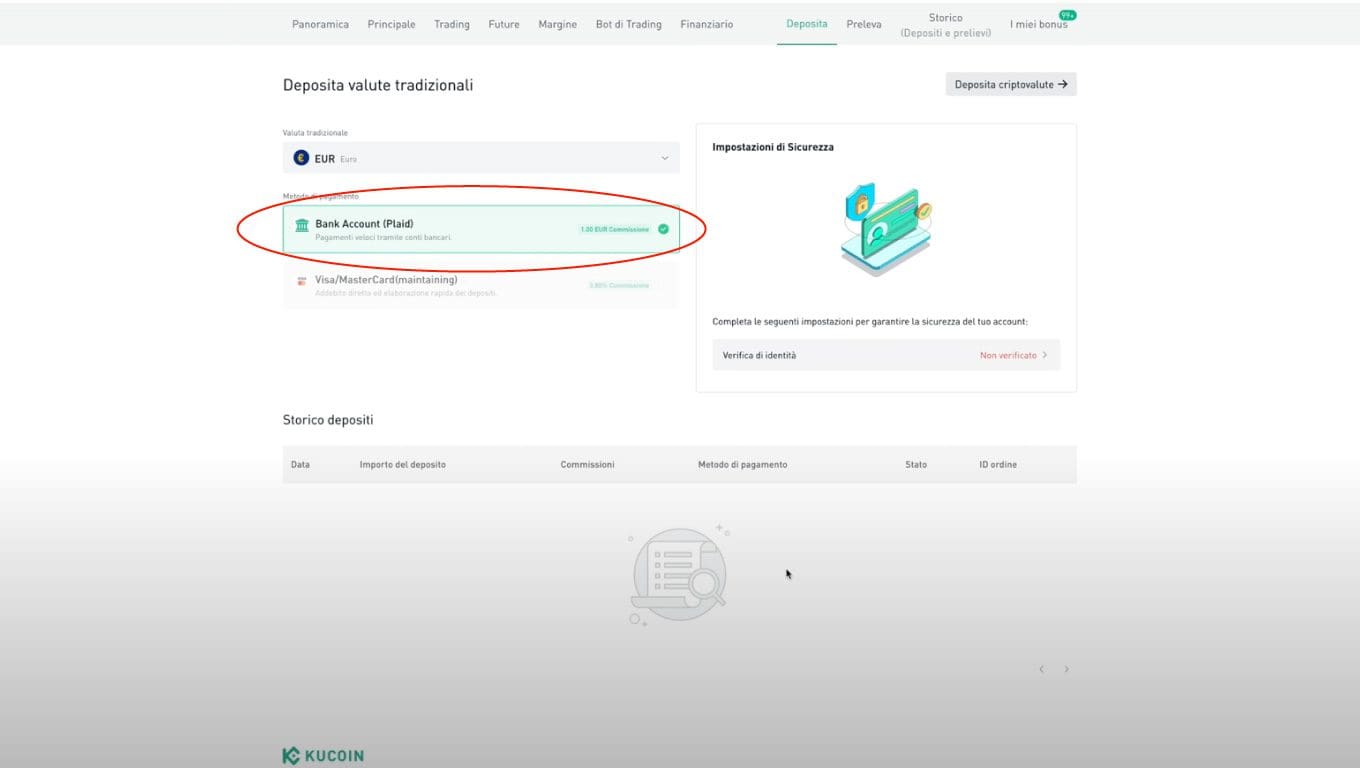

After logging into our account, we select from the menu located at the top the words Buy cryptocurrency. At this point a drop-down menu will open on which we are going to click Deposit fiat.

From the page we will have access to we can proceed. Basically, the procedure boils down to a window where we will find the bank details to which we will send the transfer. Be careful, however, to respect these two important points:

- Include in the reason for the transfer the code provided along with the recipient’s coordinates;

- Send the transfer from a bank account in the name of the same person who holds the KuCoin account.

KuCoin obviously also supports credit and debit cards on Visa and Mastercard circuits. The fees go up and vary, but they are certainly higher than with a bank transfer. On the other hand, however, you save quite a bit of time, as there is no need to wait the canonical 2 to 3 days. Unless there is an urgency dictated by one’s operations, we recommend always using the bank transfer, so you can save money.

Finally, it is possible to deposit cryptocurrencies already in our possession into the KuCoin account. At the time of writing, the fees are zero. Of course, however, we will have to incur gas fees, which vary depending on the network (for example, they will cost more on Ethereum than on Arbitrum).

To deposit cryptocurrencies, we access the KuCoin wallet from our account. We select the coin/token we wish to deposit, the network and display the address. After that we will need to perform a normal transaction from the wallet on which we hold the crypto in question to the KuCoin wallet. See the article on wallets just linked for more information.

How to withdraw money from KuCoin?

Exactly as with deposits, withdrawals can also be made using cryptocurrency or traditional currency.

In the first case, the process is reversed from depositing:

- We select the cryptocurrency we wish to withdraw from our KuCoin wallet (we find it from the Account -> Main Account item, located at the top right of the bar);

- We click on the word Withdraw;

- We paste the address of the wallet to which we intend to spin the crypto;

- We select the network; Extreme care must be taken not to make mistakes: the sending network must match the receiving network (e.g., Ethereum to Ethereum), or the entire amount may potentially be lost;

- We indicate the amount.

After confirmations we will have completed the process.

Fees vary depending on the network and gas fee trends. We can take note of this before proceeding, so we will not have any nasty surprises.

Moving on to fiat currencies, the quickest way to proceed is from the Buy Cryptocurrencies -> Quick Trading menu item. Here we will be able to decide which cryptocurrency to sell and what currency we will receive in return. By opting for theeuro, we will have a way to select one among several withdrawal methods.

Unlike cryptocurrency withdrawal, fiat currency withdrawal requires mandatory KYC procedure.

How to use KuCoin?

Let’s explore the functionality of the platform by starting with the most basic one: how to buy crypto on KuCoin?

We have three avenues at our disposal: one is Quick Trading, accessible from the Buy cryptocurrency menu item, suitable for those who have fiat currency as their base; another is Spot Trading, which we will discover shortly; finally, here is the Convert solution.

Convert

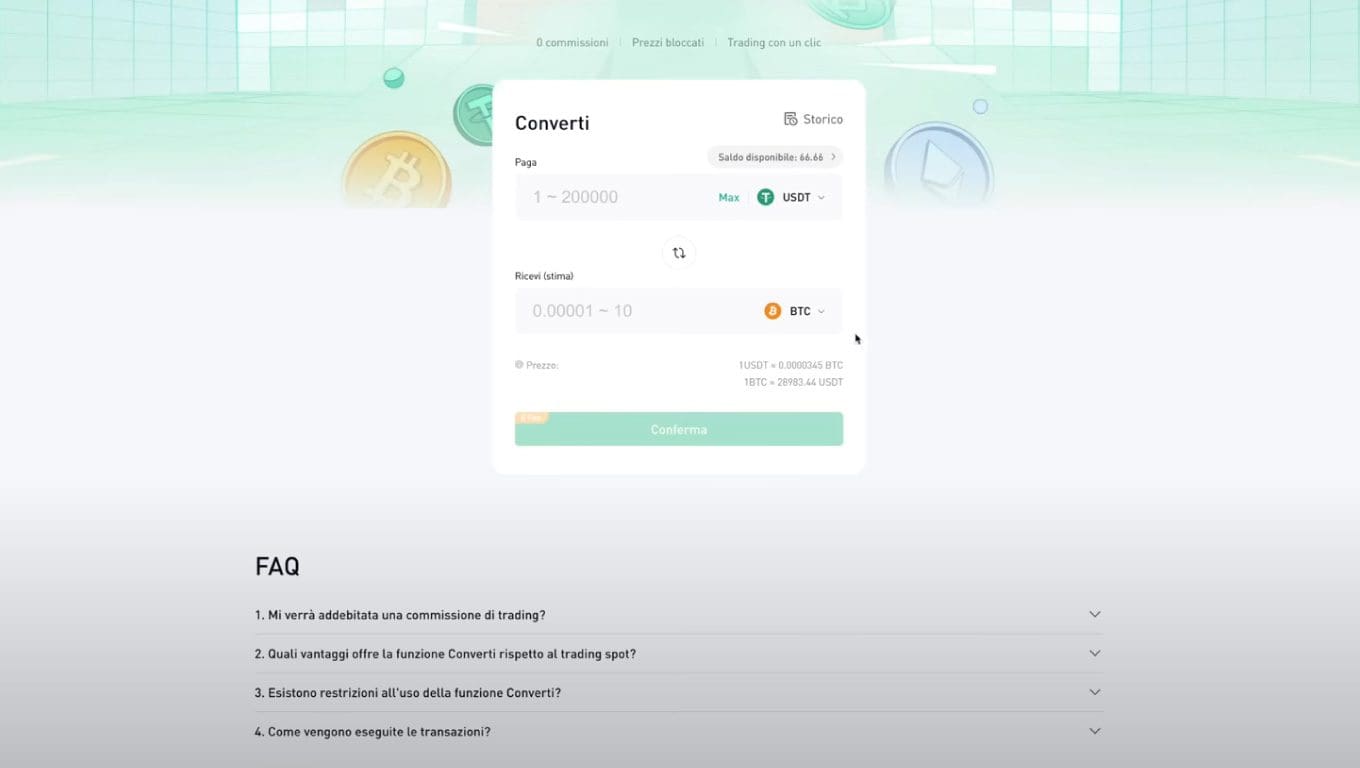

From the main menu, we select Trading and then Convert. Here is the interface that will appear on our screen:

Well, in this case there is really little to explain: in the topmost line (Pay), we indicate the crypto in our possession with which we are going to precisely pay; in the bottom one (Receive) the one we will get in exchange.

We will just have to pay attention to one thing: even if we find the words 0 Fee on the confirmation button, some spread is still there.

Spot Trading

Let us now look at Spot Trading, a service that is definitely more advanced than the previous one.

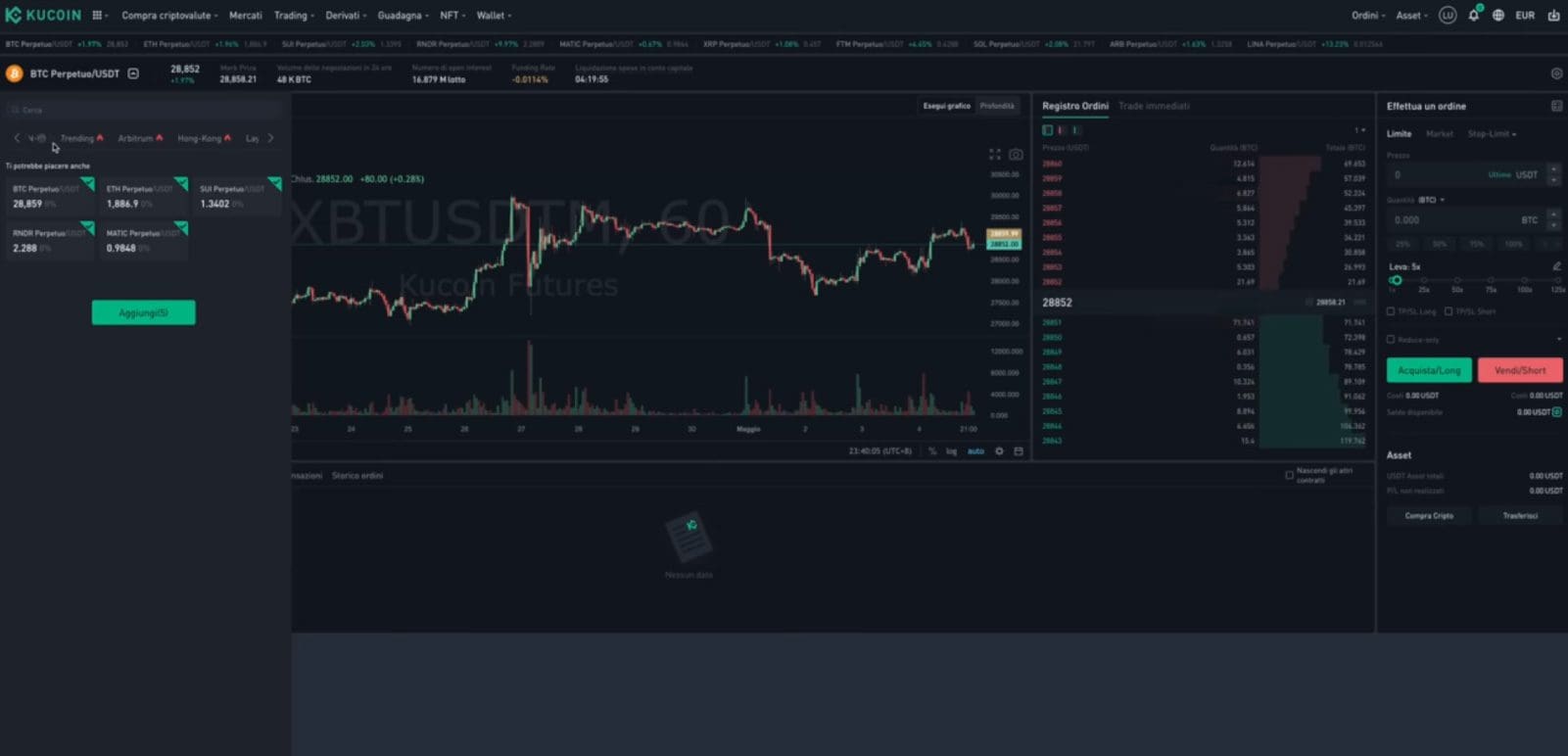

The screen looks like the classic professional interface, suitable only for traders with some experience:

In order to get started, we select the trading pair on which we intend to trade. We can do this from the upper left corner. In the image we have captured the moment when the menu opens from which to choose the pair; we have several available, both crypto/crypto and crypto/fiat.

Convenient is the categorization, such as NFT, which includes all the coins and tokens supported by the exchange and related to this world.

Going back to the interface, by default we will find the screen divided into several areas.

Most of the space is rightly taken up by the chart, which is fully customizable thanks to the built-in tools. If it looks familiar, that’s normal: TradingView operates behind the scenes.

Below we will have an eye on the balance, open orders, closed orders, history and so on. Very useful for keeping track of our trading.

On the right side space for the orderbook and, of course, the area from which we can set an order. Nothing different when compared to other exchanges that provide the advanced trading interface.

Types of spot orders

The spot order is divided into several types: Limit, Market, Stop Limit and Stop Market.

Market is an order at market price, either buy or sell. In fact, we take what the order book already offers, without bothering to set limits.

In contrast, the Limit order allows us to decide at what price to sell or buy. In this case we go to fill the order book, because we offer a sell/buy at a certain threshold.

Finally, stop orders, which can also be sell or buy. If you are not familiar with the differences, we recommend you check out this article on types of orders in trading, where you will find all the answers you are looking for.

Futures derivatives and levers

For those who want to go further, KuCoin also offers futures derivatives.

This type of product is not available on all the trading pairs seen above and requires experience. In addition, the interface changes slightly from that of the regular spot market.

Given the sensitivity of the instrument, we recommend watching the video at the end of the article: it contains a section devoted entirely to KuCoin futures.

Here we will simply reiterate that it is not a suitable trade for the inexperienced user or one with low risk tolerance, especially when particular levers are involved. In any case, with the right amount of study, futures can be a viable way to trade cryptocurrencies.

KuCoin BOT trading.

We close our overview of KuCoin’s features with BOT trading, a service that is increasingly present on centralized exchanges. Thanks to it, investors can set up automated strategies that aim for efficiency; however, let’s not forget that there always remains the risk of cashing in losses, impossible to avoid!

KuCoin’s BOTs follow different settings: from the classic grid, which continuously buys/sells to maximize returns, to DCA, automatic rebalancing, and even Martingale. Some settings are less risky, while others push on the accelerator: greater opportunities for gains are matched by equally increasing dangers. In short, not something for everyone.

For this product, too, we recommend weighing the pros and cons well, and avoiding becoming enticed by the potential income without fully understanding the risks.

In the video we test the various BOTs a bit, seeing how to set them up and also how to place stop orders to protect our capital. If you are considering using KuCoin’s automated trading, watch it carefully.

KuCoin exchange commissions

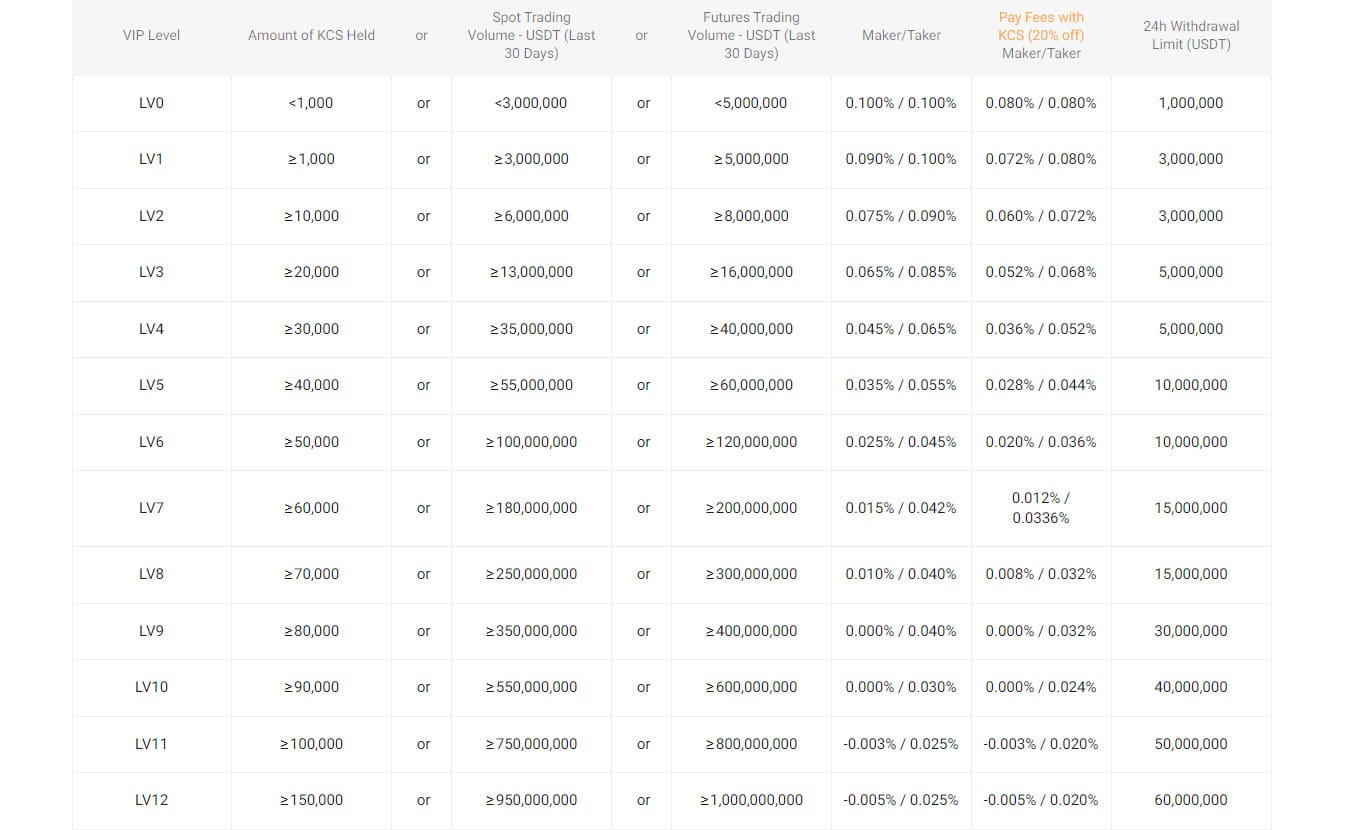

Commissions (here the official webpage) vary depending on the type of trading. Let’s start with the most widely used one, which is the traditional spot market.

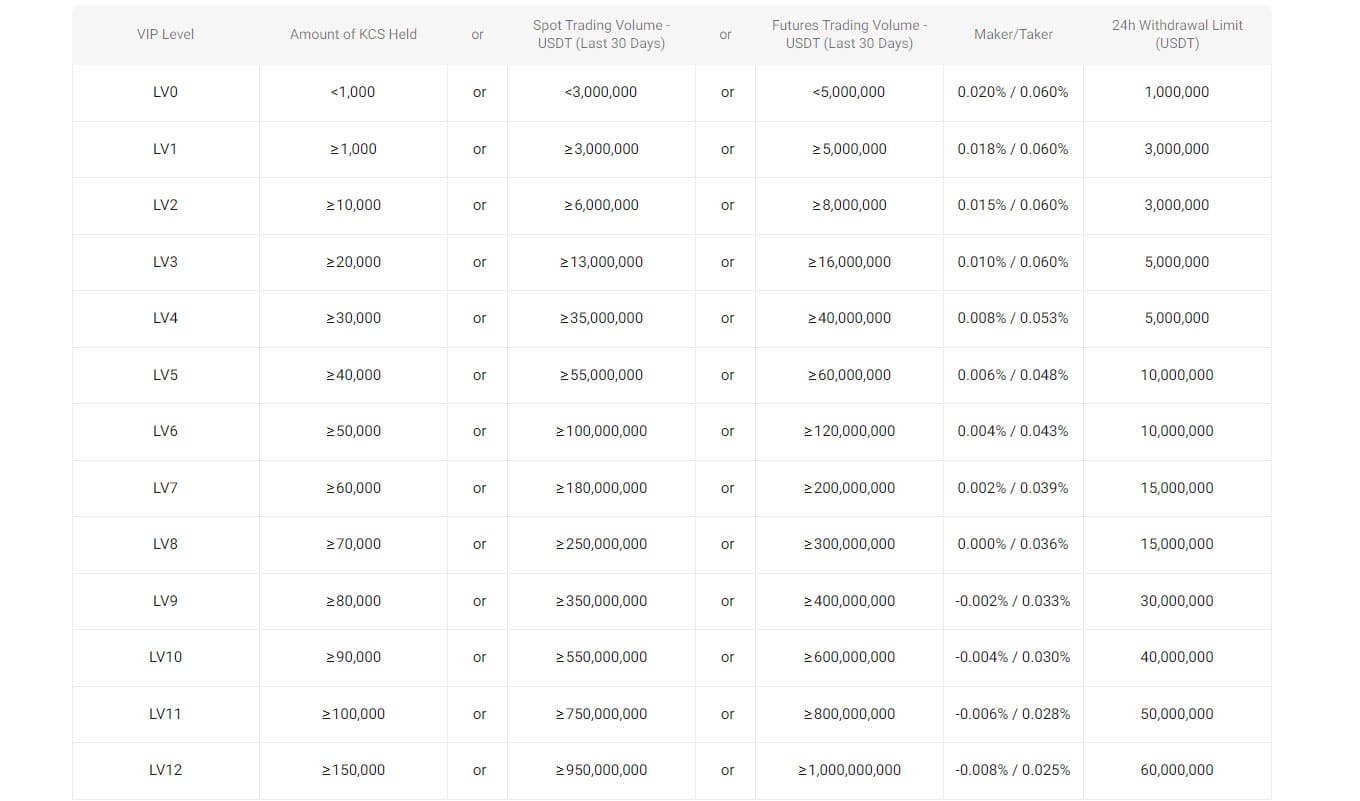

The base fees are 0.1 percent, currently identical to those of Binance. Satisfying one of the following three conditions provides access to a level that ensures lower fees:

- Possession of a certain amount of KCS (KuCoin’s crypto) in the past 30 days;

- Spot trading volumes;

- Future trading volumes.

In addition, paying commissions in KCS entitles you to a 20% discount. We therefore recommend holding a few euros in this crypto so you can benefit from the rebate.

In addition, you can knock 10% off the fees by signing up for the exchange through our referral. The discount will remain forever, regardless of volumes moved and KCS held.

One last note: coins and tokens on the platform are divided into three classes (A, B and C). The first is the one that houses most cryptocurrencies, while the other two cover lesser-known or more exotic realities. Class A provides the lower fees, which then go up in B and touch the maximum (0.3 percent base) with group C.

Images last update: september 2024

Let’s move on to futures trading fees. Plain and simple: 0.02% Maker and 0.06% Taker base, with the possibility of lowering them using the same mechanisms as before.

Only difference: paying commissions in KCS will not entitle you to the 20% rebate.

As for withdrawals and deposits, we have already discussed them in the dedicated paragraphs.

Conclusions

Now you should know much more about KuCoin. If you want to start using this exchange, here is our KuCoin referral link to sign up: it entitles you to 10% off commissions and mystery boxes worth up to $500.

Despite the high security standards, as with any centralized platform there are risks. Therefore, be careful about leaving large sums deposited on the exchange. In addition, we recommend avoiding operations on complex instruments without proper prior knowledge and experience.