Leggi questo articolo in Italiano

NFTs and CryptoPunks: Tax evasion in the USA for $13 million

By Daniele Corno

Record sales and profits worth tens of millions of dollars from NFTs CryptoPunks: A lawsuit in the USA for $13 million in undeclared profits

Tax authorities, USA and NFTs

With the non-fungible token (NFT) market, there are many investors who have made numerous profits in the 2021/2022 cycle, and among these, there are isolated cases of those who have kept these earnings for themselves.

This is the case of Waylon Wilcox, a 45-year-old man from Pennsylvania who recently pleaded guilty to underreporting his earnings to the IRS from the sale of 97 NFT CryptoPunks.

According to the prosecutor, in fact, Wilcox earned over $13 million in profits from the sale of his CryptoPunks in 2021 and 2022. Undeclared sales and earnings, which evaded $3.3 million in taxes on capital gains.

The guilty plea came just before April 15, the deadline for filing the 2024 tax return with the IRS. The guilty plea could reduce the sentence of the individual in question, compared to a maximum sentence of six years in prison.

A case that is making waves as the first major case of tax evasion related to the sale of NFTs.

Never again like 2021/2022?

Sales in the context of 2021/2022 refer to a period of time that the market seems to have forgotten.

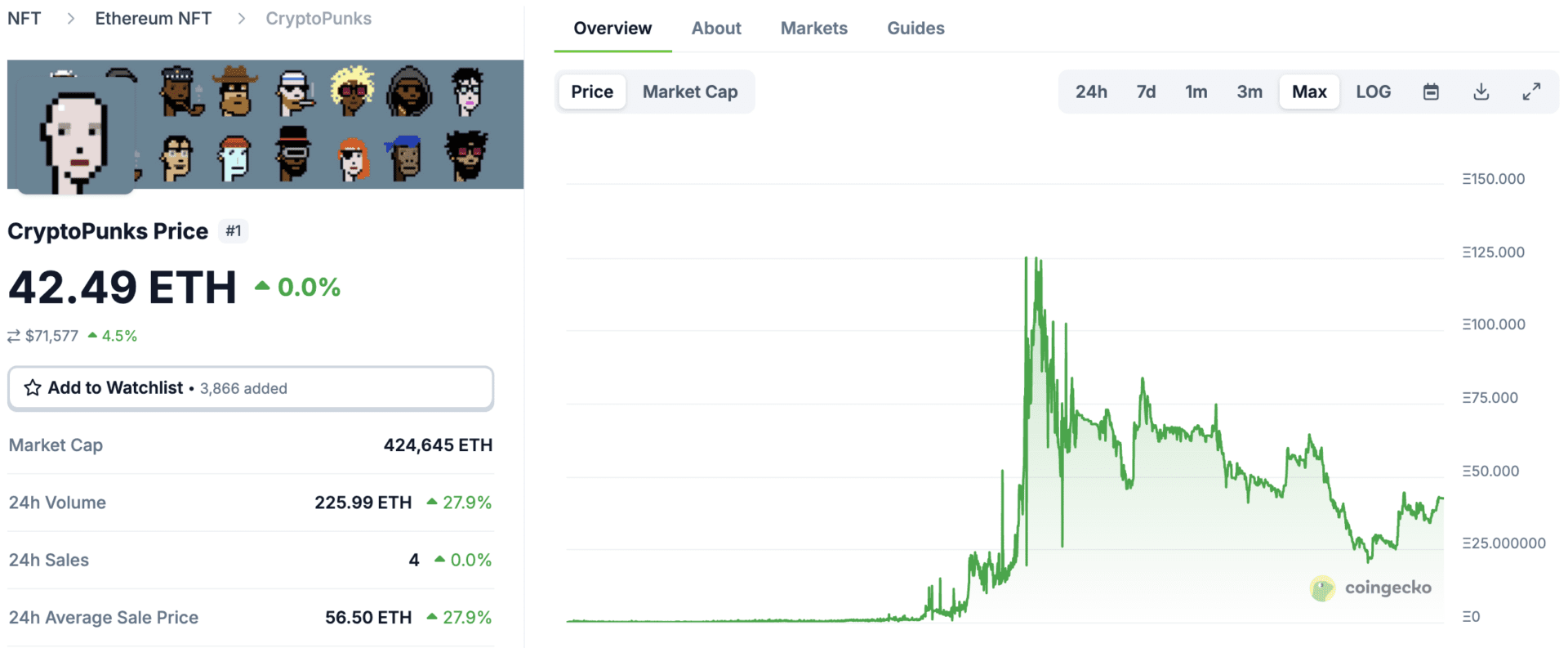

Still market leaders, with a market cap of over $700 million, CryptoPunks have given up a huge slice of their value.

In fact, in less than three years, thanks to the fall in the price of ETH, their value has lost -86%. From a floor price of around 125 ETH, which at a price of around $4,000 gave them a value of around $500,000 dollars, to current values, with a floor price of 42.5 ETH, equal to around $70,000 dollars.

The floor price in terms of ETH has almost doubled in the last 6 months, but from the same nominal value in dollars, given the drop in the price of Ethereum.

Is the trend over? What is clear is that trends dominated by narratives have a beginning and an end and today, that distant 2021/2022, seems nothing more than a forgotten memory.