Leggi questo articolo in Italiano

SEC approves options on Blackrock's Bitcoin spot ETF

By Daniele Corno

Blackrock: the SEC has approved the listing and trading of options on the iShares Bitcoin spot ETF Bitcoin Trust (IBIT)

First Options on a Bitcoin spot ETF approved, the introduction of a new marketplace

The U.S. Securities and Exchange Commission (SEC) has approved for the first time the listing and trading of OPTIONS on Blackrock‘sBitcoin spot ETF.

BREAKING: 🇺🇸 SEC approves options for BlackRock's spot #Bitcoin ETF. pic.twitter.com/g7R8rSLRI1

— Bitcoin Magazine (@BitcoinMagazine) September 20, 2024

Options give holders the right to buy or sell an asset (BTC in this case) at a predetermined price by a predetermined date.

Approved on Friday, Sept. 20, they will be covered by the spot underlying. This means that, when exercised, they will involve the exchange of physical Bitcoins in the market.

These U.S.-style options can be exercised at any time before expiration.They offer investors greater flexibility and the ability to develop more complex strategies on the underlying Bitcoin.

The green light for the Bitcoin options market?

Options offerample leverage. The introduction of this new instrument onBlackrock’s ETF allows investors to develop complex strategies. They can use this instrument both to hedge their positions and to speculate on the price of Bitcoin.

“I assume more options will be approved in short order,” said Eric Balchunas, senior analyst at Bloomberg. “Huge win for bitcoin ETFs (as it will attract more liquidity which in turn will attract more big fish).”

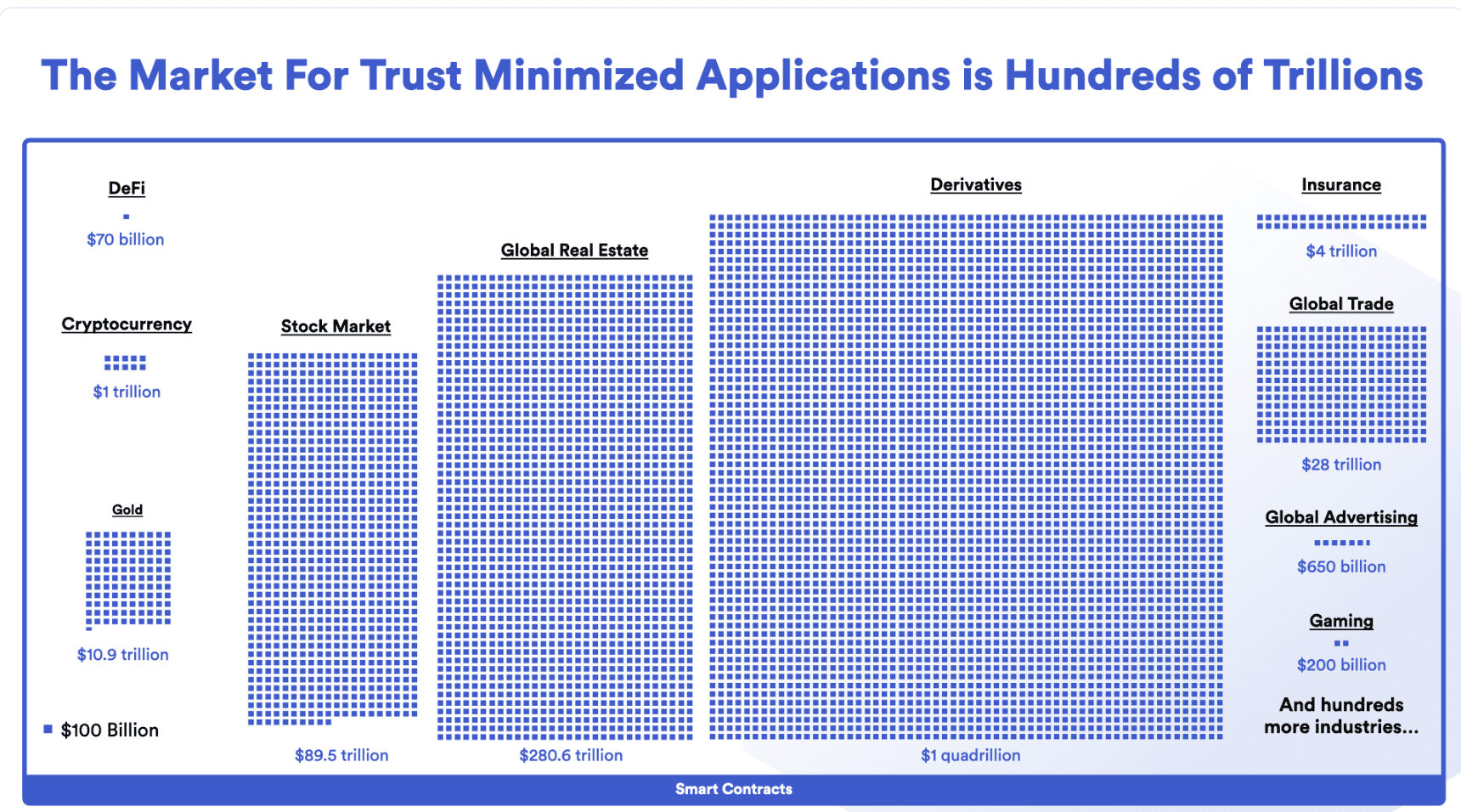

In a prospectus reported by Chainlink in 2022, options, part of the financial derivatives category, are one of the most liquid markets in the world.

Conclusions

The SEC pointed out that this approval would allow investors to hedge their positions in Bitcoin by using the options market to mitigate BTC’s inherent volatility.

With this approval, the market demonstrates a growing maturity to integrate into mainstream finance.

The integration of these instruments is the necessary foundation to provide investors with all the derivative instruments they need to build their exposure and operations in an asset like Bitcoin.