Leggi questo articolo in Italiano

NFT: CryptoPunks rally rekindles hope

By Davide Grammatica

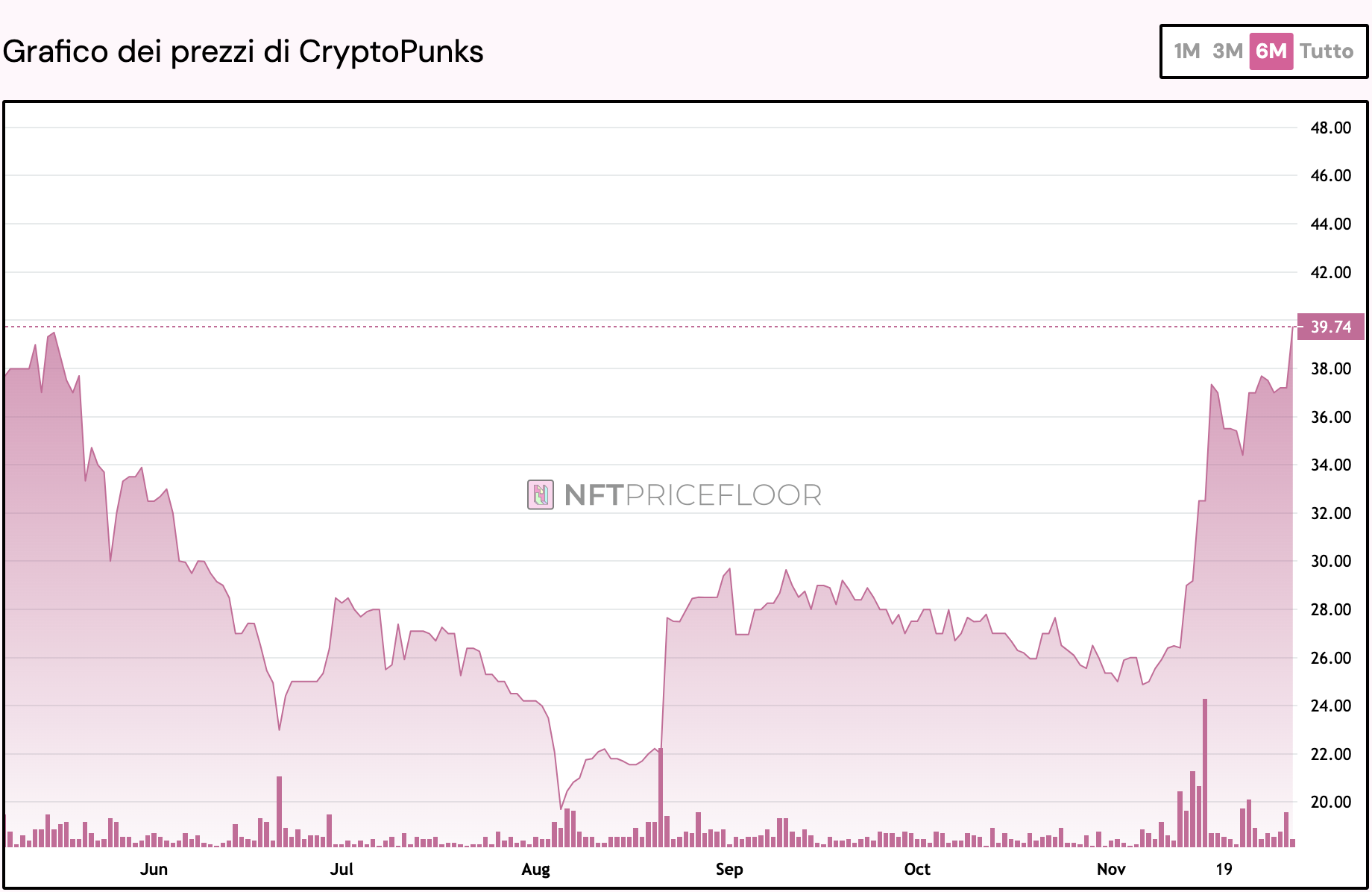

NFTs also show some signs of recovery: the floor price of CryptoPunks is up 47 percent in a month, to its highest since last May

CryptoPunks rally

The floor price of CryptoPunks, one of the world’s most famous NFT collections, rose 47 percent in November. It is the highest level touched since last May, and hovers around 37.68 ETH, about $140,000, following a low of 25.35 ETH reported earlier this month.

In fact, CryptoPunks have been the best NFTs in a nonetheless bullish environment, with a recovering market involving multiple ecosystems. Important signals also came from BAYC, Milady Maker and Pudgy Penguins, up 7 percent, 34 percent and 28 percent, respectively, in the same time frame. On average, floor prices of major collections rose 34.5 percent in November.

Obviously, playing in favor of the sector’s rise is the rally of BTC, again close to $100k and always one step away from marking new ATHs. So too does the Ethereum ecosystem, which, although lagging behind, saw especially in November a significant increase in trading volumes, thanks in part to the support of all layer-2s.

NFTs are still alive

That NFTs would also reap the benefits of such a euphoric market, however, was not a foregone conclusion, as bearish signals were never lacking in recent months. Suffice it to mention, for example, the closure of Kraken’s marketplace this week.

Long-time investors and traders have since “inflated” CryptoPunks’ performance partly because of the collection’s high liquidity, which is also very present in the secondary market, and which offers users many opportunities in times of capital turnover.

It may be a coincidence, but a correlation with the media case of these days concerning the purchase of “Cattelan’s Banana” by Justin Sun for more than $6 million is not ruled out either. For some, contemporary art is but an NFT in the real world, and if the reverse were also true, it is not excluded that we might again see significant sums spent on the “blue chips” of the sector.