Leggi questo articolo in Italiano

Bitcoin: a RECORD November, here's who contributed

By Daniele Corno

November has come to a close. With just hours to go before Bitcoin's monthly close, here's who contributed to the rally toward $100K

The most important year in Bitcoin's history

The year 2024 was a year that identifies a before and an after in the history of Bitcoin. The first watershed was January, with theapproval of spot ETFs on BTC, until November, where Trump ‘s election provided a huge assist for the entire industry,

The resulting rally pushed Bitcoin’s price close to $100,000, a psychological threshold investors have been waiting for. Up 37 percent on the monthly chart, with a price increase above $25,000, here are those who contributed to the number one cryptocurrency ‘s rally.

Bitcoin spot ETFs

The introduction of spot ETFs opened the door to an immense pool of liquidity, which until 2023 did not have access to the sector.

It was quite obvious, but November was one for the record books for spot ETFs. In the past 30 days, nearly $100 billion in total volumes were traded, almost 20 percent of the total volumes in a single calendar month.

The inflows were also obviously RECORD-breaking. With a positive inflow of $6.465 billion, over 120,000 Bitcoins entered the pockets of ETFs, which now have over 1,120 million BTC in custody.

BlackRock , as always, leads the way. Over $5.5 billion in fact, relates only to the IBIT product, which contra 495 thousand BTC in custody.

Corporations and pension funds

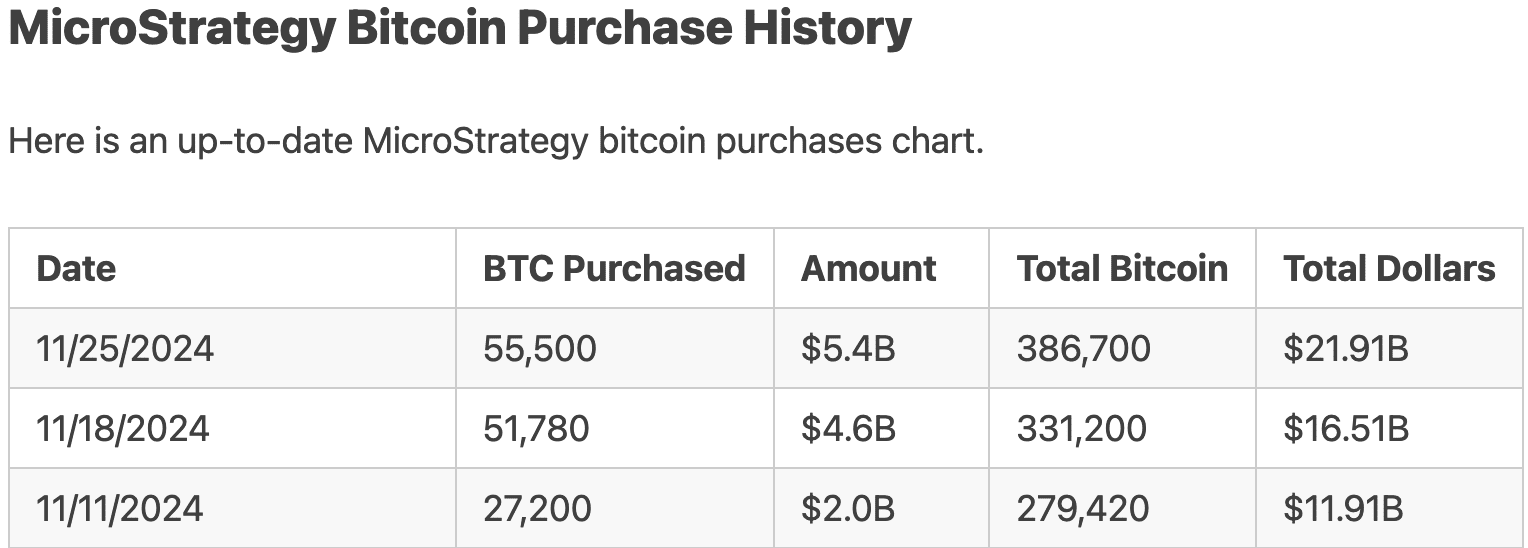

November was also the month of corporations. Among all of them, the company of pro-Bitcoin Michael Saylor stands out, of course . Microstrategy in fact, bought over 133,oo0 Bitcoin, worth $12 billion individually exceeding all flows related to spot ETFs.

Mara holding, a mining and investment company also added $615 million worth of Bitcoin in its holdings. Other public companies are also involved, but for certainty in purchases and values, we will just have to wait for the Q4 2024 quarterly reports. In addition, Asian companies have also joined the roll call, such as SOS, a Chinese company that recently purchased $50 million and Metaplanet, a Japanese company that added an additional $6.7 million to its previous purchases.

In addition, November also brought new players into the market. One example is the first pension fund in the UK that has allocated 3 percent of its assets directly into Bitcoin, amounting to about $65 million.