Leggi questo articolo in Italiano

Bitcoin collapses as stocks plummet: All eyes on the FOMC

By Daniele Corno

Bitcoin is strongly correlated to the stock market crash: All eyes on the FOMC on March 19th

Direct correlation to the market crash

In recent weeks, the ongoing correction in the US financial markets has fueled sell-offs on major indexes, including Bitcoin.

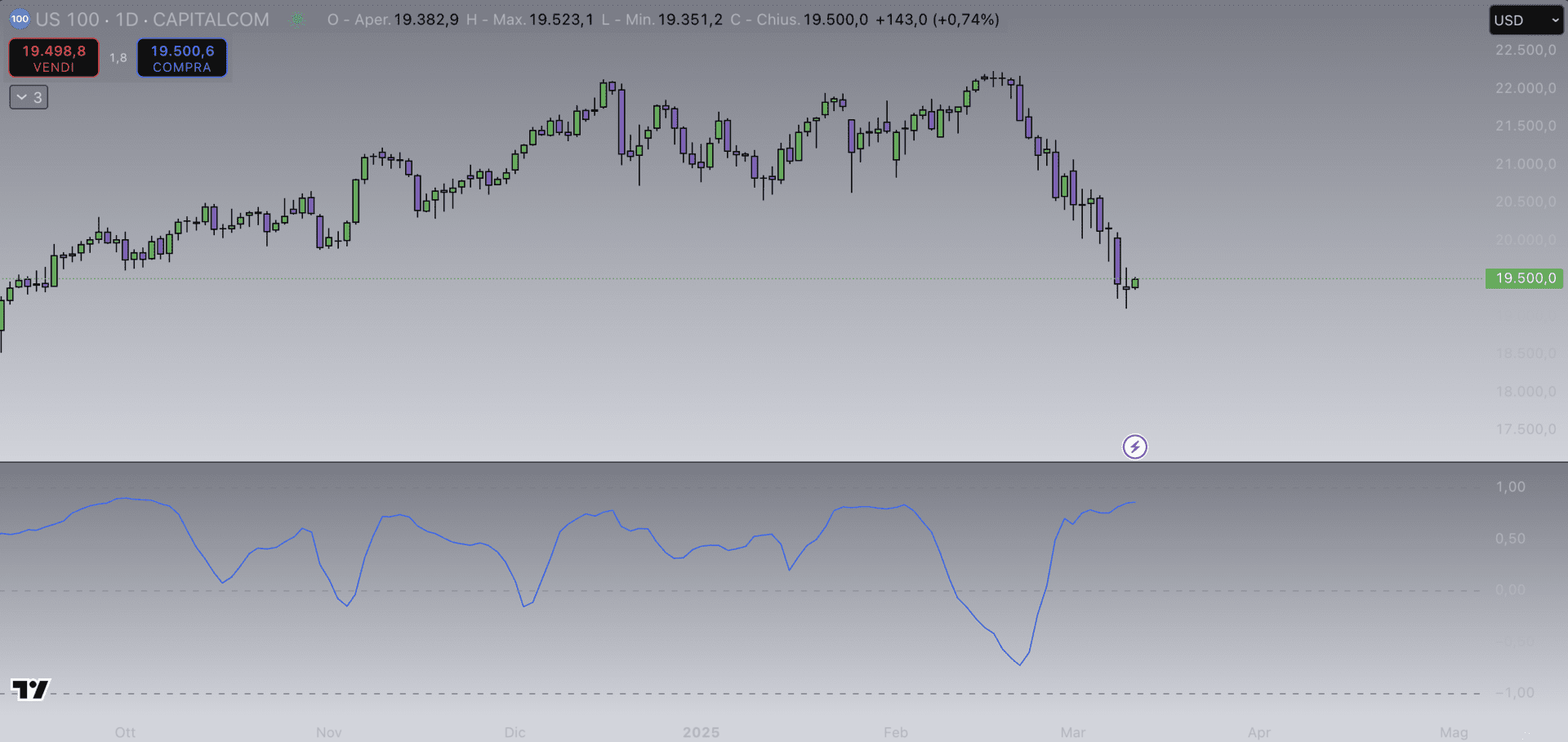

The Nasdaq 100, for example, after reaching its ATH in the 22,240 area on February 18, in just 15 trading days fell by -14.10%, showing the most aggressive loss since the previous collapse in July-August 2024. In the same period, “the correlation coefficient” between the Nasdaq 100 and Bitcoin, on the daily chart, rose to a level of 0.88, the highest level since October 2024.

According to Geoff Kendrick, head of research at Standard Chartered, Bitcoin is reacting negatively in the wake of bearish pressures in the US market. In fact, he argues that “Bitcoin has been trading solidly within this ‘Magnificent Seven plus Bitcoin’ group” in terms of volatility.

In fact, among his hypotheses, the recovery of BTC can occur through two catalysts: The first is a broad recovery by the US market, pending data on inflation that will be released this afternoon at 1:30 p.m. and pending the FOMC of the FED on March 19. The second, on the other hand, is related to government purchases of Bitcoin, both in the US market and in other third countries.

All eyes on the FOMC on March 19, over to the FED

An important driver for the recovery of the markets is undoubtedly the value of the cost of money, represented by interest rates. Cuts that, according to Kendrick, would be necessary for the recovery of the markets and consequently, for Bitcoin.

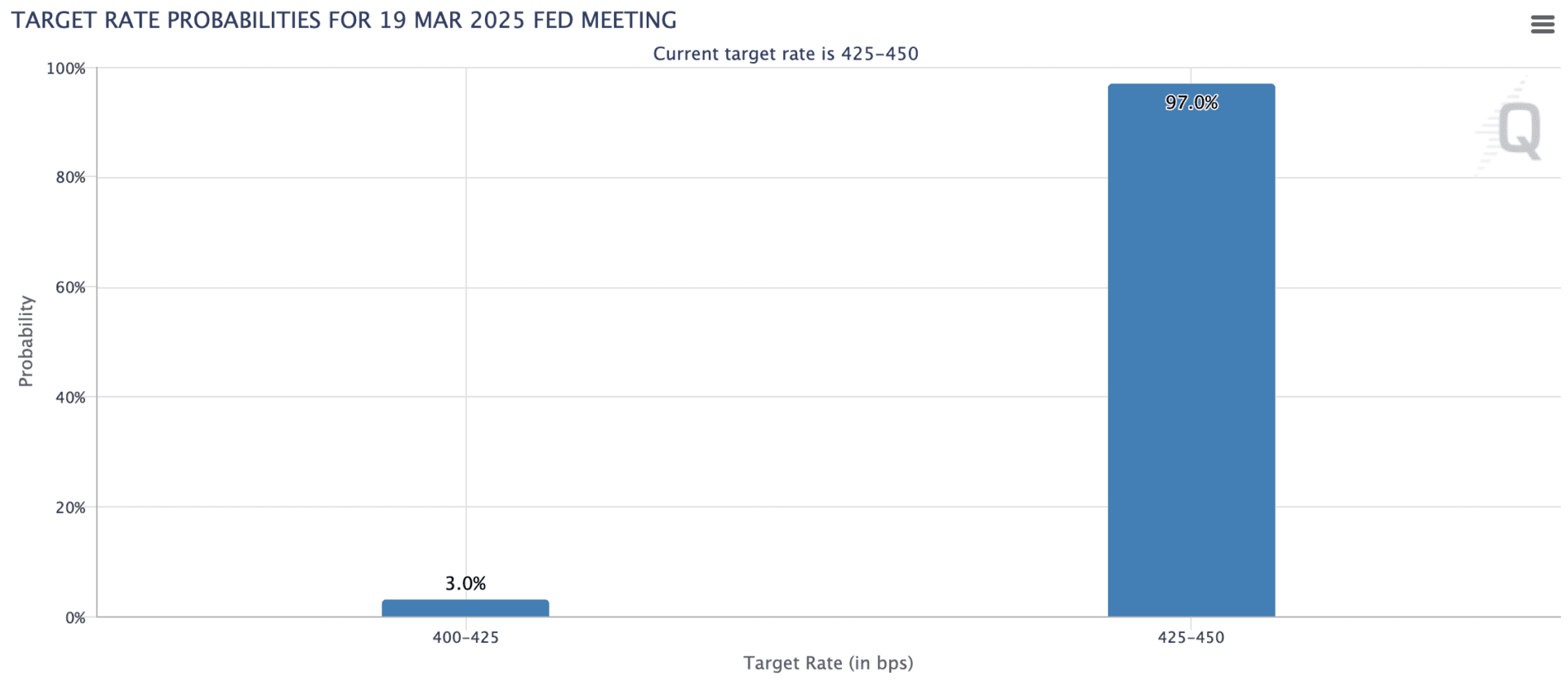

However, the forecasts to date show that nothing will happen, with a 97% probability of remaining in the range of 425-450 basis points, while there is only a 3% probability of a cut in interest rates of 25 basis points.

However, the inflation data this afternoon, if better than expected, could favor a more dovish policy from the FED. Looking ahead to the next FOMC on May 7, forecasts for 25 basis point cuts are already up to 36.5%.

However, as pressures continue amid tariffs, uncertainty and fears of recession, a breakdown to the downside of current lows could lead Bitcoin to a new plunge to previous ATHs in the $69,000 area. However, today the sell-offs have only been interrupted, pending inflation data, with a current price of $82,500.