Ripple Ledger and SWIFT

Ripple and the XRP cryptocurrency were born with a specific purpose: to modernize and simplify the current international monetary exchange system.

How many times have we heard the acronym SWIFT mentioned? Well, we are talking about the Society for Worldwide Interbank Financial Telecommunication, which has been in operation for 50 years now.

The system devised by this society is responsible for the movement of currencies between banks scattered all over the globe.

As is easy to understand, this is an infrastructure that plays a key role in the world economy.

However, the SWIFT circuit has one major limitation, which has become increasingly apparent over the years: inefficiency.

A sum of money can stop at several banks before reaching its destination, leading to wasted money, energy and time. Not to mention the often lackluster transparency, so much so that one wonders which hands the money from a given transaction passed through.

Here we come to Ripple, the blockchain world’s answer to the problems just written about.

In this in-depth discussion we will answer questions such as “What is Ripple?”, “What is Ripple for?” and “How does Ripple work?”

We will also, of course, highlight the critical points that raise more than one red flag about the project.

Finally, space for Ripple predictions, assuming that we cannot have any certainty about the future. We will base considerations only on observation of the current scenario.

One thing is certain: at the end we will be better prepared and will be able to invest in Ripple cryptocurrency (or give it up) in an informed way.

Index

What is Ripple?

Ripple is an American company based in San Francisco, founded in 2012. Present in more than 50 states and with more than 800 employees serving, it has always been active in the blockchain industry .

XRP Ledger: what is Ripple for? Ripple Ledger is a payment network designed to serve the financial sector and aims to replace the inefficient SWIFT. This blockchain is Ripple’s core infrastructure, commonly identified by the very name of the company (we will do so as well later in the article).

XRPL is open source, making it perfect for anyone wishing to develop solutions based on it. In addition, the network is energy efficient and winks at the environment. We will study its strengths and weaknesses in detail below.

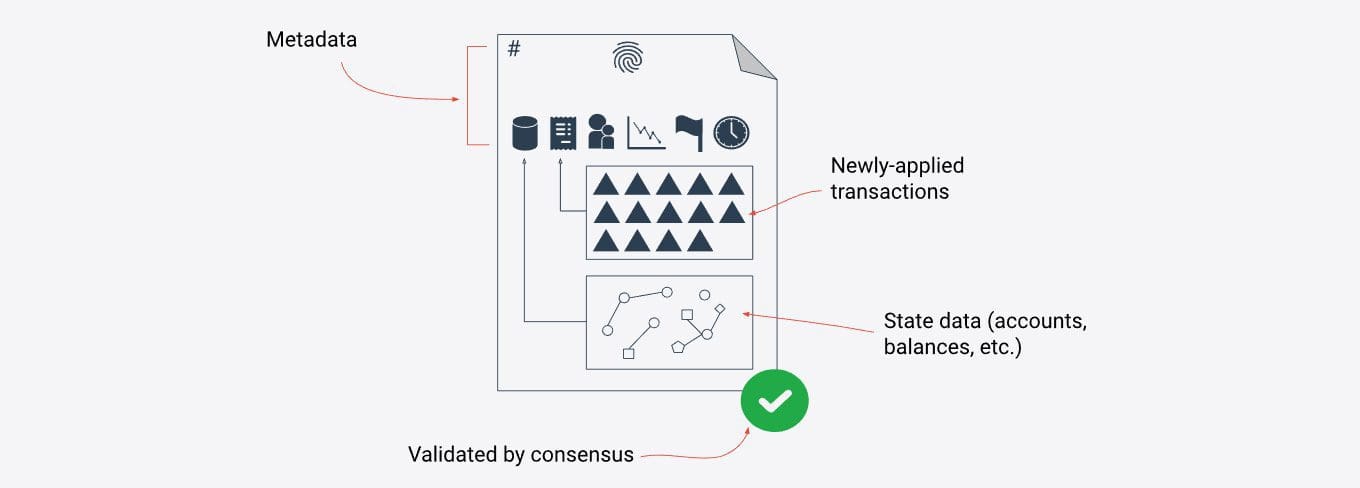

Ripple’s operation is based on a peer-to-peer mechanism that connects several independent servers. These process transactions and compare the available data to ensure that everything is correct and free of manipulation. The use of metadata is key: it would not be possible to pass a malicious transaction as not agreeing with the previous status.

What is special about Ripple is that there is no mining process or coin stake; the competitive component typical of so many consensus algorithms is completely eliminated.

The XRP Ledger blockchain offers the possibility of setting up one’s own server, an ideal solution for those who use it often and with large volumes.

As we said, Ripple was created with the aim of replacing the SWIFT system, which is outdated and unsuitable for the current times.

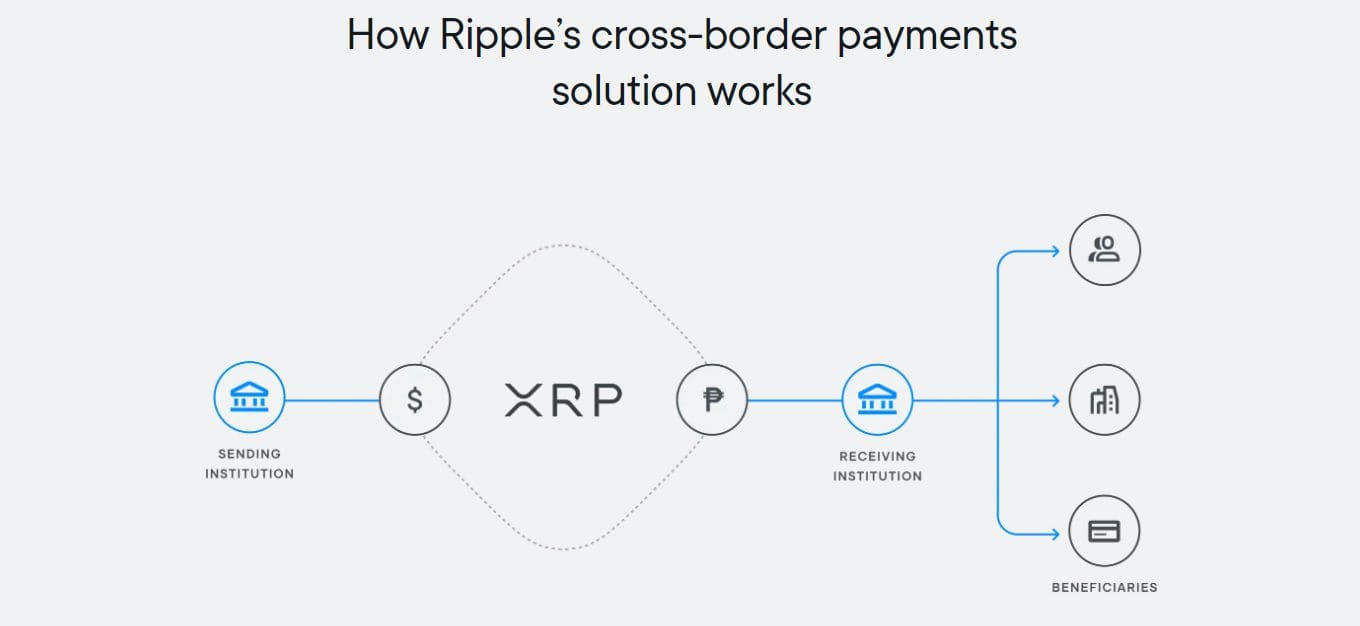

The idea behind the project is simple: instead of having a certain amount go through multiple banks, as is the case today, let’s leverage the blockchain and make it more streamlined, secure and inexpensive.

If Bank A were to turn over an amount to Bank B, all it would take would be to convert the amount into XRP, Ripple’s native coin. After that it would be sent via blockchain. Upon receipt, Bank B would only have to convert XRP back into the original currency, or another of its choice.

This system offers three considerable advantages:

- Capital arrives at its destination in seconds.

- Fees have negligible costs, not comparable to traditional circuits. There are some reservations on this point; we will come back to it.

- Transparency is assured thanks to the traceability offered by the blockchain, although in reality there is not much to trace: the sum goes directly from A to B.

Although Ripple has banks as its natural customer, this does not detract from the fact that individuals can also take advantage of its potential. There is plenty of competition, though: the arrival of solutions such as Lightning Network, Bitcoin‘s layer-2, puts XRPL in trouble as far as the retail sector is concerned.

Tokenomics, what moves the price of Ripple

XRP is the crypto of the Ripple blockchain, but how much is a Ripple coin worth?

The supply is 100 billion. There is no mechanism for creating the currency: every XRP has already been minted.

As for distribution, it is currently broken down as follows:

- 5.8 billion XRPs are held by Ripple;

- 43.4 billion are instead held in escrow;

- The remaining 50.8 billion coins are in circulation.

The figures are as reported by Ripple’s official website, not updated to 2024.

The release of XRP is different from that of other cryptocurrencies such as Ethereum. In fact, it is the company that decides when to sell a portion of its coins on the market. This mode has always attracted criticism, because in fact Ripple is free to manipulate supply at its own discretion; the fear of massive sales is therefore a source of widespread concern.

A study by Messari considered precisely the criticality just mentioned.

The investigation reveals how indeed Ripple acts in a non-transparent manner and by conditioning coin inflation.

Specifically, three modes of operation are highlighted that leave some perplexing:

- XRP sales were being reported in dollars rather than XRP. In doing so, the calculation of inflation is not straightforward.

- Using volume data taken from CoinMarketCap, which is highly pumped and therefore inaccurate. Calculating the percentage of sales by Ripple on these numbers leads to underestimation. Today, this problem has partly receded due to some changes made by the famous crypto analytics portal.

- XRP sales by the firm are not all properly reported.

Although the study has a few years on its shoulders (2019) it is still an interesting and current read. Indeed, some issues persist on the issue of clarity; as a result, the investor in Ripple may not be able to properly assess all aspects.

As for price, like so many others, the coin suffered the bear market of 2022.

The highest value reached was several years ago now, when ripple price caressed $3.5. Today we cruise steadily on significantly lower figures, after a partial comeback in April 2021 to over $1.84. But time has passed and this is just a memory.

In light of the above, caution: while Ripple XRP is consistently among the top cryptocurrencies in capitalization, there are many things to watch out for.

XRPUSDT Chart by TradingView

How much is Ripple worth in euros?

Finding out the value of Ripple is super easy and you can follow several avenues.

First, Google, where you just type in Ripple Euro to get the real-time valuation.

Alternatively, you can view its trend and price on all the major platforms dedicated to the crypto world, such as CoinMarketCap and CoinGecko.

Finally, for the most demanding, we highly recommend TradingView, the best portal for technical analysis around. In addition to being able to monitor the value of Ripple Euro, you will be able to thoroughly examine the situation and set up the best operational strategy. Below is the XRP/EUR chart borrowed directly from the platform just mentioned.

Ripple: pros and cons

Let’s explore the pros and cons of Ripple, starting with the former.

Pros of Ripple

As a first thing, the network is fast. Comparing it with SWIFT, the system it aims to replace, there is absolutely no comparison: Ripple takes 3 to 5 seconds to finalize the transaction.

Outside of this reality, if the financial industry wants to speed up and lighten up, blockchain is the right place to look.

Ripple is cheap, on the order of a few cents per transaction. However, there is a prioritization system that gives priority to those who decide to pay more. This is nothing new: other chains adopt a similar model, although it may not appeal to everyone.

The network is also scalable, an aspect not to be underestimated in case of mass adoption. Ripple’s website reports as a constant figure that of 1,500 transactions per second.

Efficiency is also at home because not much energy is required to power the chain. On this point, environmental sustainability is also rewarded.

Finally, Ripple is quite versatile in the sense that it adapts to different types of users.

We know that the project was born looking at the financial world; however, even the private individual can use the chain without problems, for example, to buy and sell items by paying in XRP. Thus, there is not too much rigidity.

Up to here there are many positive aspects. However, let us discover the other side of the coin.

Cons of Ripple

We have already mentioned the presence of some critical issues.

First of all, Ripple is a decidedly centralized network: there are few validators and a good portion (less than half anyway) are somehow tied to the company. True, there is no obligation to adopt the proposed ones, however, at the outset the assumptions are not great.

Turning to coin XRP, the main problem has already been raised: Ripple can sell tokens and manipulate supply. The shadowy points mentioned above help generate some concern about the issue.

Ripple’s most significant con, however, lies in its usefulness. The idea behind it is certainly sound, and the two main solutions proposed (xCurrent and xRapid) are proof of that.

However, many banks are beginning to look at stablecoins, whether issued by companies like Tether or created by central authorities. And the numbers don’t lie: the trend is growing.

Finally, while Ripple is doing quite well, there are many blockchains that are faster, scalable and more comprehensive. In short, the classic mantra “it’s the banks’ crypto” goes a bit awry.

"Ripple: a thorough evaluation of pros and cons is essential before deciding whether to invest in the project"

Ripple and the SEC: what future for Ripple?

One cannot talk about this project without mentioning the ongoing legal action with the Securities and Exchange Commission (SEC). Below is the narrative of the main facts, with the latest updates at the end of the paragraph.

It all began in late 2020, when the SEC filed a lawsuit against Ripple and its crypto.

The reason? Because the company can freely decide when to release XRP, the SEC believes that it should register as a security. If this claim were true, Ripple would have raised large amounts of capital without having permission to do so.

Key figures in the California-based company Christian Larsen and Bradley Garlinghouse, co-founder and CEO respectively, are obviously involved in the lawsuit. This is because they allegedly gained a great deal from the procedure deemed illegal by the SEC.

Now everything is in the hands of Analisa Torres, the judge assigned to follow the matter. The lawsuit is seen as a clash between the crypto and mainstream worlds. The hearings attract many people who support both sides.

Should Ripple win, the message would be strong. The SEC would be silenced on the issue and a precedent would be set that would place cryptos clear of certain cases, especially considering the recent aggressiveness shown by the commission toward these assets.

Conversely, if the SEC were to win, an equally important history would arise. XRP would be framed as a security rather than a currency, with all the attendant implications. The Commission could use this outcome to apply similar treatment to others in the crypto world.

Pending final judgment, one thing is certain: Ripple and XRP are taking the hit. A pending lawsuit is never good, and investors are more reluctant to pour in capital. What’s more, the same caution is being exercised by potential new customers of Ripple’s proposed services, banks first and foremost.

Important update of July 13, 2023: Judge Torres ruled that Ripple is not a security. Thus ends a long rigmarole that challenged the coin, which, however, emerged victorious in the battle against the titan. Now, although everything is in its infancy, Ripple XRP and crypto can count on a precedent of historic significance.

August 2024 update: The court put the “end” to the Ripple SEC affair by fining the company with $125 million, when the SEC had instead asked for $2 billion. However, the affair could continue in the event of an appeal.

Where to buy Ripple?

Buying Ripple is no problem: we can safely turn to the major exchanges around.

Binance, the industry benchmark, is a very valid option. By following the link provided you can sign up and benefit from a 20 percent fee discount forever.

Also available on two other well-known crypto exchanges like OKX, Bitget, Crypto.com, and Bybit

"Where to buy Ripple? Centralized exchanges are the solution!"

Is Ripple a good investment?

Ripple is a project that generally divides users into two groups: supporters and non-supporters. It is difficult to find the middle ground.

By itself, the network is well developed, secure and efficient. Not having to mine coin is a plus that makes everything more scalable.

However, there are critical points that should be carefully evaluated. In short, Ripple does not seem to be a technology that is destined to revolutionize the world.

We have no way to take a look into the future. Weighing the facts lucidly, in our opinion the scales today say that the cons outweigh the pros.

Those interested in investing in Ripple should study the project very carefully. Indeed, in this in-depth study we have simplified a considerable amount of material. What can we say, just like exams, homework never ends!

What do you think of Ripple? Have you invested in it or preferred other cryptocurrencies? As always, our social channels are available if you want to share your impressions.

Keep following us for the latest Ripple news!