Leggi questo articolo in Italiano

Tesla, Google, Apple crash: what is happening?

By Gabriele Brambilla

U.S. market biggies leave several percentage points on the street: tough start to the week!

The stock market is down...

It is also a bad day for the financial markets. The US stock markets opened badly, dragged down by some of the most important stocks in terms of capitalization: Google, Apple, Tesla… few are saved from the temporary red of these markets.

Let’s take one step at a time and see in a few lines the performance of some of the most influential stocks, taking a look (at the time of writing) at how much value they leave on the ground.

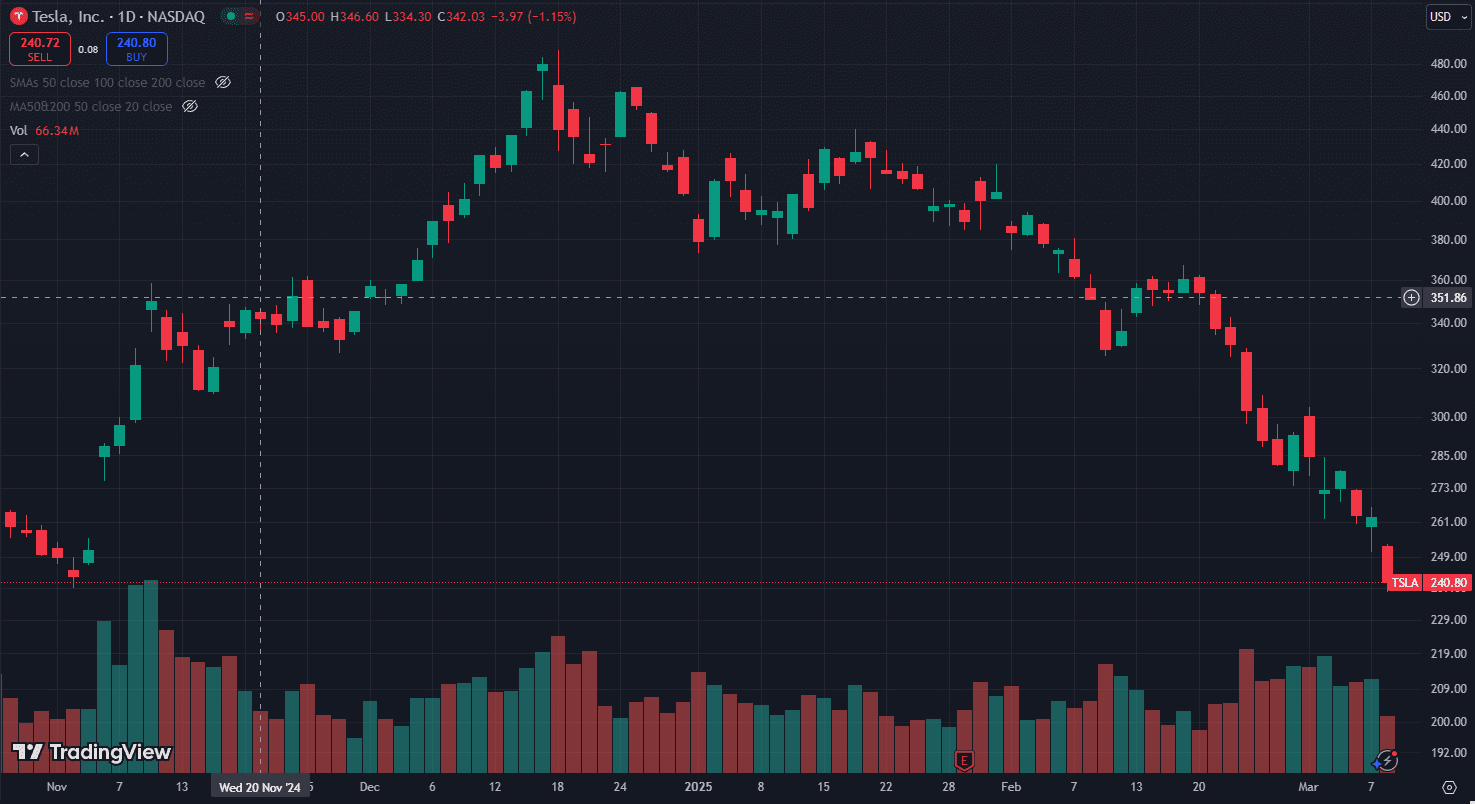

Tesla collapses and confirms bad period

Tesla is one of the biggest companies in trouble, paying a high price for several reasons, but largely because of Elon Musk. We already mentioned this writing about Tesla shares some time ago: the unpredictability of the founder and former CEO is adouble-edged sword for these stocks and for the company in general.

At the time of writing, the stock is losing about 10%, trading at $236 per share. To think that in December 2024 we were close to $500.

The bleeding does not seem to want to stop. Some investors may find the situation interesting and attempt a highly speculative entry, but we have no doubt: there really is too much confusion around Tesla, better to stay away.

Apple: what a red candle!

Apple’s 2025 is also characterized by losses, although to a much lesser extent than Tesla’s: from about $260 per share at the end of December to the current 227. This is somewhat the trend for many stocks that grew disproportionately until the end of last year.

Apple shares lost 5% in this first part of the American Monday, sharing the concerns regarding the recession, which has returned to frighten investors and experts.

Overall, Apple remains a huge, solid company with a loyal and lively market. However, it is not immune to the economic context and could continue to see its value decline after the huge run to new highs.

Be careful of the area we are about to enter: between 224 and 226 the gap created at the end of February would be closed. The area could act as a valid support, but we will have to evaluate the balance of power between supply and demand.

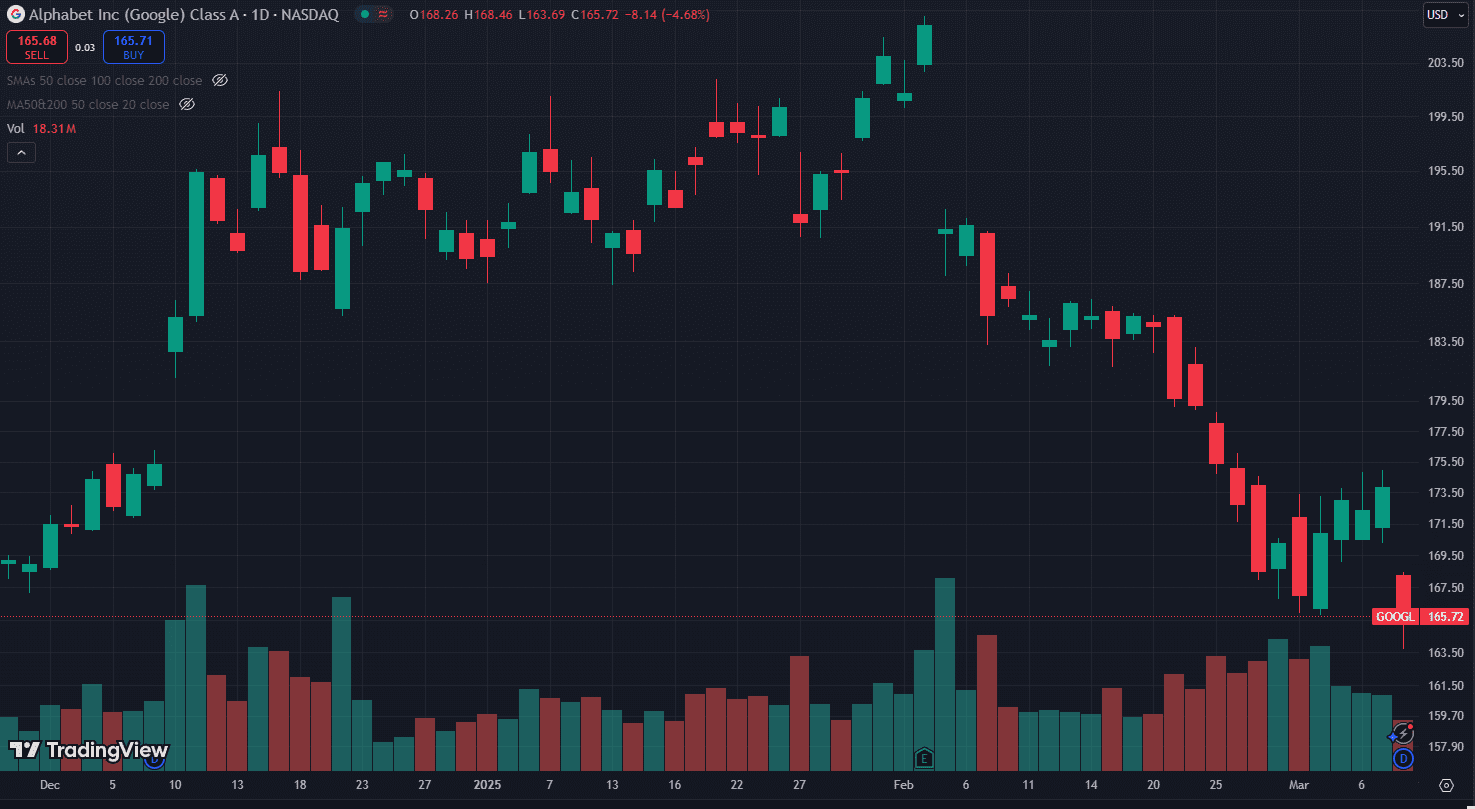

Anche GOOGL è in perdita

Alphabet, or GOOGL, is also down 4.7%. In short, not even this giant is immune to market concerns, which have arisen mainly due to the Trump administration’s implementation of tariffs.

The president himself, responding to Fox News, said that there could be a transition period for the markets, but did not express any particular concerns. Investors, however, think differently.

Google did not react well to the news and returned to price levels not seen since November 2024. And to think that in the last few sessions the stock had tried to revive itself, even if the volumes were progressively decreasing.

At this point, pay attention to the various levels of support that are below current values. For now, $164 has responded well, showing a decent demand capable of absorbing part of the supply, generating a decent lower shadow. We’ll see how the day progresses.

Other big names

Meta too is losing almost 5%, in a continuous decline from mid-February to today ($740 against $596 per share).

Microsoft is doing better, but still in negative territory (-3%, $381 per share).

Amazon is also down 3%, from $242 at the beginning of February to below $195 today.

However, there are also those who are earning. Protectionist stocks such as Coca-Cola, Procter & Gamble and Johnson & Johnson are growing. IBM is also holding its own: +1% at the time of writing, which is excellent considering the sector in which the company operates.

Everything is in flux and what has just been written could change suddenly. We recommend caution when moving in the markets at this delicate stage.

The graphs included in the article all come from TradingView.