Leggi questo articolo in Italiano

Blackrock: Bitcoin spot ETF over $1 billion in volume

By Daniele Corno

Blackrock's Bitcoin spot ETF, IBIT, surpasses 1 billion dollars in volume in October's first trading session

Geopolitical tensions and market selling

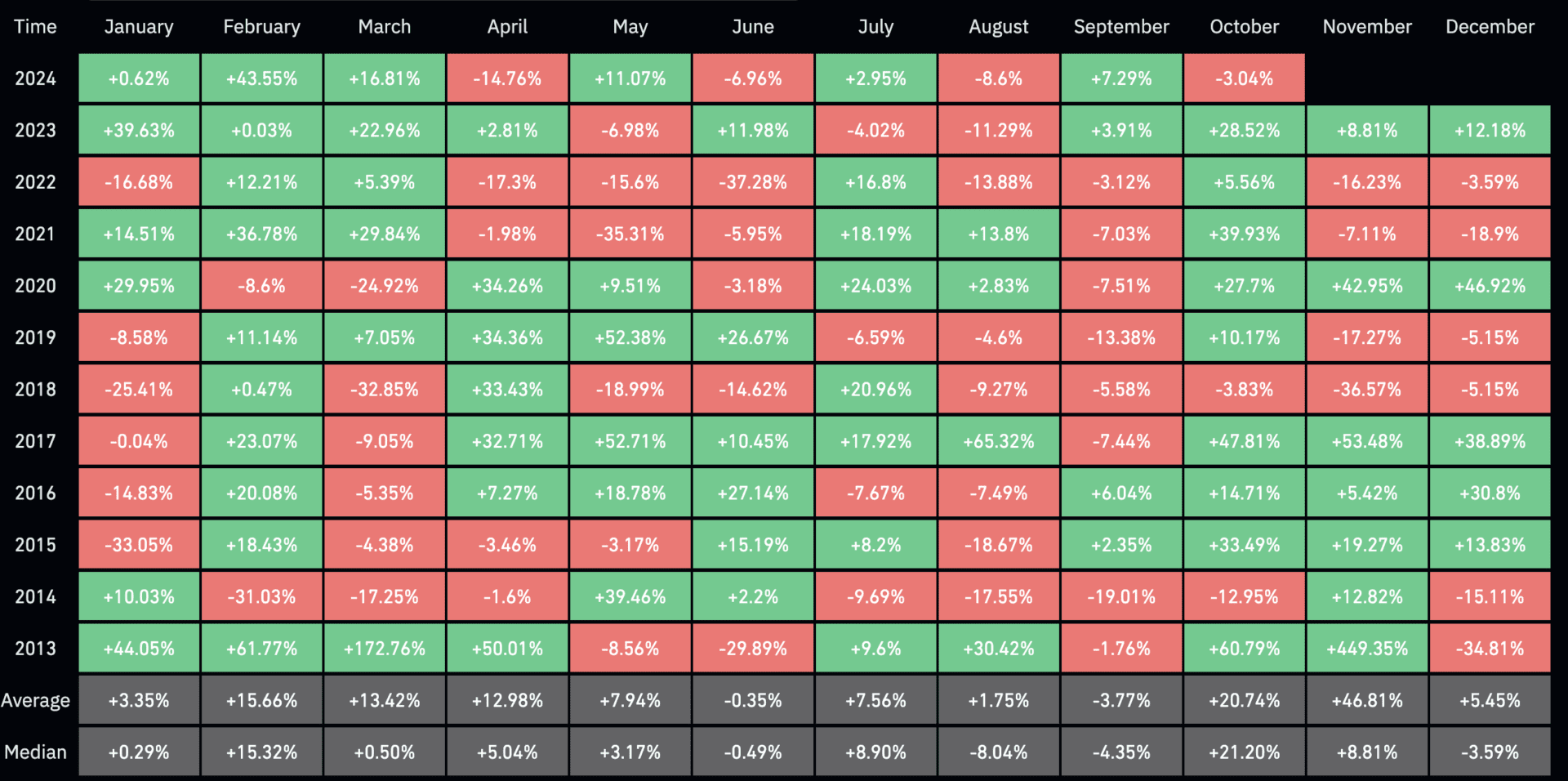

October, statistically one of the best months for BTCprice performance , with an average positive movement of more than 20 percent, opens with the price registering -4 percent on the daily chart.

The bearish directional movement, began as a result of the U.S. manufacturing data, continued later as a result of pressures in the Middle East, which saw Iran carry out a missile attack on Israel. The combination of these dynamics led to large sell-offs in the stock sector, later spilled over into the crypto sector, with Bitcoin, sinking to find support at the $60,000 level

Record volumes on ETFs, negative total flows

As reported by Bitcoin Magazine, as of 7 p.m. on Oct. 1, Blackrock’sspot BitcoinETF, had already surpassed a cumulative volume of more than $billion.

JUST IN: 🇺🇸 BlackRock's spot #Bitcoin ETF already hit $1 billion in trading volume so far today. pic.twitter.com/nVedhS5ScS

— Bitcoin Magazine (@BitcoinMagazine) October 1, 2024

The volumes, in comparison, still remain far from the volumes traded on the major exchanges. Only Binance, on the same day, saw spot volumes for Bitcoin exceeding $30 billion.

Despite higher than usual volumes, the day ends with ETFs seeing an outflow close to $250 million. Blackrock’s IBIT, in fact, is the only product to end the session with positive flows. Fidelity (FBTC) and ARK (ARKB), follow the market trend, seeing outflows of $145 and $83 million, respectively.