Leggi questo articolo in Italiano

Cake on the rise: Watch out for breakouts, new yearly highs?

By Daniele Corno

The price of Cake is at a major crossroads while all on-chain metrics are on the rise: Towards new yearly highs?

Positive signals from Cake's price action

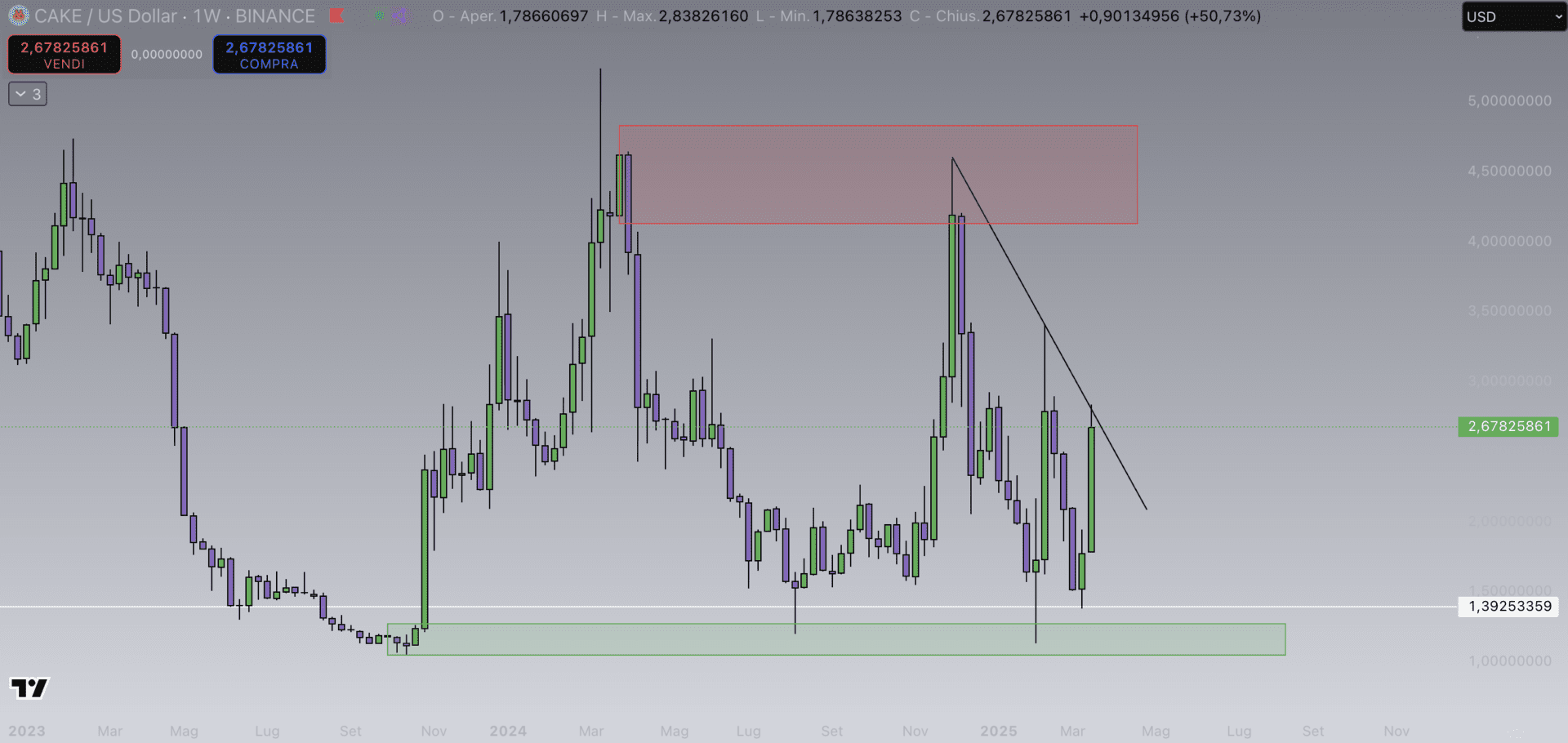

With the crypto market struggling, Cake‘s performance stands out clearly on the weekly chart, with a +50%. The price is in fact at a crossroads, at key levels that indicate an imminent pullback or a new upward excursion.

In the graph below, we can see how the accumulation area that brought the price to its highs in 2024, including in the $1.05 and $1.30 area, was a zone of significant purchases, specifically during the flash crashes that occurred from mid-2024 onwards.

After attempting an initial lunge on August 5, 2024, the price found significant buying in the $1.2 area, which was later manipulated in the collapse of February 3, where the price went as low as $1.13, before a bullish rally of +200%.

The correction that followed, culminating in the $1.4 area, returned to close all inefficient levels on the minor timeframes, favoring a recovery that is now at a key point.

Furthermore, as shown below, the price is dangerously approaching a descending trendline that has contained the price in the two recent attempts at bullish excursions. However, the POC (Point of Control) of the last two bullish movements are supporting the bullish movement, indicating the highest level of volumetric interest between $2.45 and $2.6.

It may still be too early to tell, although a breakout of the $2.8/$2.9 area could favor the creation of new annual highs, with prices above $3.4 dollars. If you want to learn more about the dynamics related to price action and trading, you can find support through our 1to1 training.

On-chain metrics growing strongly

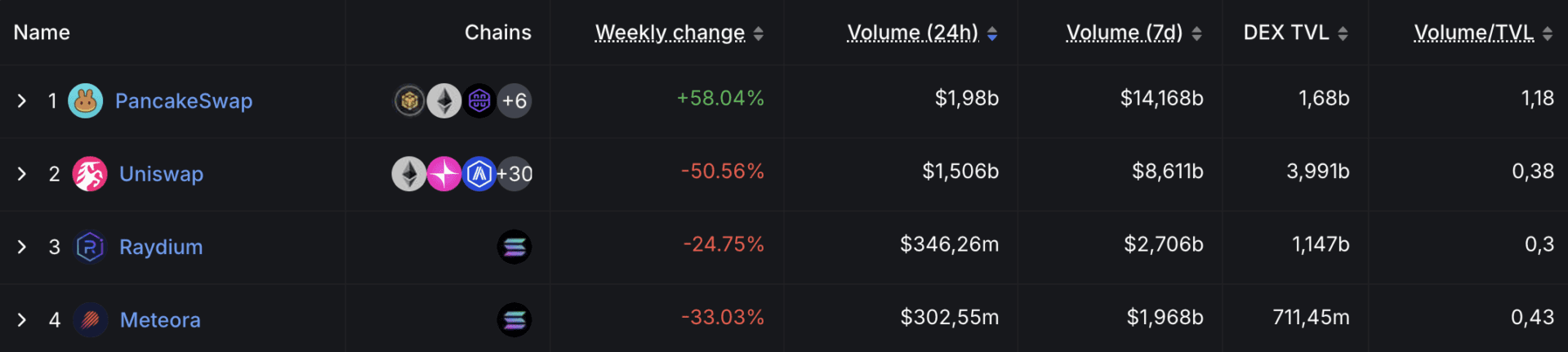

The positive narrative for Cake also extends to volumes. Ranking first for daily and weekly volumes, PancakeSwap shows a clear countertrend compared to its main competitors.

With $2 billion in 24 hours, the leading dex on the Binance blockchain surpasses the cumulative of Uniswap and Raydium. On the weekly chart, on the other hand, with over $14 billion, it marks almost 2x the volumes generated by Uniswap.

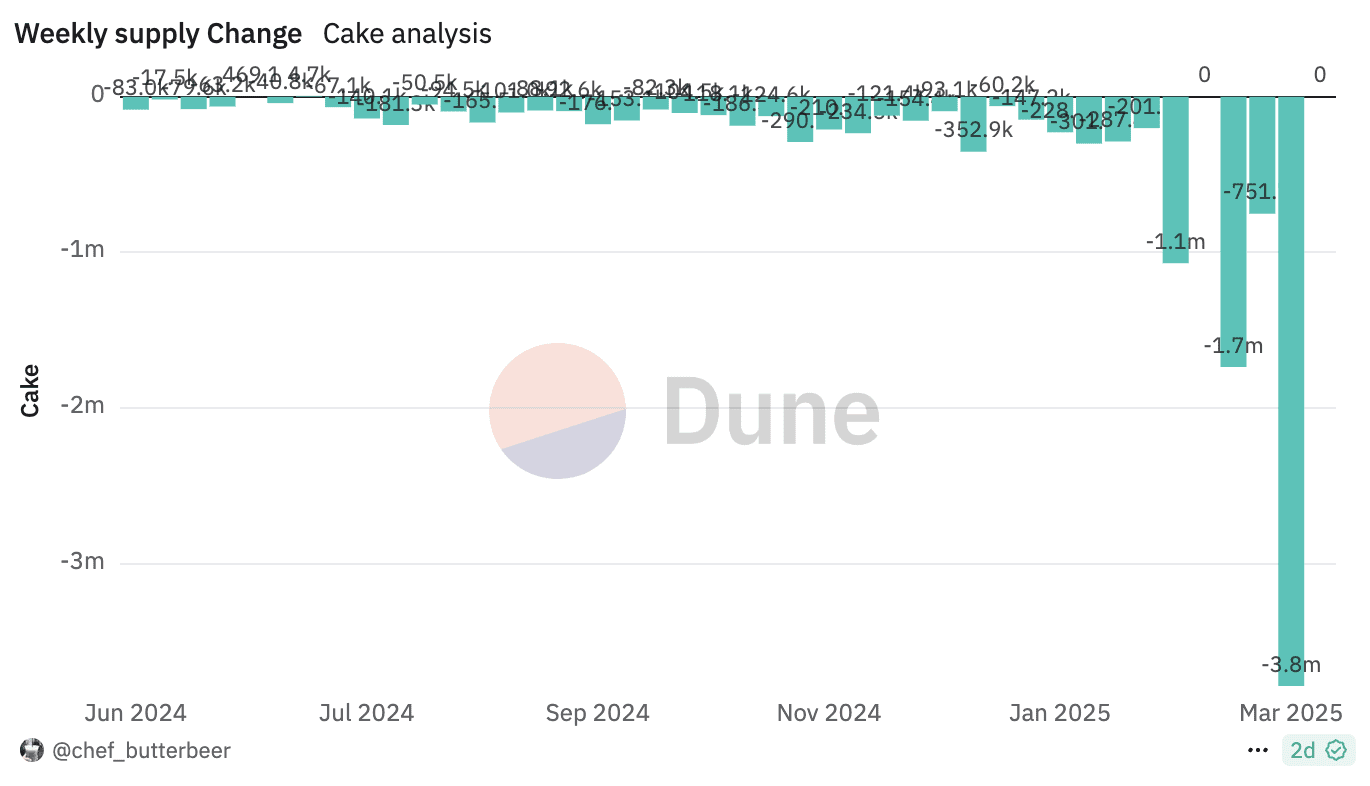

Not only that, the growth in volumes has a direct impact on tokenomics of Cake, fueling Burns and enhancing its supply deflation. In fact, the last few weeks have contributed to significant Burns that have contributed to a clear reduction in supply, equal to about -2% in the last 3 weeks, thanks to a ratio between emissions and burns equal to -6 million Cake.

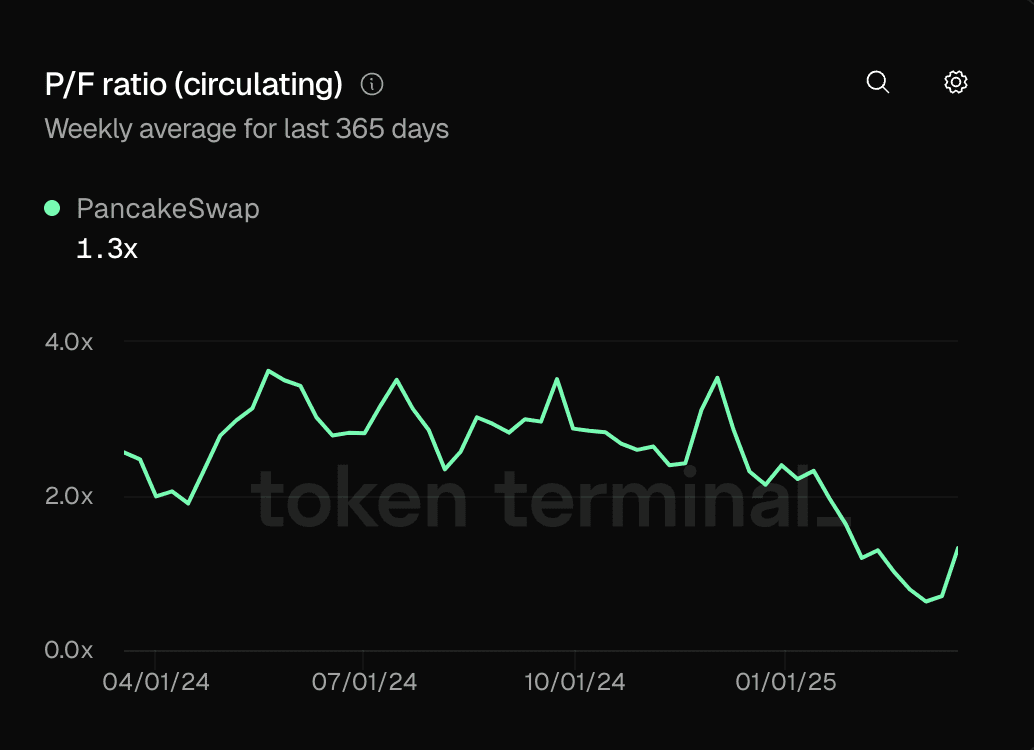

Furthermore, according to Token Terminal data, the current ratio between price and fees generated is 1.3x. This indicates that, according to the annualized figure, compared to the market cap of approximately $800 million dollars, Cake generates approximately $615 million in fees.