Leggi questo articolo in Italiano

Ethereum: What is it and how does it work?

By Luca Boiardi

Let's discover Ethereum, the first blockchain where decentralized applications and smart contracts can be developed, from wallets to how to buy Ethereum

Ethereum: introduction to the blockchain by Vitalik Buterin

In addition to performing simple cryptocurrency transactions, Ethereum is a blockchain on which decentralized applications can be programmed. These applications are called DApps; they consist of a variety of smart contracts that manage transactions and allow even very complex services to be offered.

A smart contract is an algorithm developed by expert programmers. In it are written the instructions to be followed to carry out certain transactions in a fully automated way. Joining multiple contracts together gives rise to decentralized finance protocols but also gaming platforms, metaverse and NFT marketplaces.

Ethereum’s added value lies precisely in being the blockchain of choice when it comes to smart contracts and applications. The big trends were born on this network, which is still a major player despite the many alternatives that have sprung up over time.

In this article we will get a good understanding of what Ethereum is and how it works. We will answer the question “How does the cryptocurrency Ethereum work?”, known as Ether, by exploring its various use cases.

By the end we will know everything about Ethereum. Let’s start!

Index

Ethereum's history

The idea for Ethereum was born in 2013, back in the days when cryptocurrencies were still something for a few computer geeks.

Who invented Ethereum coin? By now it is a reality with a team of specialists in the field. We originally found only two masterminds, though: Russian-Canadian programmer Vitalik Buterin and Gavin Wood, who now is involved in Polkadot.

In thinking about Ethereum, Buterin wanted to go beyond simply “managing a transaction ledger” (the main task of the Bitcoin protocol). In fact, the goal was to create programmable currency-a unit of value that could be managed automatically by software, while maintaining Bitcoin’s level of openness and decentralization. A fascinating undertaking but far from simple.

Years later, we know how it turned out: Ethereum is an immense reality, the only one that deserves a place in the grandstand with Bitcoin.

Simplifying how Ethereum works, we can say that the blockchain also contains real lines of code, algorithms. They are packaged within smart contracts (we will learn about them shortly). A multitude of interacting smart contracts form a DApp, already mentioned in the introduction.

A DApp is nothing more than the final interface visible to the user. By interacting, the latter will be able to send transactions of various types. Some examples of Decentralized Applications are Uniswap, Aave, and Curve.

Going back to the birth of Ethereum, it is curious why it carries this less.

As a good nerd, Vitalik is a big fan of science fiction. Browsing Wikipedia, here he came across the definition of ether, an element described as “the invisible medium that permeates the universe and allows light to travel.” His reaction? After a “that’s cool!” also came “now I’m going to “steal” its name for my project!”; the rest is history.

Along with Ethereum came Solidity, a Turing-complete programming language designed specifically for writing smart contracts. Today Solidity is the language of choice for a variety of protocols, although viable alternatives are spreading.

The initial funding for Ethereum occurred in 2014 by selling the ETH coin in exchange for BTC. The counter value was a few cents per ETH (yes, I know what you are thinking: a real gem!).

This mode allowed 31,500 BTC to be raised, at the time worth about $500 each. This was the first ICO in history, another victory for our good Vitalik.

"Ethereum's goal is to create programmable currency while maintaining Bitcoin's level of openness and decentralization"

What is Ethereum?

We have argued that Ethereum blockchain aims to add programmability to Bitcoin’s functionality and use cases. We just have to find out how.

The functional unit that allows value to be managed, in the form of ETH or tokens compatible with its blockchain, is the so-called smart contract.

A smart contract is an algorithm written specifically to perform specific actions, following well-defined rules.

Actions are nothing more than transactions containing ETH, tokens and data. For example, swapping one coin for another will lead to interaction with several smart contracts, each with a specific task.

Just on the subject of the tasks of a contract, it all depends on its source code. In one case it may establish rules and procedures for staking a token; in another it may define the method for giving liquidity to a pool, or exchange one coin for another at a specific price. The applications are almost infinite: it all depends on the platform and the services offered.

The outputs are therefore strictly dependent on the type of smart contract.

Let us analyze a concrete case such as the smart contract that changes ETH to USDC on Uniswap. For those who do not know, Uniswap is a DEX that allows exchanges to be executed without an intermediary, the exact opposite of a centralized platform such as Binance.

Going back to the smart contract, it will receive Ether or USDCs as input, it is up to the user.

As a first step, the contract will need to know the exchange rate, and guess what? This data will come from another smart contract dedicated for the purpose. At this point, the output will consist of a transaction to the same sender address containing an equal counter value of the other token.

Summarized further: the user initiates the transaction; the smart contract inquires about the exchange and makes appropriate verifications; the smart contract concludes the job and the user receives what is desired.

By interacting with the contract we have no clue about the complexity of the system that is working for us. What to the eye is a simple button really hides a lot of complexity.

If we were to analyze a smart contract, we would see “only” lines and lines of code that are impossible for non-experts in the field to read. After the contract is concluded and tested, it is uploaded to blockchain, becoming operational and no longer modifiable or arrestable.

By combining several smart contracts communicating with each other, here is formed a decentralized finance DApp.

We mentioned Uniswap, that is, the application whose purpose is to enable the exchange of coins and tokens.

To do so, the platform hosts various smart contracts: one for each exchange pair, one to manage the price feed, one to control liquidity within them, and many others with technical purposes that are beyond the scope of this article. Just to give some idea of the amount of work that needs to be put in.

All of these smart contracts continuously exchange inputs and outputs, in a flow of information and value.

There are so many applications: some are forks (Uniswap boasts numerous copies scattered across various networks), while others perform original tasks.

The most important information to keep in mind is that this is all done in a decentralized manner, which is why Ethereum blockchain is often referred to as World Computer.

"Smart contract: an algorithm that performs a given task automatically and independently"

Bitcoin vs Ethereum

Whether we are talking about Ethereum or Bitcoin, it is natural to get to the point where comparisons are triggered. So let’s find out what the most significant differences are between the two major blockchains (and related coins) in circulation.

The first major difference is the nature of the currencies themselves: bitcoin is a store of value and medium of exchange; Ethereum, on the other hand, is programmability territory and opens the door to a variety of applications.

A second difference lies in the consensus algorithm that governs the operation of the two blockchains.

Bitcoin is Proof-of-Work, based on what is known as mining. Creating a new block takes 10 minutes, and the maximum amount of BTC is set at 21 million.

Ethereum is a former Proof-of-Work blockchain. In fact, a landmark event called Merge occurred in September 2022, responsible for Ethererum’s transition to the Proof-of-Stake consensus algorithm. Future upgrades will bring this network to ever better performance.

The maximum amount of ETH has no limit, and this is one of the main criticisms: since there is no ceiling, the coin is constantly devaluing.

However, in 2021 came a major Ethereum fork, codenamed London. It involved removing some of the ETH spent on gas fees from circulation, which drastically reduced (by about 30 percent on average) the issuance rate.

The Merge led to further declines, which is why it can be assumed that inflation will remain contained in the future; after all, the mechanism is simple: the more the Ethereum network is used, the more gas fees are burned and inflation minimized.

What is the intrinsic value of Ethereum?

We have realized that the purpose and use cases of Ethereum are quite different from those of Bitcoin. Therefore, who uses Ethereum? Users are heterogeneous and resort to the network for a variety of reasons. Smart contracts and DeFi are certainly a driving horse, as are NFT and normal transactions. Let’s take a closer look at what the intrinsic value of Ethereum and ETH is.

Bitcoin is the ultimate store of value, scarce and secure, while Ethereum is programmable value. But then how do the two coins relate in terms of intrinsic value? What is Ethereum’s given by? What is Ether for?

Ethereum cryptocurrency is used to pay for gas in any transaction executed on the Ethereum blockchain, whether it is to a wallet or a smart contract.

Therefore, if you want to use the network you need to own ETH. This is the main driver of demand. More applications and use cases lead to the growth of the entire ecosystem. Hence comes more demand for ETH and consequently its intrinsic value also increases.

In contrast, on the supply side, Ethereum possessed an issuance rate of 2 ETH per block. A block was mined about every 12 seconds, which settled its annual inflation at 4.5 percent, with no maximum supply. However, these figures are now obsolete.

The Ethereum London hard fork in the summer of 2021 dealt an initial blow to inflation. The mechanism is as simple as it is successful: gas fees spent by transactors are partly burned, that is, removed from circulation.

Therefore, the greater the use of the network, the higher the gas fees spent and the greater the reduction in inflation.

At the time, this factor reduced inflation by about 30 percent:

Even, on some days the use of the network was so intensive that Ethereum became deflationary.

Beware, however, because the merge brought further improvements, not only on the inflation issue. Let’s move on to the next section and find out about them in more detail.

"Ethereum possesses several use cases and, as a result, a decidedly high intrinsic value"

Ethereum 2.0: what has changed?

Ethereum 2.0 (known as such even though the term has fallen into disuse) is the most anticipated set of updates ever for investors and users of the network. Not only that, we can regard it as a landmark event for the entire crypto and blockchain industry.

The reasons for this excitement are mainly two:

- the drastic reduction in gas fees, which effectively makes Ethereum more “popular.”

- the decrease in annual inflation estimated at about 70 percent.

How is all this possible? Let’s see.

The main change in the move to 2.0 was the farewell to the Proof-of-Work consensus algorithm to the Proof-of-Stake algorithm.

First and foremost, the adoption of PoS leads to higher performance. Or rather, it lays the foundation for the integration of more scalable and faster solutions, eliminating the limitations of mining.

In addition, energy and environmental sustainability also benefit. Indeed, the computational power required by Ethereum plummets.

But it is inflation that takes the hardest hit. The combination of very low inflation and supply reduction proportional to protocol use makes ETH also very attractive as a store of value. This is a first for a crypto previously seen only as a consumable to execute transactions.

Ethereum 2.0 also aims to solve the scalability problem by combining Proof-of-Stake with other solutions such as sharding.

The latter gimmick fragments the blockchain by assigning validators to each shard. This “chunk” will have much less computational load, so transactions will be finalized with greater speed and at lower cost.

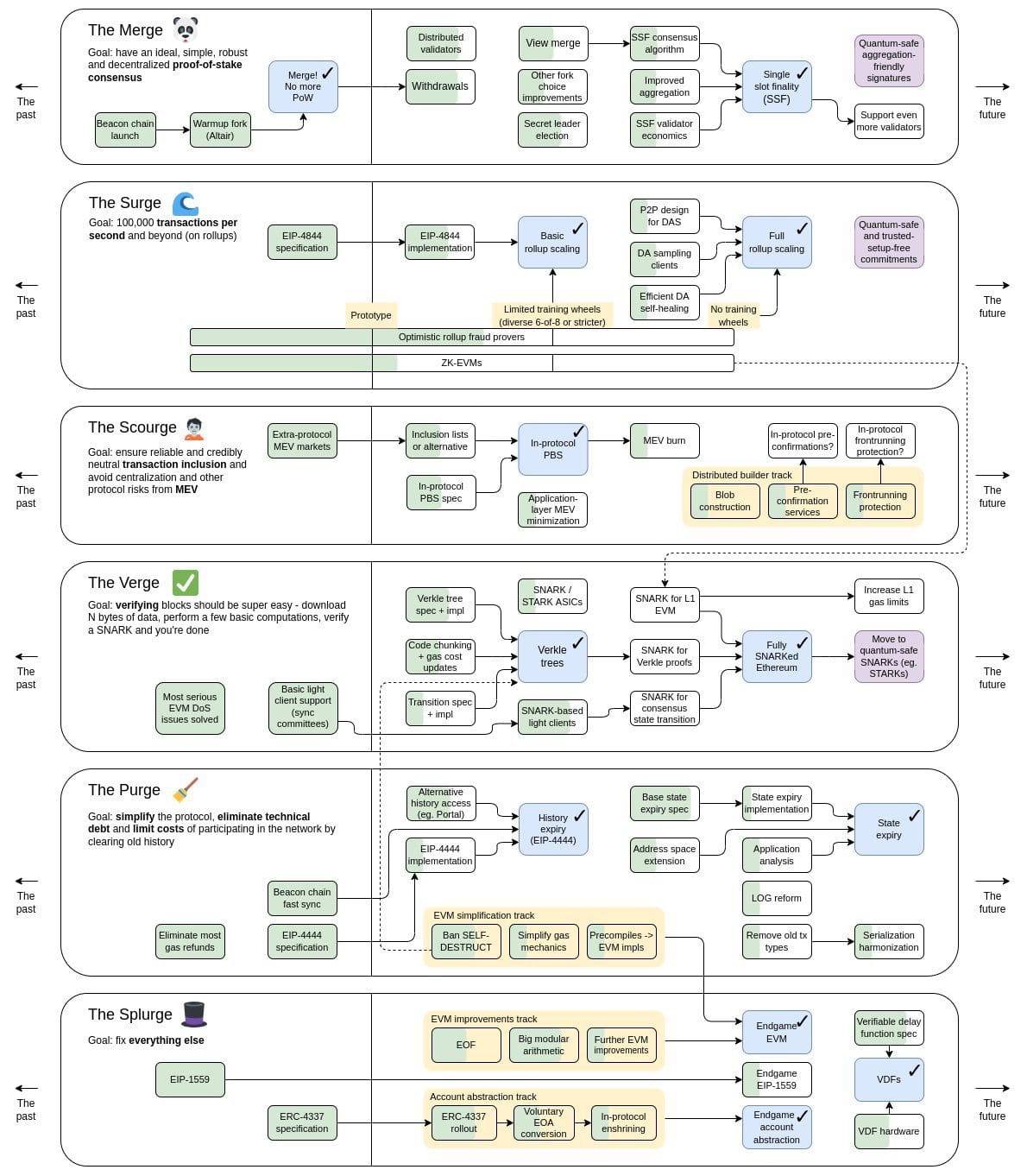

The latest updates to Ethereum’s roadmap (shown below), also published by Vitalik Buterin, give quite a bit of weight to rollup solutions, which are considered technologically better for the network’s needs. In any case, the founder continues to show care for his creature.

Ethereum 2.0 is divided into several phases that will take years to complete. The Merge is just the beginning: we are going to see some great things!

"Ethereum 2.0: Once again, this blockchain stands as a role model for the entire industry"

Where to buy Ethereum?

If after a careful fundamental analysis you were wondering how to buy Ethereum, here are some tips.

The vast majority of crypto exchanges offer buying and selling for this coin. Among the best around, considering the low fees:

- Binance, perfect for everyone. By clicking on the link just provided you can sign up through our referral and get a 20% fee discount forever.

- Bitget, suitable for those interested in derivatives and bots. 15% cut in fees for life.

- Bybit, another excellent exchange, suitable for all types of users.

- OKX, another really interesting name. Follow the link and you will test your luck: two mystery boxes worth up to $10,000 await you.

How to get an Ethereum? Regardless of the amount you are interested in buying, CEXs are really easy to use. In just a few steps you are able to deposit traditional or crypto currencies and then convert them to Ether.

If you were wondering “how to buy Ethereum?” outside of centralized exchanges, DeFi also offers many alternatives including Uniswap and SushiSwap.

However, operating directly on the blockchain, you need ETH to pay the exchange gas fees. So if you don’t already own ETHs, at least the first time you will have to go through a CEX.

"Choosing the right exchange is key to saving on fees and operating at your best"

Ethereum wallet: which one to choose?

Ethereum provides users with a wide choice of crypto wallets with which to trade.

From MetaMask to Trust Wallet, from Exodus to MyEtherWallet, the options are many indeed.

So which wallet for Ethereum to choose? There is no absolute best wallet; each person has specific needs that could be met by a specific wallet.

Indicatively, the names mentioned a few lines above are all good and safe. One just has to try and then decide which one is preferred; however, no one forbids us to have more than one ETH wallet as well.

How to create Ethereum wallets? It is easier to do it than to explain it. We have prepared several tutorials on crypto wallets, where we indicate point by point how you should go about it.

"Ethereum provides users with a wide choice of crypto wallets to trade with"

What will Ethereum be worth in 2030?

Predictions always leave time to be found, especially over such a long time horizon. Considering that the project is relatively young, 2030 is really too far away to say what a coin will be worth.

However, we do know that everything depends on the adoption and evolution of the project.

If Ethereum continues to improve and establish itself, while also defending itself against existing and future competitors, this ecosystem can certainly continue to have its say and grow. Growth would increase the demand for ETH, leading the price to rise.

Should things not go that way instead, the ETH coin would find itself in an uncomfortable situation.

As investors, we can only stay updated and evaluate our strategy on a regular basis, ready to make changes if necessary.

Ethereum price

Let’s close the in-depth study with two lines devoted to quotations: how much is an Ethereum worth? Where to consult it?

Those who want this information quickly need only type Ethereum price, Ethereum price chart or Ethereum price usd into Google. The data is reliable and updated in real time.

To consult an Ethereum chart, as well as more accurate data, choose CoinMarketCap, CoinGecko or similar services instead. The default currency is the U.S. dollar but we will be able to easily change it to the Euro or Pound if needed.

Finally, the more demanding will have to turn to tools such as TradingView, possibly considering a paid subscription. In addition to Ethereum quotes, TradingView contains an immense amount of data on stocks, commodities, indices and much more. Here is the ETH/USD chart in real time:

Whichever you choose, in this article we have discussed just the services to monitor crypto quotes.

In any case, before buying or selling, let’s check the Ethereum quotes of the platform we are about to employ so as to avoid unwanted surprises.

We are at the greetings, see you soon!