Leggi questo articolo in Italiano

GOLD perpetual all time high perpetual

By Daniele Corno

2024 is undoubtedly the year of GOLD: ATH perpetual since the beginning of the year. Here are the tokenized assets to own gold in the crypto sector

RWA, tokenized GOLD and adoption

With a performance of more than 30 percent since the beginning of the year and a value that is poised, at the time of writing , above $2670 per ounce, 2024 is undoubtedly the year of gold.

The RECORD-breaking increase, confirms the interest of investors in allocating part of their capital to value stocks. Assets such as GOLD are leading the way.

In the crypto landscape , investors, have the opportunity to buy it through two tokenized assets, which represent a single ounce of gold. PAXG, provided by Paxos and XAUT, provided by Tether.

These assets are guaranteed by the companies, which hold as collateral the consideration for the tokens issued. Tether, currently, holds 246,524.33 ounces, with a total value in excess of $655 million, while, Paxos, recently surpassed $500 million in managed value, with a consideration of 188,715,280 ounces.

Bitcoin and Money Supply

Considered by all as the global store of value, gold is under media attention.

With the first rate cuts by the Federal Reserve, the dollar tends to lose value. First, lower rates lead people to borrow more money, increasing the money supply. Second, yields on the dollar fall, leading investors to allocate their capital to other assets, gold being one example.

As noted in recent years, the main driver for the price of Bitcoin is precisely the global money supply, (M2) however, currently an interesting correlation is occurring in the market.

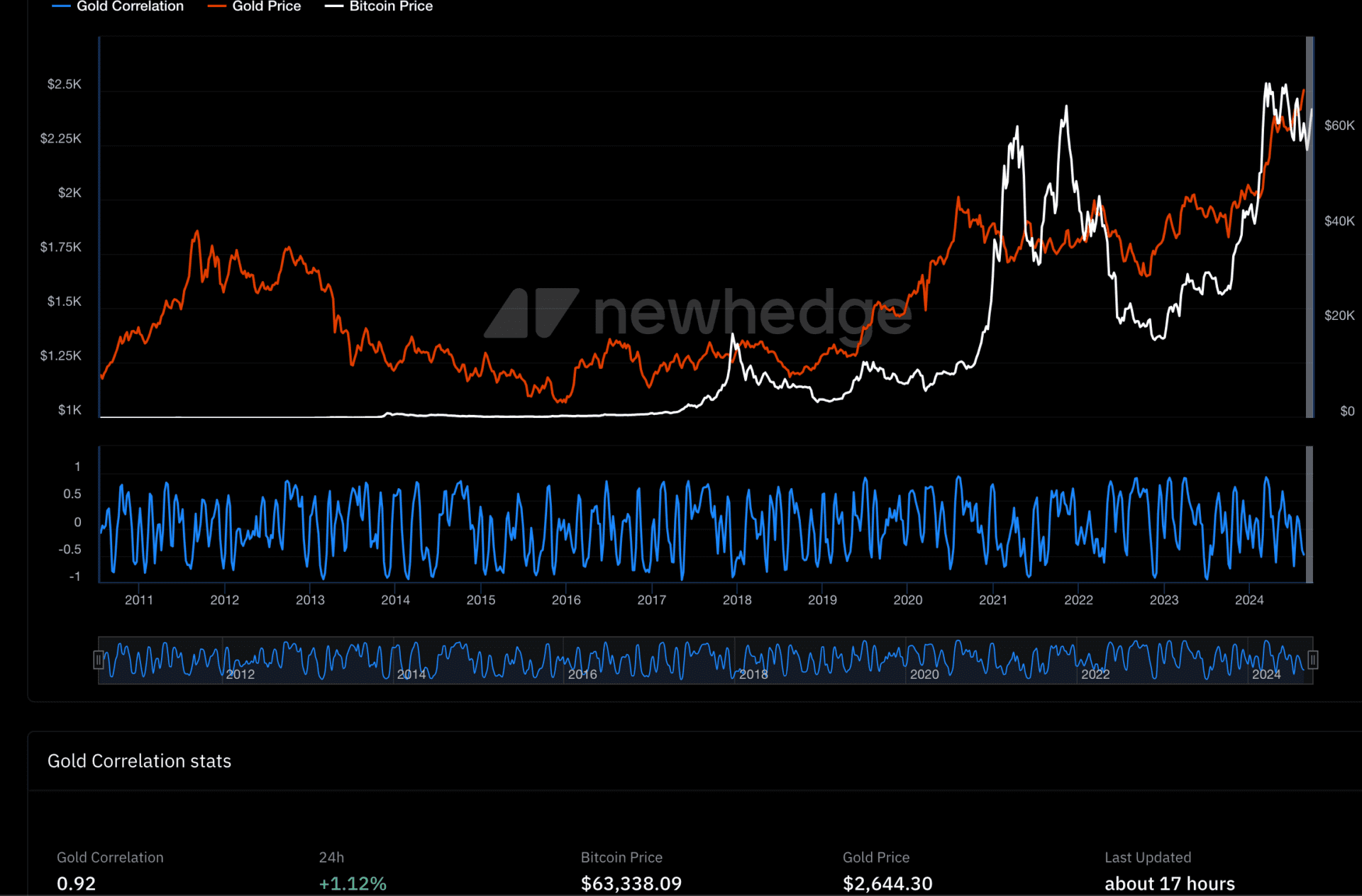

As inserted in the chart below, Bitcoin and Gold, currently, have a correlation index of 0.92. This indicator, with levels between 1 and -1, indicates on the level of 1 the maximum correlation between the two assets, with the level of -1 instead indicating a maximum inverse correlation. The 0 level, on the other hand, indicates complete decorrelation between the two assets. An interesting consideration for the future of Bitcoin‘s price