Cryptocurrencies, privacy and the role of Monero

Let’s talk about Monero and its coin XMR.

Blockchain is a truly amazing technology and one that allows assets to be moved quickly and safely. Another plus point concerns privacy. In fact, a crypto address does not require any documents or names to be created and managed.

At the same time, however, it is almost impossible to launder money or otherwise from illicit activities. This is due to the total transparency of the blockchain that makes every transaction perfectly traceable. Therefore, although the addresses do not have a linked identity, it takes very little to bring down this wall.

For example, if a ransom was paid in bitcoins, they could be tracked in every movement. The moment the BTCs ended up at an exchange, well, that would be the end of the story. In addition to the immediate freezing of the funds, one would also have a name, namely that of the account holder on the exchange. If the identity were false, the dirty bitcoins would still be taken out of the hands of the miscreants.

Therefore, cryptocurrencies such as bitcoin and Ether provide good privacy and security from illegal movements.

However, transparency is not always a good thing. If we had a friend’s address available, we could find out his balance and movements in a few clicks. The same of course applies to a complete stranger: in a trade made in bitcoin, he could pry into the status of our cryptocurrency funds.

Very little is needed: the address. As we know, to carry out a transaction we are obliged to spread it, there is no alternative.

Or is there? After all, we are dealing with sensitive issues, and it would be nice to prevent other people from knowing how much and what we have in our wallet, just as it happens by bank transfer. The solution to the problem is called Monero, the coin that guarantees total privacy and anonymity.

Index

What is Monero?

Monero is a cryptocurrency based on the open-source CryptoNote protocol, designed to preserve the anonymity of its users. This can be of great importance in certain contexts.

Let us take a step back and return to the bitcoin example, introducing traditional currencies as well.

A €10 bill always has that value. If we exchanged it for another, although the serial numbers are different, we would still be in possession of €10. This makes these banknotes perfectly fungible and interchangeable with each other.

Bitcoin is a little different. Yes, we can send 1 BTC and receive another in return. However, the construction of the blockchain makes possible widespread traceability that potentially jeopardizes the anonymity of the user. Indeed, the movement history remains available for eternity, exactly the opposite of what happens to a bank bill.

Monero is a cryptocurrency designed to protect people’s privacy. To do this, several technical solutions are employed, which we will discover in a few lines.

The project has its own blockchain based on the Proof-of-Work consensus algorithm. In contrast to bitcoin, XMR (ticker of Monero) mining prefers classical CPUs. This move is no accident: in addition to privacy protection, Monero stands as an egalitarian alternative. Anyone can therefore mine Monero coin and contribute to the normal network process.

"Monero makes privacy its workhorse, but we will find that it is not only a positive aspect..."

Monero blockchain: how it works

The Monero blockchain is deliberately constructed to be opaque.

Users’ transactions are mixed into a single pool. From the outside you can only see this but not the details about the individual transaction: sender, receiver and wallet balances remain totally obscured. Exactly the opposite from many other realities.

The two pivotal elements that enable this level of privacy are ring signatures and stealth addresses.

The former, translated into “ring signatures,” protect the sender of a transaction by concealing the sender’s identity.

With each transaction, Monero combines the user’s keys with the public keys of the blockchain itself. In doing so, it becomes impossible to trace back to the person: there is nothing that can be traced as there is on other networks.

Instead, stealth addresses are designed to ensure the anonymity of the receiver. This gimmick generates with each transaction a disposable address on which to send assets, obscuring the recipient’s real one.

Clearly, decidedly complex mechanisms operate behind the scenes, difficult to summarize and explain in so few lines. The key point to make ours is that Monero armors privacy and anonymity.

Monero Tokenomics

The coin Monero has no maximum supply.

Although there is no ceiling, the release of new Monero is so slow that it does not produce significant inflationary pressure. The issuance schedule has two phases:

- Main curve: lasting until May 2022, about 0.8 XMR per block. Just over 210,000 per year: issuing a block takes two minutes.

- Tail curve: from May 2022 onward, 0.6 Monero/block, timing always two minutes. Less than 158,000 new XMRs per year.

Tail curve issuance phase brought negligible annual inflation of less than 1 percent. Incidentally, given the increase in supply, this figure will go down year by year.

Why hasn’t the supply been capped? The Monero team argues that miners need a premium to continue their work. Without them, the blockchain could not work. The 0.6 XMR per block represents just such a reward.

Monero price trend has experienced several ups and downs over the years, and can be framed in five macro-trends:

- 2014-summer 2016: first phase, uneventful.

- Summer 2016-end 2017: powerful bull run with the price rising from under $2 to around $470!

- bear market 2018-2019: past theeuphoria on cryptocurrencies, Monero also experienced a long bearish trend. However, the price remained above $30, a significant rise from the first phase.

- super pump 2020-2021: a strong bullish wave with new all-time high above $480.

- 2022 bear market and subsequent laterality continuing to the bitter end.

- present and future: to be deciphered

XMR million question: is Monero a good investment? The crystal ball is always a myth and it is impossible to provide an answer. However, we can highlight a few things to consider.

First, Monero is a serious project, not just any scam or shitcoin. This cryptocurrency has proven to be a viable reality and its more than 10 years of age legitimize it.

The downside lies precisely in its strength: anonymity. This in fact can be a concrete obstacle to widespread adoption, especially by institutions and companies that need to be as transparent as possible instead. We will return to this issue in the next section.

So, to each his own considerations. We repeat: Monero is nonetheless a serious reality and could be part of an investment strategy.

On the topic, here is some advice about building a crypto portfolio and the steps to take to develop a good fundamental analysis.

Here is the TradingView XMR/USDT chart to trak Monero price:

Strengths and weaknesses of Monero

Let us summarize what we have seen so far in terms of pros and cons.

Monero protects privacy, and this is certainly a positive aspect. Indeed, the idea of being able to buy something in Solana or Ethereum, knowing that the counterparty can find out our movements and balance, is not the best.

XMR protects us: we send and receive funds without having to worry, no one outside of us will be able to know what crypto we have, in what amount, and what we do with it.

Monero could thus be a viable solution for anyone who wants to use cryptocurrencies without exposing themselves to the curious.

XMR is fully fungible, unlike many other coins that are not 100 percent fungible. One Monero is equivalent to another; there is no historical precedent.

As for transactions, they require relatively short time frames when we consider the type of consensus employed. Also, being precisely a Proof-of-Work blockchain, security is quite robust.

Last but not least, gas fees are quite low.

Let us now turn to the weaknesses of Monero, focusing mainly on privacy. It is unfortunately both virtue and flaw, let us see why.

From the perspective of mass adoption, it is hard to imagine that this coin can become widely used. In fact, transaction opacity is exactly what institutions and companies want to avoid, unless they have something to hide.

We are used to hearing politicians and inexperienced people claim that “bitcoin is anonymous ‘ and ’cryptocurrencies favor criminals”. However, we know that these claims are utter nonsense.

Unfortunately, for Monero, the argument is not wrong: by ensuring anonymity, illicit transactions can be covered up. Of course, not everything is so easy: suddenly receiving large funds on an exchange, a criminal should have a good cover to justify their origin. However, traceability is lacking, so there is one less obstacle to think about.

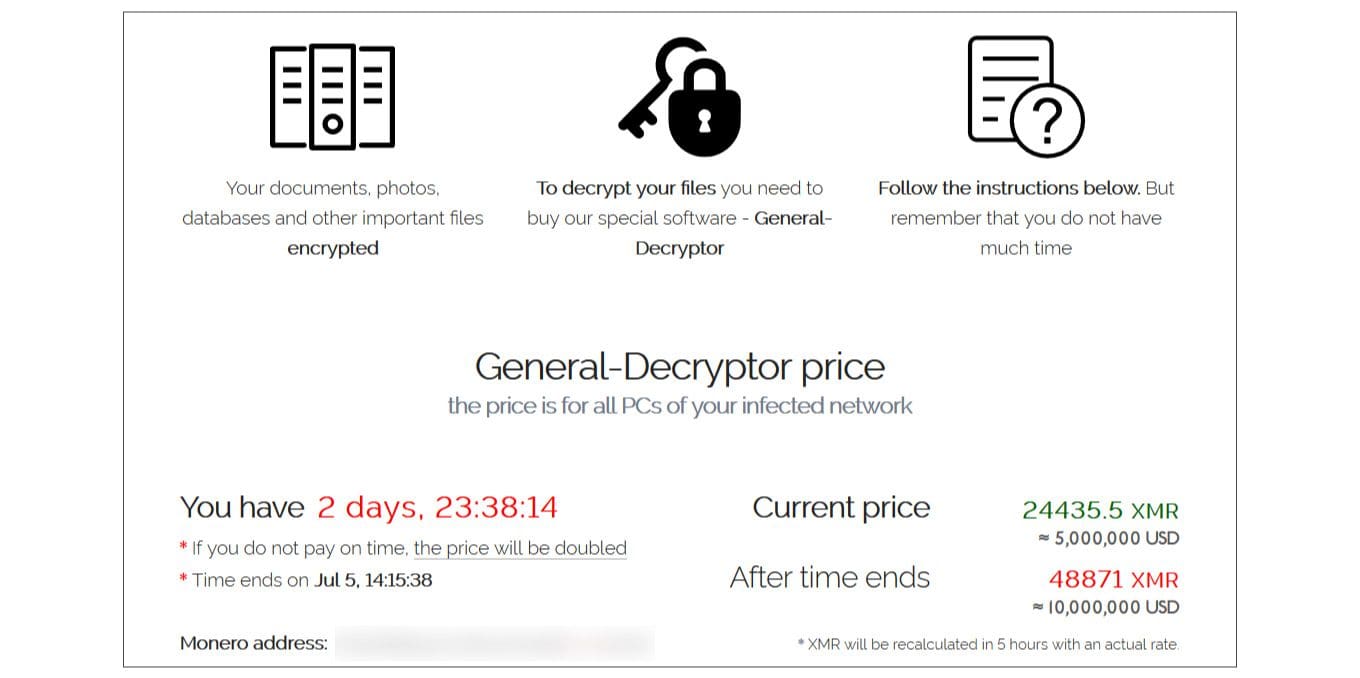

The data show what has just been stated: Monero is indeed the most widely used currency on the darkweb and in a variety of illegal operations, including cyber ransomware. Regarding the latter category, here is an image (source Wikipedia) showing a typical screenshot where ransom payment is demanded in XMR.

There, let’s repeat it again: this cryptocurrency is serious and with a definite design, there is no scam. The idea behind it is great because it is right to protect the privacy of every individual. However, as is often the case there is a rather dark downside.

"Privacy is a double-edged knife: on the one hand added value, on the other serious criticality"

Where to buy Monero?

Buying Monero is so easy.

In fact, this cryptocurrency is available on several major exchanges. At one time the first option was Binance, but the exchange delisted the coin in February 2024. Now the two main centralized marketplaces are Kraken and KuCoin.

By buying the coin on an exchange, you do not lose anonymity. In fact, moving the asset to one of the dedicated wallets enters the Monero machine and the transaction will not be linkable to our address. The only data one will be able to know concerns the purchase of XMR, after which all trace would be lost, a bit like when withdrawing cash at an ATM.

Monero wallet

Regarding the wallet, we have several software to choose from.

Monero GUI Wallet is excellent and available in both simplified and advanced versions. It represents a good compromise, suitable for everyone. Free, open source and developed by the community.

The more geeky will appreciate Monero CLI Wallet, probably the most customizable choice. Also open source and community-built, it is not suitable for the average user.

There are two mobile offerings: Cake Wallet (Android and IOS) and Monerujo (Android).

On the official Monero website are links to download all the alternatives presented.

We also have the opportunity to employ a hardware wallet. Ledger Nano X, Flex and Nano S Plus interact correctly with all the software just mentioned. Trezor Model T , on the other hand, does not support Monerujo.

Want to increase the security of your cryptocurrencies but don’t have a physical wallet? Purchase a Ledger!

Monero: anonymous cryptocurrency between lights and shadows

Monero would probably be the best cryptocurrency if we had a goal of protecting our privacy.

Being totally fungible, it is the most similar asset to circulating banknotes. There is no history behind a particular specimen, or rather, no way to track it.

The blockchain is well constructed, secure and open source. In short, there is no shortage of positives. Unfortunately, we also found some critical aspects, related precisely to the lack of transparency.

While Monero protects privacy, it can also be a medium of exchange for evildoers and criminal organizations. This heavily influences its adoption and institutional recognition. One would think that this coin could be among the first targets in the event of regulatory tightening-there would be all the evidence to support such action.

That said, at the moment XMR is a cryptocurrency with good capitalization and fairly well used. As always, the future is uncertain.