Leggi questo articolo in Italiano

Bitcoin rally? ETFs own 1 Million BTC

By Daniele Corno

2024 is confirmed as the year of Bitcoin ETFs. New market players put on a turbo-charge, 1 million Bitcoins purchased in 10 months

Record upon Record for ETFs

It has been just over ten months since that famous January 10, 2024, when the Securities and Exchange Commission (SEC) gave the green light to trade Bitcoinspot ETFs.

Over the course of these months, traditional finance investors and their clients have shown significant capital interest in the sector.

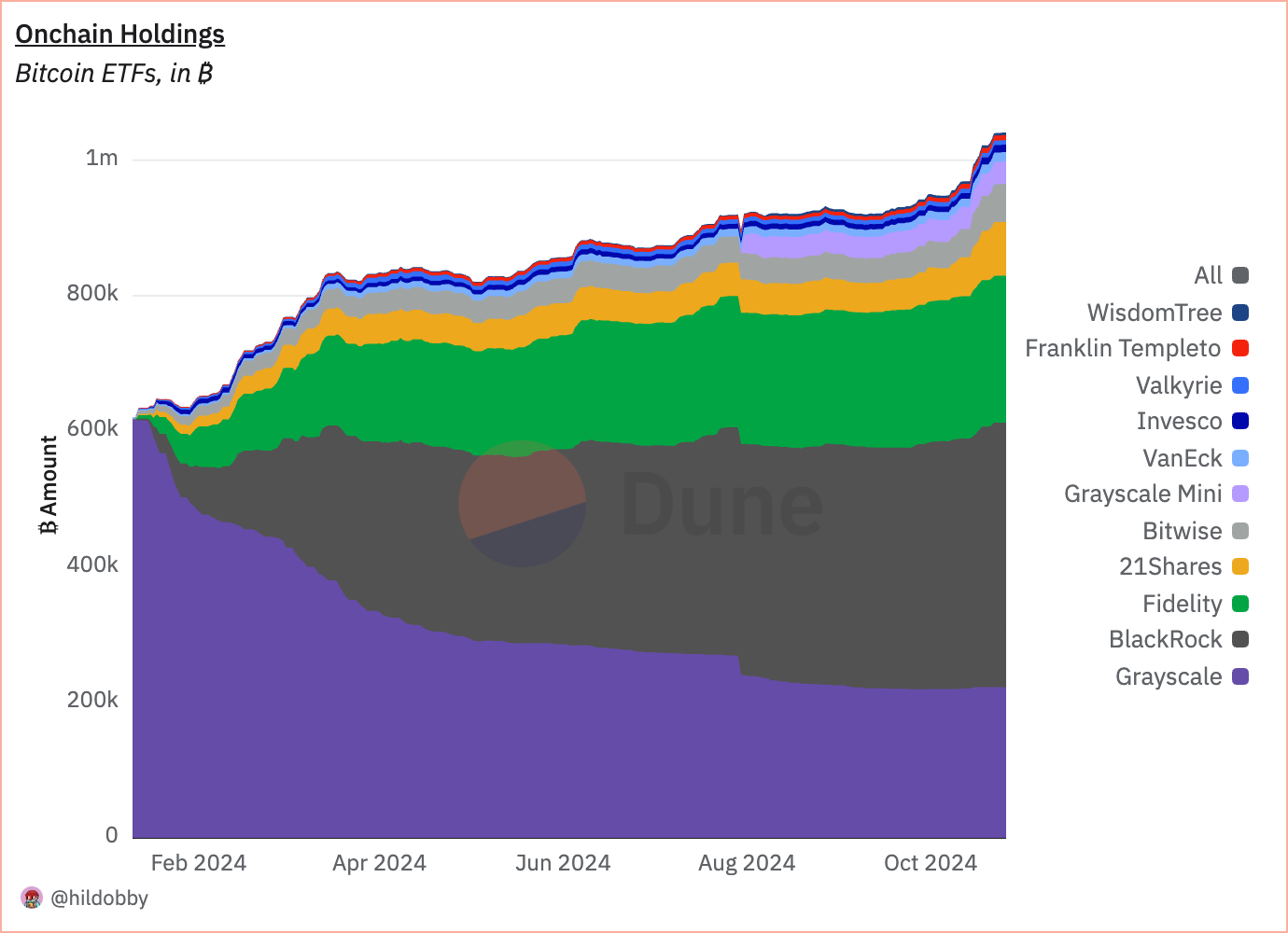

To date, the Bitcoin spot ETF market holds more than 5 percent of the circulating supply of Bitcoin. With more than 1.1 B ILLION BTC in their pockets, representing a countervalue of $70 billion, traditional investment vehicles have broken new ground and new opportunities for the industry.

It should be specified that, on January 10, the conversion of Grayscale’s Bitcoin trust into an ETF took place, which had over 600 thousand Bitcoins in custody. However, the imposed 1.5 percent annual fee has led investors to migrate their positions to cheaper instruments. In fact, GBTC currently holds just over 222 thousand Bitcoins, just over 30 percent from the beginning of the year.

Blackrock is the main driver

Traditional finance is also reflected in the crypto sector. In fact,Blackrock, the world’s leading investment fund demonstrates its hegemony in our sector as well.

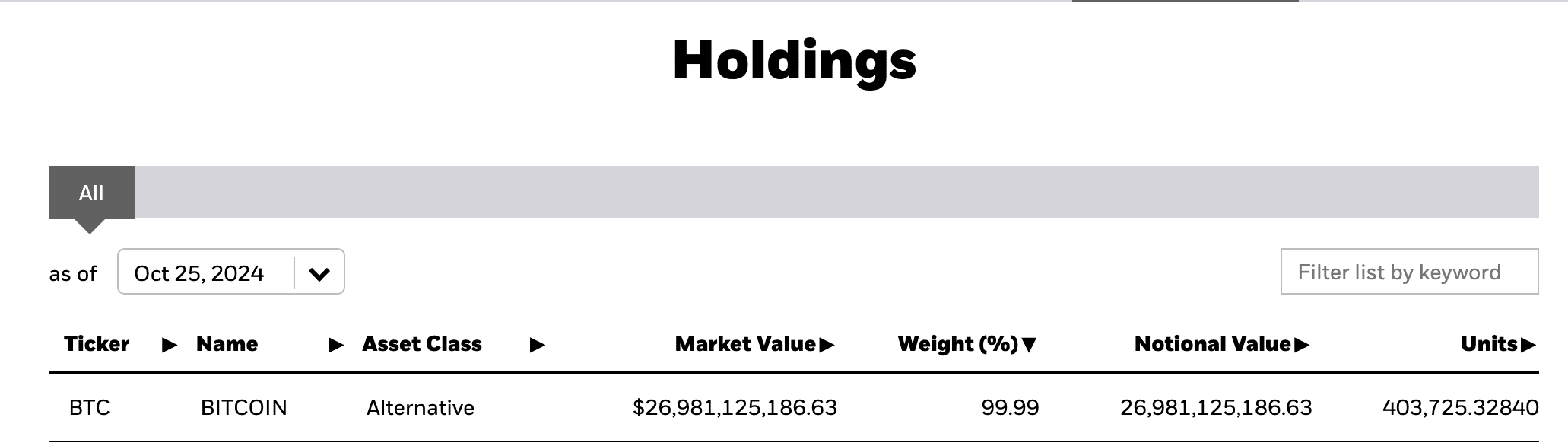

In the week just ended, net flows related to the ETF market totaled $997.6 million. The even more interesting figure, which highlightsBlackrock ‘s control , is that on IBIT alone , positive flows totaled $1.147 billion.

IBIT currently owns nearly 40 percent of the total Bitcoin in ETF reserves, with over 403 thousand BTC in custody. With Bitcoin currently at $67,500, the countervalue in IBIT‘s pockets is close to $27 billion.