Leggi questo articolo in Italiano

BITCOIN options: SEC approves trading on NYSE and CBOE

By Daniele Corno

The SEC has given the green light for options trading on Bitcoin spot ETFs on NYSE and Cboe, new financial investment instruments

SEC approval opens up new opportunities for Bitcoin ETFs

The U.S. Security and Exchange Commission (SEC) recently gaveaccelerated approval to NYSE and Cboe to introduce options trading on ETFs Bitcoin.

BREAKING: 🇺🇸 SEC approves options trading on spot #Bitcoin ETFs. pic.twitter.com/5aAgplH6cW

— Bitcoin Archive (@BTC_Archive) October 18, 2024

This decision comes afterSeptember’s approval for BlackRock’s iShares Bitcoin Trust on Nasdaq. Major managers such as Fidelity, ARK21Shares, Invesco and Franklin are now included in the list of Bitcoin ETFs enabled for options trading.

The decision aims to offer institutional investors more advanced and diversified investment tools, increasing the liquidity of the cryptocurrency market.

The hedging option, coupled with volatility protection mechanisms , makes the market safer and allows large investors to gain exposure to a still financially immature sector.

Options on Bitcoin ETFs improve liquidity and reduce volatility

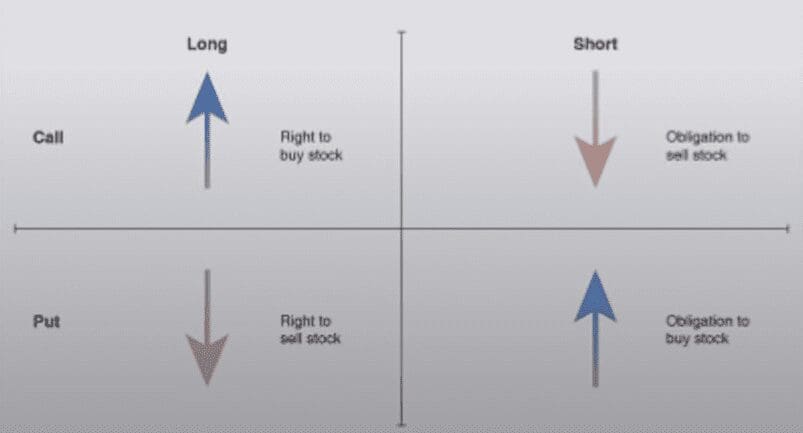

Options are instruments that allow you to buy or sell assets, such as ETFs, at a price set before a specific date.

Now, withSEC approval, ETFs such as the Grayscale Bitcoin Trust and the Bitwise Bitcoin ETF will offer these options. This will help investors protect their portfolios and better take advantage of market movements.

Options on ETFs can improve market stability and reduce volatility. The growth of options on Bitcoin ETFs, according to several experts, could lead to a phase of maturity for the crypto sector, encouraging further capital inflows and investment opportunities.

According to Eric Balchunas, analyst at Bloomberg, the approval was expected, but it still remains a positive step for the future of the Bitcoin market.