Leggi questo articolo in Italiano

BITCOIN on fire: is the big RALLY near?

By Daniele Corno

China injects liquidity, U.S. elections in sight, and new rate cut expected at the next FOMC. The recipe for Bitcoin's rally?

New fiscal stimulus, expanding monetary policies

In recent years, the direction of central banks has reversed. After a long phase of restrictive monetary policies, introduced because of the 2019/20 pandemic and conflicts in Europe and the Middle East, we are seeing a new expansion.

China, for example, is continuing with its fiscal stimulus. Starting October 25, Chinese commercial banks will reduce mortgage interest rates. This action follows previous stimulus in recent weeks, including the firstrate cuts and a reduction in the required fractional reserve ratio.

In addition, Beijing is set to issue more than $325 billion in treasury bonds, with the aim of raising the liquidity needed to support the economy. This scenario could pave the way for an increase in the value of high-risk assets, including Bitcoin.

U.S. elections and FOMC

With three weeks to go until the U.S. election, with a November 5 election date, Republican candidate Donald Trump continues to gain new gains in election polls.

Over the past week, Trump has gained a significant lead in Polymarket polls, distancing himself by 10 percent from the polls in favor of Kamala Harris. Bets on the two candidates are approaching a traded value of $2 billion.

A potential re-election of Donald Trump could, according to many, benefit the industry through clear regulations, designed to expand the ecosystem and not obstruct its growth.

The following Thursday, Nov. 7, is also scheduled for the FOMC, where analysts expect another 25 basis point interest rate cut, following the previous cut in September.

$500 million influxes on ETFs

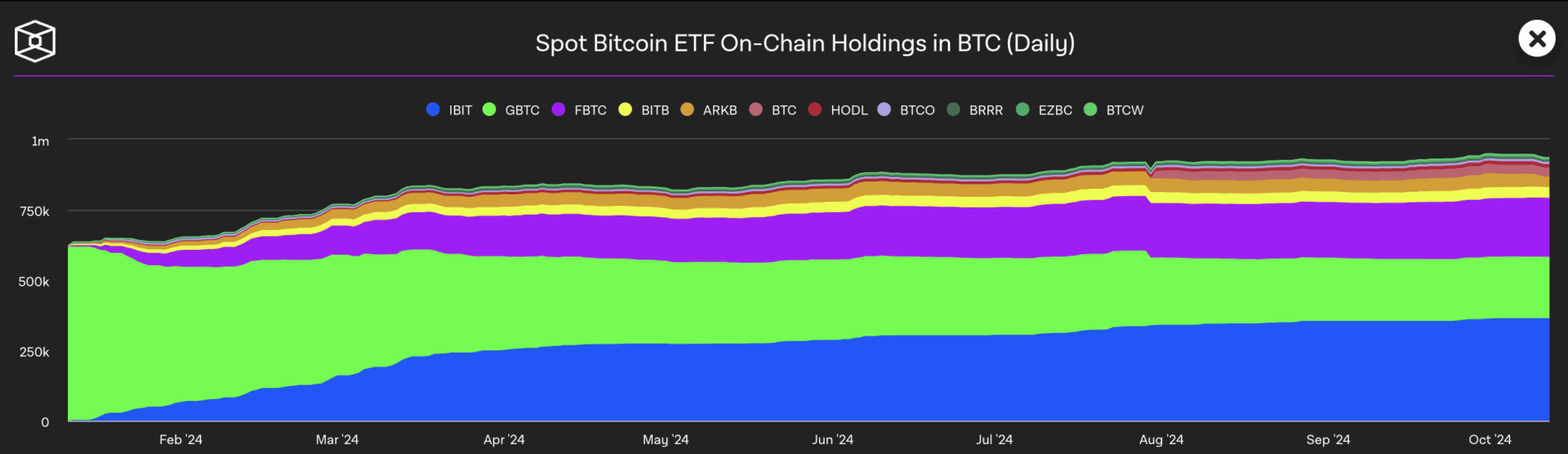

In the last week, net inflows into major Bitcoin ETFs reached nearly $500 million.

These investment products, launched less than a year ago, already hold a significant amount of BTC. Currently , spot ETFs hold about 935,500 Bitcoins, or 5 percent of the global circulating supply. Blackrockalone manages nearly 2 percent.

The combination of these market dynamics favors positioning on Risk On assets. Bitcoin may rank among the best choices, with attractive prospects for the price of BTC during Q4 2024. The price currently sits above $62,000, up after the liquidity hunt carried out on Thursday with the plunge below $60,000.