NFTs: the Non-Fungible Tokens

In 2021, NFTs were the main trend in the blockchain universe. The movement attracted increasing interest, which then became real FoMO, that is, the fear of being excluded from something. At the same rate, prices and total volumes traded grew, reaching figures above the insane limit.

The Ethereum blockchain, the heart of the NFT world, saw more and more transactions for these assets. This led to a surge in the cost of gas fees, which also reached several hundred dollars. A side effect that did not please network investors at all.

Despite this, collectors, speculators, and would-be speculators continued to trade, making the NFT niche a huge and richly proposed industry.

To understand the magnitude of this phenomenon, suffice it to know that Collins Dictionary elected as the word of the year 2021 precisely “NFT” (Non Fungible Token). Considering that we are talking about one of the most authoritative and widely used English language dictionaries in the world, not bad at all!

However, the ascent of tokenized creations is just beginning.

The year 2021 was one of frenetic growth but, at the same time, obvious speculative bubble traits. Numerous people with no knowledge on the subject entered NFTs just to “not miss the train.” Some soon abandoned it, content to speculate and make a profit in the short term. Others bought at the highs and still end up with hugely devalued assets today.

As with others in the blockchain world, probably the real boom is yet to come.

In the very near future, we might say almost present, interest in NFTs will become increasingly broad, knowledgeable, and informed. This kind of growth, less emotional and more solid, will spin off figures far beyond what we have become accustomed to.

We are currently seeing more and more brands and celebrities entering the NFT world, aware of the real potential behind it. And no, it’s no longer a bubble about something curmudgeonly; now there’s really so much more.

From Aston Martin to Snoop Dogg, Nike to DC Comics, all the major players in the industries that dictate fashion, interest, and lifestyle are now coming in. Then add collaborations like the one between Adidas and BAPE: a fusion of physical product (of limited edition shoes) and digital (NFTs that attest to their authenticity and offer a virtual version of them).

NFTs continue on the journey that will lead them to mass adoption. Before long, it will be common to have to deal with them by buying, selling or otherwise interacting with them in some way. In a number of contexts this is already the case, and the trend is clearly growing.

It therefore becomes essential to understand what we are talking about, and then to find out what the main applications are to date. Let us proceed to the next section and start the journey from what NFTs are.

Index

What are NFTs and how do they work?

Let’s start with the basics: what is the meaning of NFTs? NFT meaning: Non-Fungible Token, which is a token that contains some kind of data and has an identification code that distinguishes it from others.

It cannot be traded according to the equivalence principle, as can be done with Fungible Tokens, i.e., coins such as BTC or ETH, for example. To make it clearer: if we went to exchange one bitcoin for another, we would get exactly the same thing. In the case of NFTs it is not possible to do this, because each one is unique.

Now that the meaning of NFTs is clear, we can go further and elaborate.

NFTs are not easy to frame, and there are a variety of realities that can be transformed into NFTs; for example:

- A drawing, whether handmade and digitized or created directly with a graphics tablet;

- A video or film clip;

- A photograph of a famous painting, or its digitization by scanner;

- An animated GIF;

- A virtual object that entitles one to obtain the physical one;

- An armor wearable by a video game character;

- A virtual land of a metaverse.

The applications are indeed numerous, and we will look at some examples later.

For now, let us think of NFTs as virtual objects, characterized by rarity or uniqueness, each of which has its own identifier. Originality is guaranteed by being on the blockchain.

In addition, Non Fungible Tokens are equipped with metadata that can contain a wide variety of elements: from the artist’s signature to values such as attack and defense of a warrior. Even from this feature we can see their versatility.

Although they are present in numerous ecosystems, Ethereum is the realm of these assets.

Staying on this very blockchain, there are two types of non-fungible tokens:

- ERC-721: each token has its own contract. This is the standard that represents the very essence of NFT technology. A tokenized artwork is a perfect example.

- ERC-1155: one contract handles multiple tokens. This type is mainly used in the creation of a variety of NFT collections, such as collectible playing cards.

Both standards are widespread and generate staggering daily business volumes. NFT Art thus declines according to the use for which the token was intended.

Now there is also another standard, called ERC-404. It is a token that combines the characteristics of fungible and non-fungible, opening the door to liquid NFTs that can be exchanged as normal cryptocurrency.

A little history of NFTs

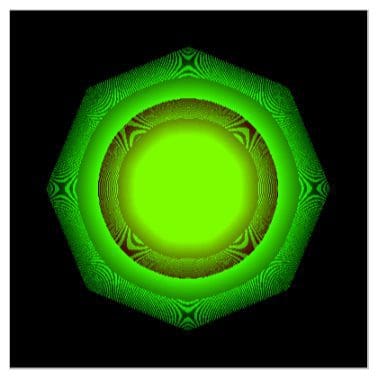

It all began in 2014 at the hands of Kevin McCoy, creator of what is recognized as the first NFT in history, Quantum.

This work consists of graphics that change totally autonomously and decided by the code itself. Here is a frame of it:

McCoy stated that his goal was to experiment and combine blockchain and art.

Quantum was employed within a presentation at the Seven on Seven conference on May 3, 2014.

The NFT was sold in 2021 by Sotheby’s auction house for $1.4 million (including commission). Impressive considering it was conceived as a mere experiment.

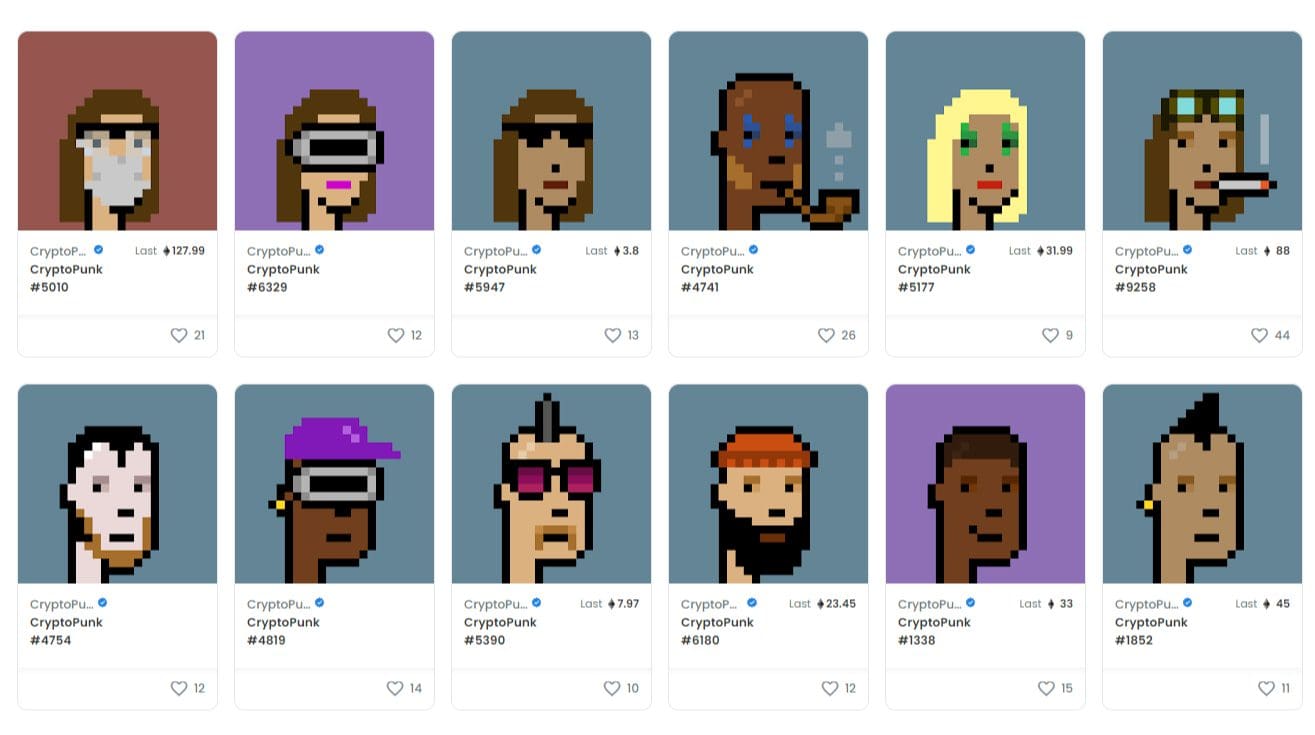

In 2017 came the CryptoPunks, the series of non-fungible tokens that continues to turn dizzying figures: suffice it to say that during the same auction mentioned just now, the buyer of Quantum sold a CryptoPunk for the modest price of $11.8 million.

CryptoPunks is an NFT project, a series of 10,000 NFTs depicting different characters, all generated through an algorithm.

Each CryptoPunk is unique-there is no other example from the same combination of colors and features.

Initially sold for a pittance, sometimes even given away, these bizarre pixel characters are now worth a fortune: on OpenSea, the leading NFT Marketplace until a few years ago, CryptoPunks NFT trading have moved a total of more than 1,250,000 ETH at the time of writing… impressive!

Continuing on our journey, impossible not to mention another top NFT project, Bored Ape: also created algorithmically, these NFTs depict monkeys wearing the most diverse objects. The phenomenon has even led to the birth of its own cryptocurrency: ApeCoin.

We don’t think there are only whimsical creations, however: the world of NFTs is also home to works of art created by world-renowned artists.

This is the case, for example, with a work by Banksy, whose original was set on fire after being tokenized. There, perhaps in this case it was taken a bit too far; it hurts quite a bit when you think about it.

NFT Art: beyond traditional works

Leaving behind burned monkeys, kittens, and Banksy, let’s look in detail at how art and NFT can tie together, giving rise to NFT Art in the narrow sense.

Let’s start by thinking of an illustrator, painter, or draftsman who ultimately makes a creation. By digitizing the work and making it an NFT, he/she would have a way to sell it through the many marketplaces available. Or he/she could simply make himself/herself known.

Either way, tokenization would also provide the certainty of protecting the originality of the creation, an advantage for both the artist and the buyer.

What’s more, it is possible to create and experiment freely, thus being able to express one’s art to the fullest without any limitations.

Photographers and videomakers can also use this world to their advantage to develop so many ideas and new ways of working. These are then joined by sculptors, actors, and performers in a wide variety of categories.

We could create a video depicting a tightrope walker and tokenize it: if community and critics appreciate it, there we will have succeeded in our intent to merge a technical gesture of the body with the world of art. This is something truly incredible if we stop and think about it.

However, a critical issue arises that is still difficult to solve: anyone could take a work created by someone else, create the NFT and then sell it without any problems. In fact, the token created is original. What is stolen is its content, and it is difficult for the artist to right the wrong. On this point, for now there is little that can be done and it will be necessary to find a method to protect the real creators.

The encounter between art and NFTs is not limited to traditional canons. In fact, the use of these particular tokens is also spreading to corporate settings, sports teams, and celebrities.

One example is the series of photographs of the Formula 1 team Aston Martin, available on Crypto.com’s marketplace. In this case, illustrations depicting the cars become works of art and project a racing stable into a whole new dimension.

There are no limits outside that of imagination. Such is the case with the Seventh Art, cinema: NFTs depicting scenes from famous movies are gaining momentum, merging different artistic fields and going so far as to weaken their boundaries.

Of course, not everything that goes around is valuable; on the contrary, garbage abounds. Original creations with their own aura are flanked by numerous achievements of pseudo-artists looking for easy money. Therefore, thorough research should be done before investing in digital art.

Overall, art can benefit greatly from Non-Fungible tokens. Real and digital works are not mutually exclusive, on the contrary: they can complement each other perfectly and offer something more complete than in the past.

NFT Ordinals

In 2022 Ordinals, NFTs on the Bitcoin blockchain, appeared on the scene. The latter is by nature an environment where development is not as smooth as for others (think Ethereum or Solana). However, thanks to the ingenuity of developer Casey Rodarmor, this important result was achieved.

Ordinals literally sent the Bitcoin chain into crisis, which was stormed by users. The numerous transactions led to high congestion and equally high gas fees.

Having overcome the hype, Ordinals found their place and are still part of the crypto and NFT world.

What are NFTs used for? Let’s discover some use cases.

Metaverse and NFT: the perfect match

Although art is a very fertile field, it is probably the metaverse that brings out the best in NFTs.

The metaverse is a virtual world that we can explore thanks to an avatar, going to merge real and digital.

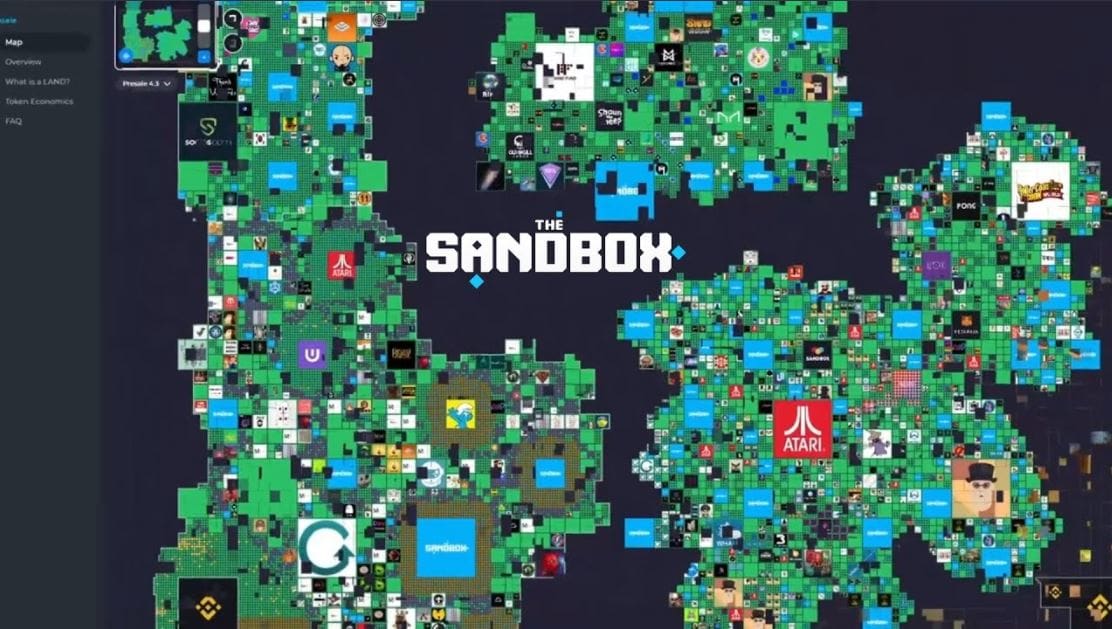

There are several highly successful examples such as The Sandbox and Decentraland.

Regardless of where we are, each of these realities houses lands (LAND), clothes, accessories, characters and tokenized objects, in fact exchangeable NFTs. That’s right: just as in real life, in metaverses you can buy pieces of land, goggles, skateboards and more.

Accomplice to Facebook’s name change to Meta, late 2021 saw a general surge in prices on metaverse-related NFTs, as well as coins.

The trend was already underway, however. For example, a small block of land on The Sandbox went from costing a few tens of dollars to thousands in a few months. The same was true for Decentraland.

Although the field is still in flux at the moment, often surrounded by excessive hype, the metaverse is expected to play a leading role in the future. The interest of companies and key figures is growing, as is that of the community composed of ordinary people.

In all this, NFTs play a crucial role: without them, there could be no buying and selling of items, lands and accessories.

Already, there are numerous users who scramble to secure rarities that they can boast about in the future, or simply resell for a good profit.

Several companies make branded NFTs instead: ever heard of Uniswap’s socks? Yes, they exist and are also worth quite a lot-who would have thought?

Then what about the lands on The Sandbox, purchased by giants like Atari, Adidas, and Binance? Well-planned marketing strategies that will bring immense visibility in not so distant times. We repeat: again, this is about NFT.

Speaking of the metaverse also trespasses into the world of gaming. The dividing line becomes increasingly blurred, if not nonexistent: the very aforementioned Decentraland and The Sandbox are both metaverses and real video games.

So let us move on to the next paragraph and find out more about them!

Gaming and NFT

In a metaverse like The Sandbox we can explore the world, interface with other avatars, and, why not, fight armies of monsters!

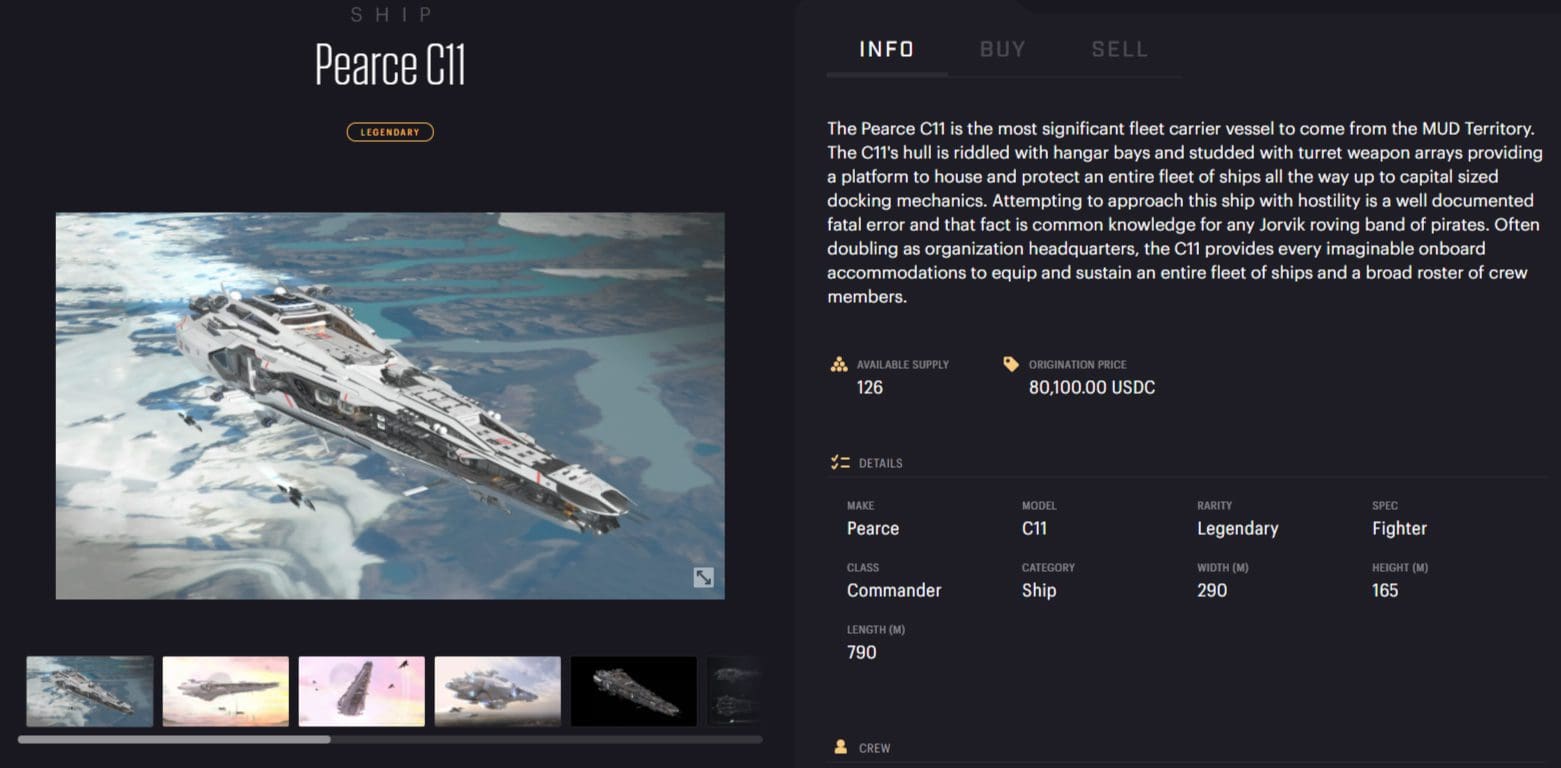

There are also other projects, some of which are highly anticipated such as Star Atlas (highly anticipated but remains in development for now). This is a game developed with the Unreal Engine graphics engine on chain Solana, featuring a coin with which to purchase items, weapons and even spaceships. Guess what? These items are nothing but NFTs, we’ve figured it out by now.

Although there is no known launch date (a long way off for now given the complexity of the project) prices are already skyrocketing, albeit down from the past. At the height of the bubble, a “Legendary” class starship could cost as much as a house in the real world.

Excessive? Absolutely so. However, it is the market that makes the price: where there is high demand and low supply, the figures balloon out of all proportion.

Star Atlas is a perfect example of the fusion of gaming and the metaverse, with NFTs leading the way. Players will actually enter a virtual world of space battles, planets to discover and chats with other characters. It will be something really interesting.

Moving on to more traditional video games, NFTs bring a breath of fresh air here as well.

In recent years, the (annoying) practice of microtransactions to buy levels, items, weapons and customizations has become common.

Until now simply purchased, this extra content could be tokenized and made exchangeable among players, going on to create a market within the game.

The applications are endless: one could go so far as to open a workshop that would make it possible to tune users’ race cars, going in and fitting tokenized upgrades and thus earning income.

Should we be worried? It depends, the important thing is not to overdo it.

Gaming fans know how expensive everything has become thanks to microtransactions and extra content. NFTs could be a viable alternative, allowing the player to resell or exchange what they no longer use. Of course, this point does not play to the advantage of the production houses, but some have already shown a willingness to go the Non Fungible Token route, see Square Enix.

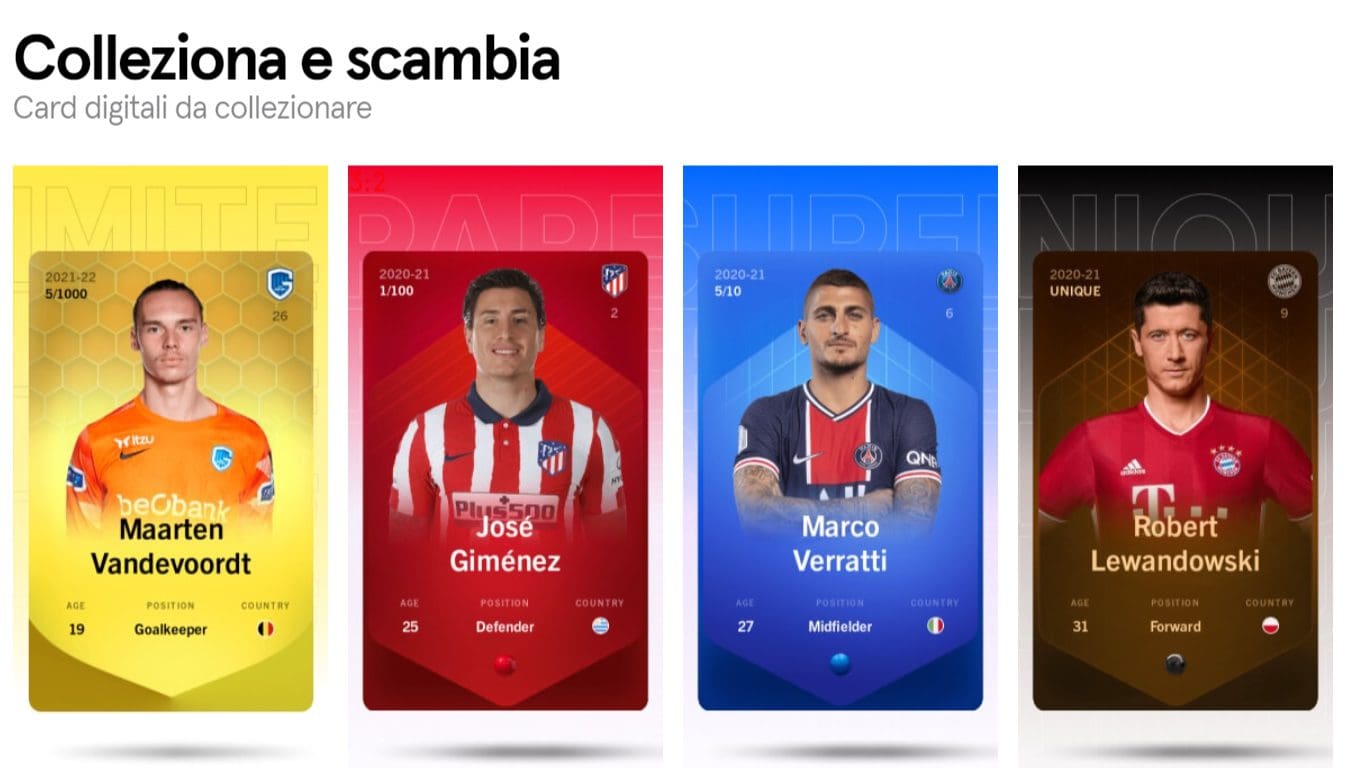

Even traditional fantasy soccer has met NFTs: such is the case with Sorare. This game has created partnerships with numerous football teams and sports leagues such as the NBA, obtaining official licenses.

Users can buy and trade figurines portraying players. There are different levels of rarity, making the cards collectible. By deploying a lineup of five players, it is possible to take part in the game, based on performances made on the field in reality.

Without going outside the world of collectible cards, games such as the famous Magic can be created in which the paper element is replaced (or even better, placed side by side) with an NFT.

It would become possible to participate in competitions with players from all over the world without moving from home, avoiding any problems arising from the possession of fake or non-original cards. To put the icing on the cake, these events could be hosted in a metaverse complete with a paying audience.

What can I say, the applications are numerous and we are only just beginning.

Before concluding, here are the answers to the most frequently asked questions on the topic of NFTs.

How much is an NFT worth?

The value of an NFT depends on several factors, and it is not possible to answer this question uniquely.

We start from a few cents to millions and millions, just as is the case with objects and works of art. The value is affected by several factors such as artist, rarity, public reception, market, and so on.

Therefore, it becomes crucial to focus on studying the market so as to avoid targeting worthless NFTs.

If you are asking yourself “how do you invest in NFTs?” know that the path is by no means simple: it takes preparation, eye and a bit of luck.

Returning to value, the most expensive NFT in history is Everyday, a creation by artist Mike Winkelmann that was hammered out at the prestigious Christie’s auction house at the monstrous sum of $69 million.

"The title of most expensive NFT in history goes to Everyday: a whopping $69 million!"

How to get NFT for free?

There are a few methods to get an NFT for free.

The first is to participate in airdrops created by new projects and NFT Marketplace on the launch pad. For example, Crypto.com released several Non Fungible Tokens at the launch of the dedicated platform as well as during various marketing initiatives.

Therefore, we will have to closely follow the NFT community, artist channels, and platform channels. In this way we will be almost certain not to miss any announcements.

Sometimes you can also receive a free NFT with the purchase of real items, in conjunction with the possession of certain cryptocurrencies or, again, by using platforms. There are no exact rules, so it all depends on being in the right place at the right time.

Finally, we can create our own non-fungible token without incurring any fees, for example by publishing it on Polygon from OpenSea. By doing so we will get our NFT for free.

Are NFTs a good investment?

Hard answer: it depends.

Each of us has our own goals and characteristics, so it is not possible to say “yes” or “no” with certainty.

Let’s say that Non Fungible Tokens are particular assets, whose value depends a lot on market phases, hype and marketing. As a result, they may fit well with people with greater risk appetite, while they are not suitable for more cautious investors.

NFTs: fusion of virtual and real?

NFTs are digital assets but this does not exclude coexistence with the physical world.

A non-fungible token could, for example, be an excellent substitute for a ticket to an event such as a concert or basketball game.

A company would also be able to sell a product and match it with digital content.

In addition, NFTs could be created that entitle people to obtain something physical. This would be a very valid application in the field of merchandising, as well as in the purchase of auction items. Being unique items, only the owner of that particular non-fungible token would be entitled to the physical counterpart.

The strength of NFTs lies precisely in this versatility: there really is no limit.

With a mix of curiosity, excitement, and concern, real and virtual increasingly merge. What asset can bind these two worlds together? The answer lies in three letters: NFT.