Leggi questo articolo in Italiano

Strategy ₿ is back with a purchase of 2 billion and almost 500k Bitcoin

By Daniele Corno

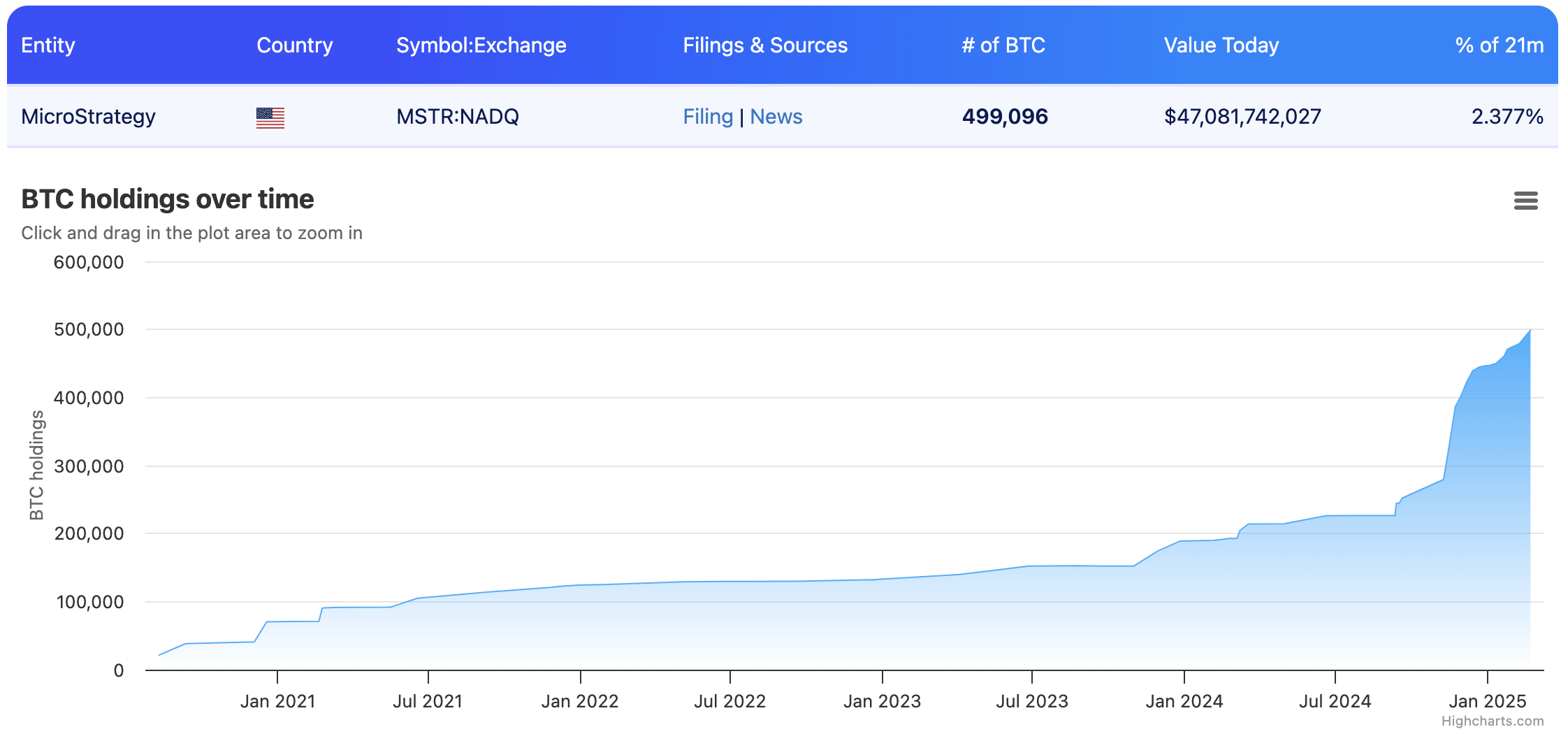

After a month's break, Strategy ₿ is back buying: $1.99 billion dollars bought and the treasury is close to 500,000 Bitcoin

New purchase in grand style

Michael Saylor and his Strategy ₿ are back to buying after almost a month’s break.

In the week just ended, the company made a buy for $1.99 billion, adding 20,356 BTC to its treasury.

Strategy has acquired 20,356 BTC for ~$1.99B at ~$97,514 per bitcoin and has achieved BTC Yield of 6.9% YTD 2025. As of 2/23/2025, we hodl 499,096 $BTC acquired for ~$33.1 billion at ~$66,357 per bitcoin. $MSTR https://t.co/mNWDaXRE7N

— Michael Saylor⚡️ (@saylor) February 24, 2025

The recent acquisition follows the previous round of financing announced the previous week, amounting to $2 billion. The round is related to the 21/21 plan and was obtained following the sale of zero-interest convertible bonds, without any new share sales.

This means that Strategy will not have to pay any interest rate on this liquidity obtained and that buyers will be able to convert the bonds if MSTR should exceed the $433.43 strike price.

MSTR is currently trading at $280, down 48% from its high of around $543 on November 21, 2024. The price is currently resting on the November 8 price gap, closing an important inefficient price level

Just a breath away from 500,000 Bitcoin

With this MONSTRE purchase, the fifth largest ever for the company, Strategy ₿ is one step away from a psychological milestone.

Thanks to these new 20,356 BTC, the company’s holdings reach 499,096 BTC, equal to 2.77% of the entire supply and, one step away from 500,000 Bitcoin.

An enormous amount of money owned by a single company. Just think that the largest ETF spot IBIT, by Blackrock, purchased by the largest banks and investment funds, manages about 586 thousand BTC.

Despite this impressive purchase, the price of Bitcoin remains stable at around $95,000, in a range between $99,000 and $93,000 that has been with us since the distant crash of February 3.