Introduction to TRON (TRX)

If you are looking for a fast network with negligible transactions, TRON (TRX) is for you.

However, it would be very limiting to focus only on speed and affordability: this ecosystem is rich in applications, portals and potential. In fact, blockchain is only part of the whole picture. So here we are going to delve into everything that is essential to know about TRON.

As we often do, we will start with a little history and then move on to the somewhat more technical aspects. Clearly we will give praise and criticism, trying to remain neutral and objective.

Space will also be given to the Tron coin TRX, a central element of the whole project. There will be no shortage of a paragraph on the USDD stablecoin, which has come under the magnifying glass because of its dangerous resemblance to Terra USD.

In addition, we will take a look at the ecosystem, recounting in a few lines some of the main protocols available to date.

Finally, we will find out where to buy TRX TRON. Here you will find our referral links, so you can sign up for the exchange of your choice while benefiting from discounts and/or welcome bonuses.

TRON is an interesting network whose ultimate goal is pure decentralization. Where do we stand? Will this really be the case? We just have to keep going to get the answers!

Index

What is TRON?

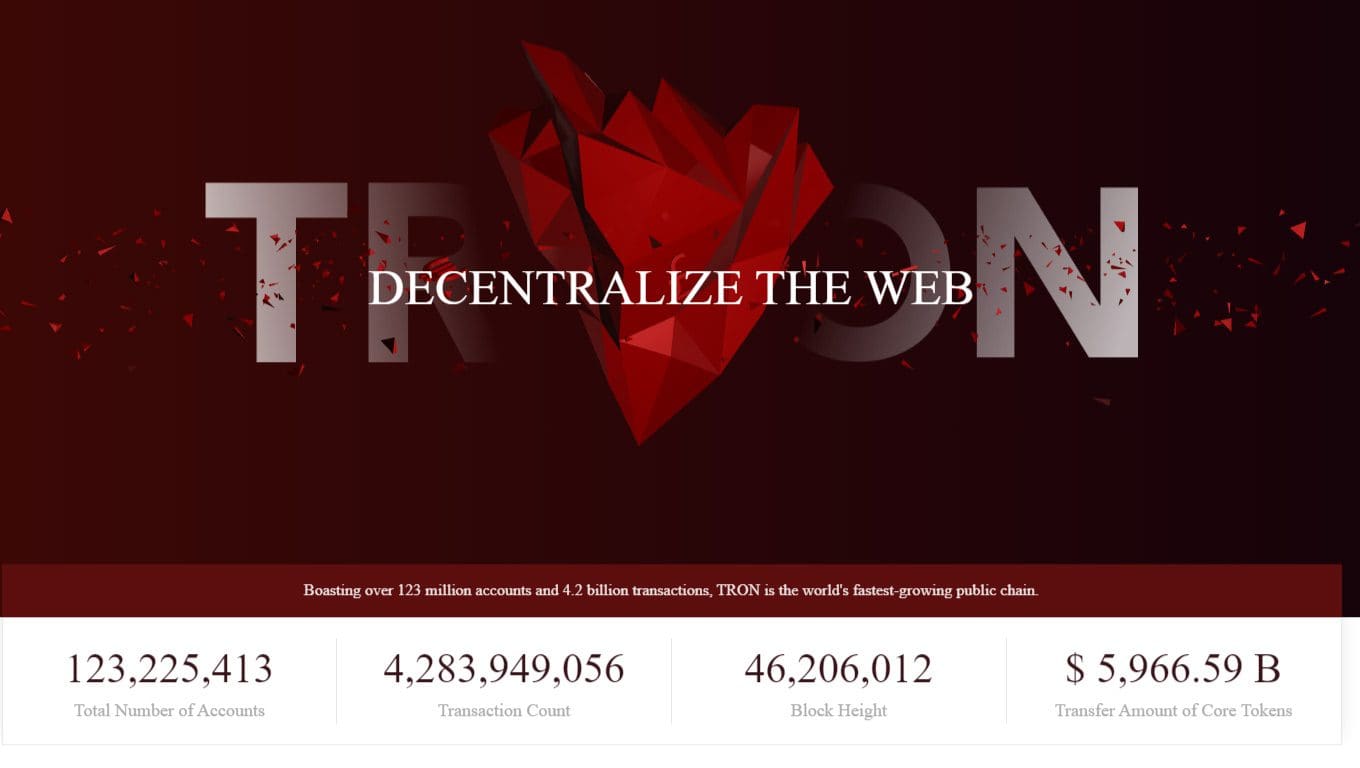

TRON is a versatile layer-1 blockchain that can perform a variety of tasks. It was founded in 2017 at the hands of Justin Sun, a then 27-year-old Chinese entrepreneur.

It all started with the creation of the TRON Foundation and the actual development of the structure. After that, the testnet was launched in spring 2018, accompanied by a dedicated wallet. A few months later it was finally time for the blockchain proper, which went live in May.

With the chain operational, the TRX crypto, initially an ERC-20 token on Ethereum, was moved to TRON. It thus moved to a situation of total independence from other entities. In addition, TRX acquired an important use case, becoming the currency with which to pay the network’s gas fees.

Also in 2018, another important milestone should be noted: the integration with BitTorrent, the popular web3 service that many will be familiar with.

What has just been written is not coincidental: TRON is founded on the total decentralization of the web, so much so that the motto that guides its actions is precisely Decentralize the Web.

What does it all mean? Well, it is difficult to list and describe all the possible uses of such a blockchain.

TRON supports smart contracts and we are well aware of their potential. At the moment, we do not have many original examples because the technology is somewhat reduced to the “usual things”: financial DApps, NFT platforms , insurance protocols, and so on. However, the team is expanding the network of partnerships so as to make Tron something beyond the standard.

In fact, smart contracts open the door to much more: since they are programmable according to the ideas one wants to develop, the limits are (almost) only those of the imagination. From enterprise to institutional applications, there is thus the possibility of creating solutions tailored to the specific needs of the case.

We always say that we still need to be patient, but we are there now: smart contracts are entering the everyday life of many realities.

With this vision in mind, TRON stands as one of the networks of choice for the future as well as the present. Not only cryptocurrencies, but also structure for the gaming and social; but also solution suitable for the complex corporate and institutional applications mentioned a few lines above. All leaving power to the participants, with no central authority.

As we wait for even more of this potential to be realized, let’s take stock of the technology behind the chain.

TRON is a blockchain that employs the Delegated Proof-of-Stake consensus algorithm, a good compromise between security, scalability and decentralization (with reservations).

In fact, DPoS realities have one major problem: the smartest validators quickly achieve high levels of reputation; this feature increasingly rewards them, penalizing decentralization. “But how… ‘ you will say, ’…shouldn’t it be a network based on decentralization?” That is the concept but there are still critical issues that prevent its full implementation.

Transactions per second are high, about 2,000. This is not the fastest blockchain but we are sure the figure could improve. However, when compared to significantly slower realities, already this number must raise a smile.

The cost in gas fees is really negligible, which makes TRON an excellent choice for sending and receiving cryptocurrencies even on a daily basis.

The structure of the chain is modular: many core modules that interact with each other so that the overall operation is more efficient. These include the TRON Virtual Machine, the brain behind the network’s applications. Modular solutions are increasingly being adopted and have amply demonstrated their potential.

TRON’s roadmap is solid and compelling. Developed over 10 years, it includes several key milestones. Among the most important, we highlight the Star Trek phase scheduled for late 2025, dedicated to the launch of a gaming platform. While multi-functional, TRON unceremoniously shows its leanings toward gaming, social, and everything that orbits these worlds.

Among the events of the recent past, in December 2021 the network became fully decentralized, meaning that no authority controls its development anymore.

Decisions are made by the community thanks to the TRON DAO. The critical point lies here: whoever has the most funds, holds the most power.

The problem is also widespread on other blockchains of this type: democratization becomes only theoretical; in practice, we will always encounter a few parties with a lot of decision-making power.

We can turn the page and devote ourselves to the discovery of TRX, the system’s native coin. After that we will also give space to the USDD stablecoin.

Coin TRON TRX

Let us examine the native coin on the blockchain, namely TRON TRX. As we said in the previous paragraph, this currency originated as an ERC-20 token on Ethereum. After that, when the network was launched, the move to “home” took place.

TRX TRON does not have a maximum supply. It thus lacks that indispensable element to create scarcity in supply. The method of release is simple: a certain amount is mined with each block.

About 86.2 billion are currently in circulation (December 2024, figure subject to change). There is a variable, transaction-based burn mechanism that can cause availability to drop (deflation). In the past year, the number of coins has actually dropped quite a bit (in 2023 there were over 90 billion).

Moving to use cases, coin is primarily the method of paying gas fees. Therefore, the more the TRON blockchain is used, the greater the demand for TRX will be.

In addition, this crypto is used to pay trading and withdrawal fees on the Poloniex exchange, exclusively for transactions involving the coin itself.

As anticipated, TRX TRON is a currency that also carries voting rights in governance, an indispensable element in a reality that puts the community at the center of decision-making.

We said, however, that the system is unfortunately not democratic: whoever holds the most coin will have the most power. From one point of view, this is good: a malicious actor would have to buy large amounts of TRX to have any clout. This discourages proceeding, because it involves spending astronomical amounts of money.

At the same time, however, the smaller ones do not have much say; they will be able to vote, sure, but they are unlikely to be able to impose themselves. In short, some light and shade on this point.

Continuing the exploration, TRX can be spent and used as a normal means of payment. Considering the negligible fees and the speed of the chain, this use case is worth highlighting. After all, one of the use cases for some cryptocurrencies is precisely to be able to pay for one’s purchases: why not take advantage of it if performance allows?

The TRX coin is burned to produce the USDD stablecoin. This is done without pre-set amounts, so as to provide greater protection from manipulative attacks.

Finally, the coin can be put into staking. In short, there is no shortage of use cases for TRON TRX.

Speculation is obviously present, which is quite normal with any digital asset. Therefore, those who want to invest in this crypto should reason toward the future, evaluating the whole project with a nice fundamental analysis. This is the only way to have a clear view, cleansed of the noise generated by speculative activity.

TRON/USD chart offered by TradingView.

USDD stablecoin

Stablecoins are cryptocurrencies that keep their value tied to another asset, such as the U.S. dollar or the euro. The most capitalized is Tether USD, a centralized reality with a real company behind it. Thanks to stable currencies, volatility is zeroed out.

USDD is the stablecoin of the TRON ecosystem and occupies a respected position in terms of capitalization. However, the coin has been labeled as dangerous as it is identical to Terra USD (UST). Will this be true? Not entirely; indeed, there are differences.

USDD shares with UST the fact that it is algorithmic, at least in part. Therefore, peg maintenance is governed by mechanisms developed specifically for this purpose. Here many will already have the jitters thinking about the past, but let’s continue.

The big difference, however, lies in the reserves: whereas UST had an insufficient amount of funds to cover its full capitalized value, USDD is an overcollateralized stablecoin, thus endowed with capital that guarantees its full protection.

By this we do not mean that Tron USDD is risk-free, quite the contrary: over time we have learned that it is impossible to achieve a risk-free situation.

By investing in USDD, perhaps lured by the high interest offered on deposits, we inevitably expose ourselves to dangers. The more interest in this stablecoin grows, the more risk will increase in tandem, precisely because capital increases.

As CoinMarketCap chart illustrates, to date USDD has lost the peg by a few cents in several circumstances, but has always managed to recover it. This is certainly a positive feature, especially considering that it is a coin born shortly after Terra’s collapse and during a strongly bearish period.

TRON ecosystem

Eyes on TRON’s DeFi.

After a 2023 marked by consolidation, the network’s decentralized finance has skyrocketed, aided by interesting protocols such as JustLend, JustStables, and SUN. Here is DefiLlama ‘s chart showing the ecosystem’s performance from 2021 to September 2024.

Let’s find out which are the main home platforms on TRON.

JustLend is the protocol dedicated to lending, as well as the number 1 overall as capitalization. Direct competitor to the likes of AAVE, Compound and Tectonic. Classic place to deposit cryptos and generate interest, possibly collateralizing them to borrow more coins and tokens. Liquidity and high volumes.

JustStables, on the other hand, is a platform at MakerDAO, responsible for another stablecoin Made in TRON: USDJ. Except in a few cases, the peg is quite stable and deviates only by a few hundredths or tenths of a percentage point.

The SUN protocol is designed for stablecoin swap, annuity generation, and TRON governance. Accordingly, the portal offers several features including:

- Swap of stablecoin and other cryptos, including TRX and BTT;

- Yield Farming, geared mainly to pools between stablecoins but also including many others between coins and tokens (watch out for impermanent loss).

SUN follows the path laid out by one of the most famous decentralized finance protocols: Curve.

To date, the proposal is good despite being forced to opt for a particular protocol. On the other hand, the choice is rather limited. We are quite certain that time will bring more platforms to the scene, although quality must always be put before quantity.

"A quality, relatively limited but expanding DeFi ecosystem fot Tron"

TRON: strengths and weaknesses

TRON is an ambitious project with a clear goal: to decentralize the Web. A goal that is not easy and requires a lot of work to achieve.

Today the ecosystem is vibrant and garners a lot of interest, which is also a good thing for the future.

True blockchain is technologically sound: fast, secure and scalable. However, absurdly, decentralization is somewhat sacrificed: according to TRONSCAN, there are 417 Super Representatives (the figure varies frequently and has increased since September 2024); these actually act as validators and enable the network to function.

There are no set limits that mark the transition from centralized to loosely decentralized and decentralized. We are the ones who have to reflect and make an assessment.

417is a number that excludes centralization, that is certain; not least because in the fray we find exchanges and competing companies. At the same time, however, this figure is not synonymous with decentralization: with over 255 million accounts (source TRONSCAN, September 2024), we are far from the goal.

In any case, we must also consider other aspects. Involving many more people in the validator role would lower chain performance. Not to mention that security would also take a hit. In short, it is really difficult to find a point that really gets everyone to agree. It’s a matter of thought and points of view.

One positive aspect of the whole TRON project is theorientation toward gaming and social, markets that have been players for years and are likely to see further growth in the future. At the same time, more “classic” use cases such as payments and financial services are not set aside. TRON thus stands as a multi-purpose, 360-degree facility.

It also likes the competitiveness of transaction fees, as well as the speed with which they are carried out.

As for the TRX TRON coin, there are positive and negative aspects.

The use cases belong to the first group and are more than enough to justify the expectation of future growth (obviously all but certain). The distribution, however, is not convincing and leaves substantial funds in the hands of a few.

Finally, the figure of Justin Sun. Let’s be clear: no attack on the person. However, a project that announces itself as decentralized cannot constantly live in the shadow of the founder. One trivial but thought-provoking thing: the About page of TRON’s official website is actually Justin Sun’s storefront. This is despite the fact that he is no longer CEO of the project.

Other blockchains also have key figures working behind the scenes, think of Ethereum and Vitalik Buterin. In this case, however, Justin Sun ‘s presence is cumbersome when we think that TRON is supposed to be entirely of the community.

How to buy TRON TRX?

The TRX TRON coin is among the most highly capitalized cryptos ever. Between exchanges and DEX, therefore, there is no shortage of places to buy it.

Binance has been offering several exchange pairs for quite some time, including those with BTC and ETH. Bybit, Kraken and KuCoin also join the list.

Each exchange has its own peculiarities that make it more or less suitable for our operations. We recommend reading our insights to understand what each reality offers and then choose the one most tailored to your needs.

As for decentralized realities, the choice could fall on two names: PancakeSwap, an arcane and feature-rich platform; SUN, a native protocol of the TRON blockchain.

What is your opinion on this ecosystem? You can tell us yours by leaving a comment on our social channels!