Leggi questo articolo in Italiano

What is inflation: a guide for everyone

By Gabriele Brambilla

From time to time, the "dreaded" inflation makes people talk about itself. Will it really be that bad? Let's understand what is inflation and what it entails

Inflation: a fundamental economic indicator

Inflation is an important economic fact that can weigh markedly on the economy and markets.

Generally seen as evil made number, inflation instead plays a major role in making the economic environment healthy and growing. The problem arises only when it exceeds a certain threshold.

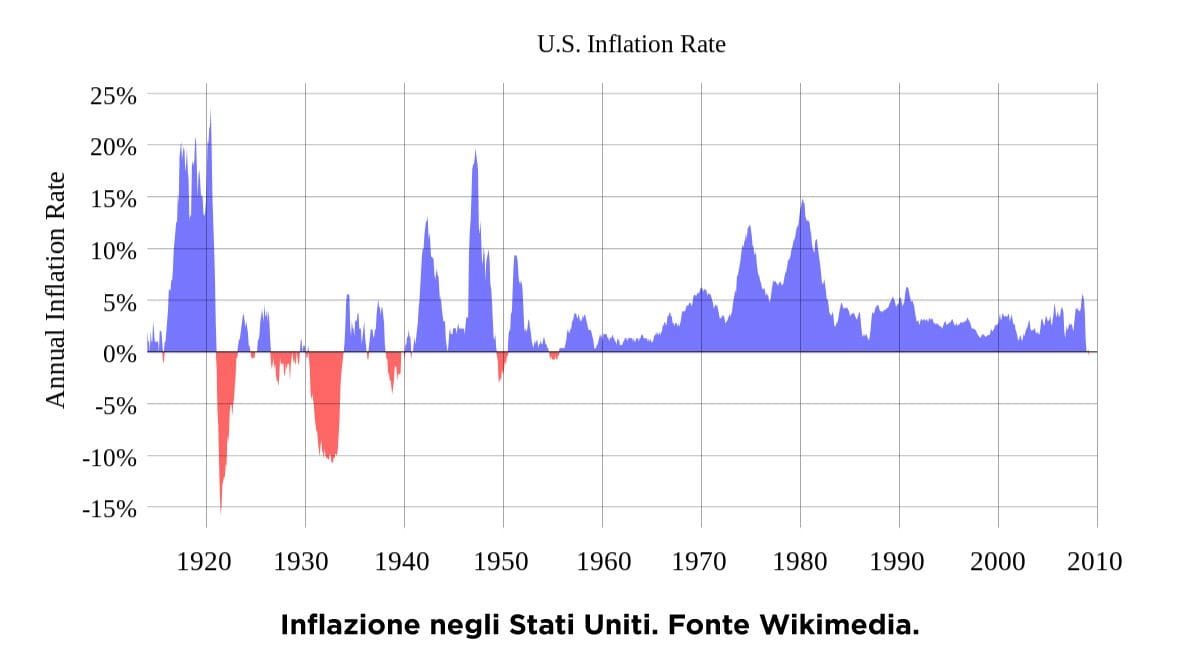

History tells us of many periods when the inflation rate has been high to the point of out of control. We went through that in 2022, but there really has been worse.

In any case, when this figure is excessive, the situation is never good. If you then add to it other factors that work against economic well-being, things get really gray.

So let us understand what inflation is, what its role is, and what it entails. We will also devote a few lines to the United States and interest rates, so you get the full picture.

Get ready because we are about to enter macroeconomic territory, where we will get to discover one of the many important threads that connect markets and the economy.

Index

What is inflation?

With the noun inflation we identify a general and continuous increase in the prices of goods and services. The relative rate measures the annual growth in the average level of costs incurred by the retail consumer.

More specifically, the inflation rate is calculated monthly, relative to the 12 months preceding it, expressing precisely the percentage increase.

If we wanted, we could also calculate the inflation of a specific commodity category such as food, small metal goods or automobiles.

Central banks and experts agree that inflation is healthy when it is around 2 percent. In fact, this figure allows for stable and sustainable economic growth while rewarding producers and suppliers of goods and services.

What happens when inflation rises? An excessive price run leads to consumers having less purchasing power, forcing them to cut spending. This generates a spiral that damages the economy and can degenerate into much worse scenarios (which we will discuss later).

Last note: let us not confuse a simple price increase with inflation. The latter is precisely a continuous increase, not a one-off.

"By "inflation" we identify a general and continuous increase in the prices of goods and services"

Types of inflation

There are different types of inflation. We can group them into two macro-categories.

The first is demand inflation, caused precisely by a general growth in demand.

As the demand for goods and services grows, firms must somehow respond to meet it.

The first response usually involves raising prices, according to the axiom “as demand rises, prices rise,” which is then accompanied by an increase in production capacity. However, the latter takes longer to achieve because new plants have to be created, machinery purchased, personnel hired, and so on.

Price increases are twofold in nature:

- Immediate response to the positive change in demand, pending the availability of the means to meet the new conditions.

- Consequence of increased production capacity (investment and more personnel lead to higher costs for firms).

You may have guessed it by now: demand inflation is usually positive. Increased demand suggests that the economy is ready to restart. To keep up with demand, output will have to grow; consequently, unemployment will be low.

Let us turn to supply-side inflation, different from what we have seen so far. It occurs when the costs of producing a given good or service rise continuously.

Again, the first move of firms will be to raise prices. However, unlike before, production capacity will also be lowered. Therefore, employment will take the hit and go down.

Costs may rise for a variety of reasons: shortages of raw materials, wage increases, penalizing policies and more. Taking what happened in 2022 as an example, with effects still being felt today, inflation was high because of a number of factors that fit together perfectly.

First, the pandemic had effectively halted industrial production for quite some time; it was therefore difficult to restart and meet demand, which had suddenly returned to pre-covid levels.

To this we must also add the War in Ukraine and international tensions, sources of extreme increases especially on raw materials (think natural gas in the second part of 2022).

Since power generation depends quite a bit on this fuel, it is unfortunately natural that retail prices of any product will explode: any business uses power, and when it is very expensive, the only way to compensate is to raise the prices of goods and services sold.

Returning to the high inflation of 2022, we then add the generous monetary policies applied in previous years, which were responsible for the post-pandemic recovery but also for the increase in the money supply.

When a currency is more available, it devalues more rapidly. As it loses value, goods and services will have to increase in price, that is natural.

At this point we can go a step further and introduce interest rates.

US inflation data and interest rates

Inflation data of thw United States are also relevant for Europeans. In addition to the size of the U.S. economy, one only has to think about how many such reports pass over the Atlantic.

The importance of U.S. inflation data is also extremely high when it comes to cryptocurrencies. Indeed, the States is home territory for numerous investors, projects and prominent personalities. What is the connection? Let’s find out right now.

The more inflation rises, the more institutions will set their eyes on it. Among them, however, central banks are the only ones able to intervene to change the figure.

Inflation is not set at the table, so it is not possible to say “Okay, let’s cut the inflation rate”. What a central bank can do is intervene in interest rates, generating such a chain reaction:

- By raising the interest rate, commercial banks will spend more to obtain money from central banks;

- Commercial banks will then have to raise their rates to provide loans and mortgages;

- Businesses and individuals will have less incentive to borrow money precisely because it is more expensive;

- Consumption and demand for goods and services will decline. Businesses are then forced to lower prices.

Of course, the mechanism is anything but precise, especially if complex and uncontrollable variables are included (see the cost of natural gas).

If all goes well, this process slowly brings inflation back down to sustainable levels.

At the same time, however, it can reach the point where the effects become negative. This is the case with recession, that is, the setback of the economy. It brings high unemployment, corporate crises and related problems not only economic but also social.

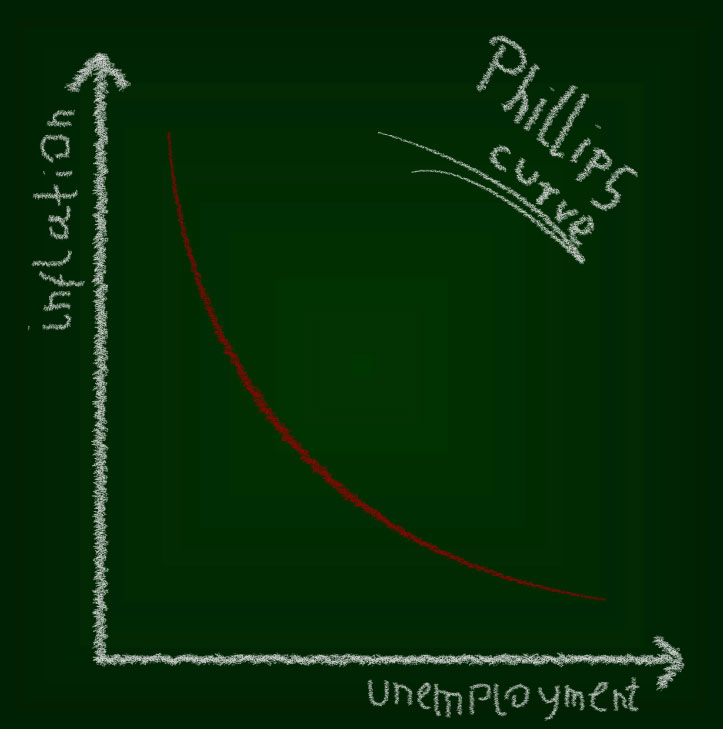

The phenomenon was well known as early as the 1950s. Originating at the hands of New Zealand economist William Phillips, the Phillips Curve shows precisely the relationship between inflation and unemployment. The conclusion is clear: only by sacrificing employment can inflation be lowered. We know, however, that stagflation thinks otherwise…

What has just been written obviously affects the markets, including the cryptocurrency market.

In a high inflation environment , investment gives way to more concrete needs, such as dealing with rising food and energy expenses.

Companies are also less stimulated to invest and struggle to grow and make ends meet. Obviously, the respective stock market valuations will follow this trend.

Bottom line: the U.S. inflation data are extremely important because they offer key insights into the future. If inflation in the U.S. declines, the economy could return to growth in the not-too-distant future. And we know how when the giant is doing well, we benefit as well.

What is the current inflation rate? You can find this and more charts on TradingView.

What is stagflation?

We mentioned it a little while ago, so we need to make the appropriate introductions.

Be careful not to confuse inflation with stagflation; the latter is an environment of recession combined with high inflation.

We find a perfect example in the 1970s, when especially in the aftermath of the Yom Kippur Conflict oil soared, triggering a chain reaction that led to a collapse in aggregate demand, recession and high inflation. In this scenario, the Phillips Curve (which we discussed earlier) is also challenged.

However, stagflation can also result from bad economic policies, especially when coupled with increased monetary supply. These are complex dynamics and require study to understand.

Inflation and deflation

To end on a high note, we only need to understand what deflation and disinflation are. Let us start with the last one.

Disinflation consists of a decline in the inflation rate (which remains positive). This is a good thing in high inflation scenarios.

What is deflation? Deflation , on the other hand, is the general decline in prices, the exact opposite of inflation. At first glance it might seem favorable but it is quite the opposite.

Is deflation good? No: Falling prices mostly result from a rather low demand for goods and services. Businesses are lowering prices precisely to entice purchase but it is not certain that consumers will go in this direction. In fact, many may be stalling in hopes of further declines. Moreover, the climate is already quite depressed, people do not have much money to spend.

In addition, if a business suffers a decline in revenues, it will necessarily have to cut costs (labor force, investment…). The spiral continues further and further down, and each action ends up making the scenario even worse.

Thus, deflation is bad because it can lead to more unemployment and contraction of the economy in an environment already marked by low demand.

What is hyperinflation?

Let us add to the accompanying meaning of hyperinflation, that is, inflation reaching very high and uncontrollable levels.

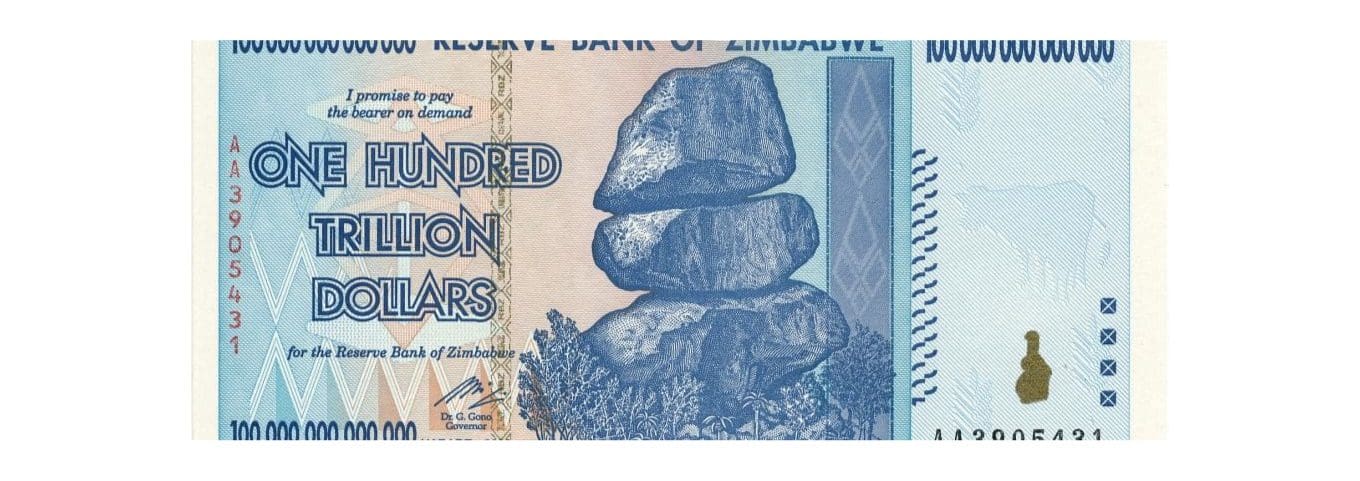

History tells us of many such events. In exceptional cases, prices could be seen to double within a few days. This led the Central Banks to have to print more and more money, so as to provide the population with currency that could buy goods and services.

Sometimes it got to the point where the currency was replaced by another. Such was the case with the African state of Zimbabwe, which was forced to switch to the U.S. dollar after it had come to produce $100,000,000,000 local banknotes.

However, the record belongs to post-World War II Hungary: the Pengo reached an inflation rate of more than 200% PER DAY. As many as 100,000,000,000,000,000,000,000 Pengo bills were printed. The solution to the problem was to switch to a new currency, the Hungarian Forint.

Before closing, how to guard against inflation?

In the shoes of consumers, there is little we can do: to a greater or lesser extent, we will suffer it.

Instead, as investors we must seek to acquire assets that will hold value over time. Among the most popular is gold, the ultimate safe haven asset.

In recent years, Bitcoin has also gained respect in this regard. While the price can fluctuate quite a bit, those who believe in intrinsic value can certainly opt for this option.

Of course, this is not financial advice: to each person the appropriate research!

At this point we can say goodbye, hoping that you found the article interesting and useful. See you soon!