Leggi questo articolo in Italiano

Rain of liquidity on the way: BTC TO THE MOON?

By Daniele Corno

RECORD debts, rate cuts, fiscal stimulus, rising M2, carry trade. Is the market ready for an abundance of liquidity, BTC to the moon?

The market seems ready to welcome a shower of liquidity

It opens with extremely positive prospects, the Q4 of 2024, with a global market that seems ready to receive a huge infusion of liquidity. A set of highly correlated factors seem to offer excellent possibilities for investors for the end of the current year and the beginning of 2025, but let’s look at them together.

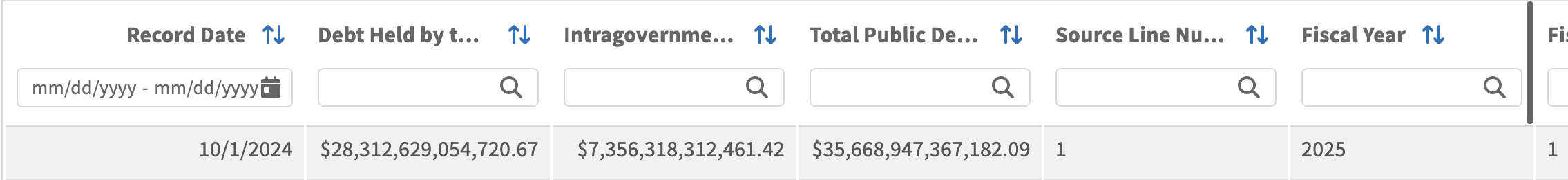

The United States, the leading global economy, saw in September the RECORD growth of one figure: the Public Debt. In the last month of Q3 alone, U.S. debt rose above the CRAZY figure of $35660 BILLION Dollars, an increase of more than $345 billion, a CRAZY growth close to 1% of total debt in a single month.

This growth, is due to the recent RATE CUT, which occurred on September 18, where, during the FOMC, the Federal Reserve made the first 50 basis point cut. This move, prompted private and institutional investors, to borrow more money, greatly increasing circulating liquidity.

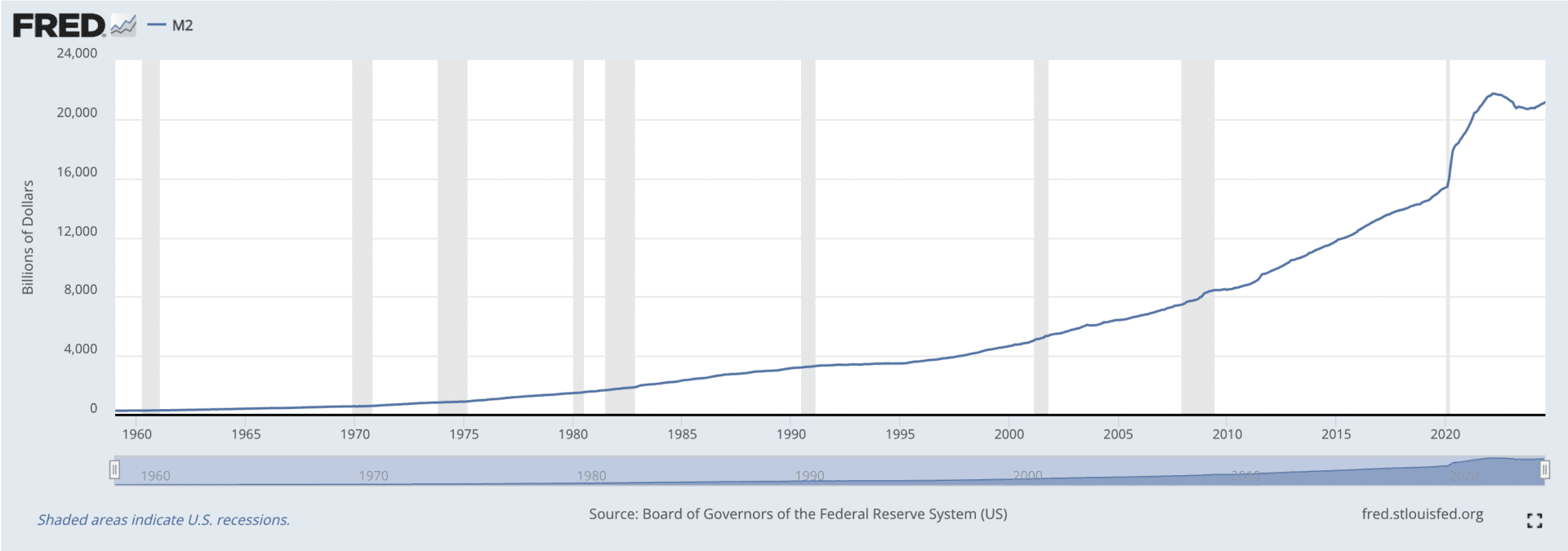

M2 on the rise

The U.S. is not the only country to have reduced the cost of money by cutting rates; in fact, Switzerland, the UK and the ECB have carried out the same maneuver. This allows the market to increase the M2 index, which corresponds to the global money supply. Currently this index is again on the rise, returning to levels above $21 trillion. The movement of this index is one of the maindrivers for the price of BITCOIN.

Asian fiscal stimulus and the future of Bitcoin's price

Also contributing to this shower of liquidity, are eastern markets such as China and Japan, for several reasons. China, in fact, has recently been working on fiscal stimulus, reducing the reserve ratio of banks and cutting short-term lending rates. A move in line with current global stimulus.

Japan on the other hand, in a different situation from all other global countries, with rates kept close to 0% for the past 30 years, in the previous month raised interest rates for the first time. However, earlier today, the Bank Of Japan, said it would NOT proceed with a further rate increase. This therefore allows the market, to continue with the financial speculation possible through CARRY TRADE.

The combination of all these macroeconomic dynamics, offers the prospect of a liquidity-rich market over the following months. This dynamic, could then further igniteinterest by investors in allocating capital in assets of a “Risk On” nature, including, of course BITCOIN.