Cardano in brief

Cardano was born in 2017 from the work of Charles Hoskinson, former co-founder of Ethereum. The name pays homage to our compatriot Gerolamo Cardano, a mathematician, physicist, astrologer and physician who lived in the 16th century.

The project is based on continuous peer-to-peer review as well as a totally scientific approach to research and development. Beyond that, Cardano finds enormous strength in the community, which is often able to compensate for the various delays and shortcomings of the project itself.

Over time, things have changed somewhat, introducing important features such as smart contracts and DeFi in 2021, after years of waiting.

In this in-depth look at the basics of Cardano and the native ADA coin, highlighting strengths and weaknesses of the project.

Index

Brief history, controversies and strengths of Cardano

The origins of Cardano ADA take us back to 2015, when the development phase began.

As we said, the originator of the project is Charles Hoskinson, an American programmer previously co-founder and CEO of none other than Ethereum, one of the leading networks in our industry.

His experience with the chain born from the mind of Vitalik Buterin ended due to an economic disagreement with the latter himself. To be precise, Hoskinson argued that Ethereum should pursue profit in some way; Buterin preferred instead that the whole thing remain nonprofit.

Cardano, launched in 2017, seeks to address some typical limitations of underperforming chains, chief among which are scalability, efficiency, and sustainability (not just environmental).

The entities behind the project are three:

- the Cardano Foundation, nonprofit legal custodian of the protocol and owner of the brand. The main task is to oversee and outline its development;

- EMURGO, a for-profit company focused on providing companies and commercial enterprises with technology solutions that implement Cardano;

- IOHK, a blockchain and cryptocurrency development company founded by Hoskinson, also for-profit. It offers services for a variety of players, including academic institutions, governments and businesses.

Thanks to these three figures, Cardano can both develop and pursue ambitious economic goals.

The growth stages are well planned and include major integrations (we will see them later). A great virtue of Cardano lies precisely in this: a well-crafted roadmap that adds value over time.

Cardano controversies.

First of all, the project has often been the victim of even very heated criticism due to its continuous self-proclaimed superiority over the competition, but without having tangible evidence to prove it.

While the scientific and continuous-feedback approach is commendable, it slows down growth too much.

By performing a quick search, we can find an enormous amount of material on Cardano. However, some of what is written has yet to be implemented.

Beware because the criticality is not in coming later; on the contrary: if one takes the right time to offer something better, even coming later than others one will still be able to “win.” Cardano’s problem thus lies primarily in communication that pushes too hard on what one does not yet have, mounting an intrinsic value yet to be demonstrated in the field.

Charles Hoskinson is a brilliant but at the same time overly energetic character. This behavior of his has created two ways of looking at him: you either “love” him or “hate” him. In the extreme, one even goes so far as to describe him as a prophetic figure — way too much!

Cardano’s community is probably the most charged and passionate: beware of criticizing the project, you may receive less than noble titles from the most hardened supporters.

Strengths of Cardano

That said, it is fair to raise criticisms just as it is equally fair to highlight what is good.

First, there is a well-built structure behind Cardano and a far more detailed development plan than many other networks. This is certainly aided by the entrepreneurial, profit-driven approach: if you want to acquire customers, you have to present your product to the best of your ability.

The founder, however peculiar, is a talented person with a track record that certifies his skills.

The community, though sometimes overly fiery, is an additional strength, as it is essential to have a hard core that believes in the project.

Finally, Cardano is showing something. In September 2021 came smart contracts, and in January 2022 the first DeFi protocol, SundaeSwap, debuted. As of 2024, growth continues, although it is still struggling to take off. Of note is the hard fork in September 2024 by the name Chang, which introduced decentralized governance and made ADA a governance token.

If decentralized finance of this chain were to take off, well, one can only be bullish for the whole ecosystem. But we will have to be patient a little longer to see if the network will have the strength to revive itself and regain positions in the ranks of the most widely used and capitalized realities.

Now that we know a little more, let’s find out in detail what Cardano is and what it is for

"The story of Cardano is one of lovers, detractors, controversy and flashes of genius."

What is Cardano (ADA)?

Cardano is a blockchain based on the Proof-of-Stake consensus algorithm, designed to be more efficient than Proof-of-Work realities.

In contrast to Bitcoin, a chain based on mining and therefore energy-intensive and slow, Cardano uses validators to ensure the correctness of transactions.

By doing so, operations do not require solving complex mathematical calculations (as is the case with Bitcoin), and performance is far superior.

Cardano is a chain that aims to be scalable, interoperable, and sustainable.

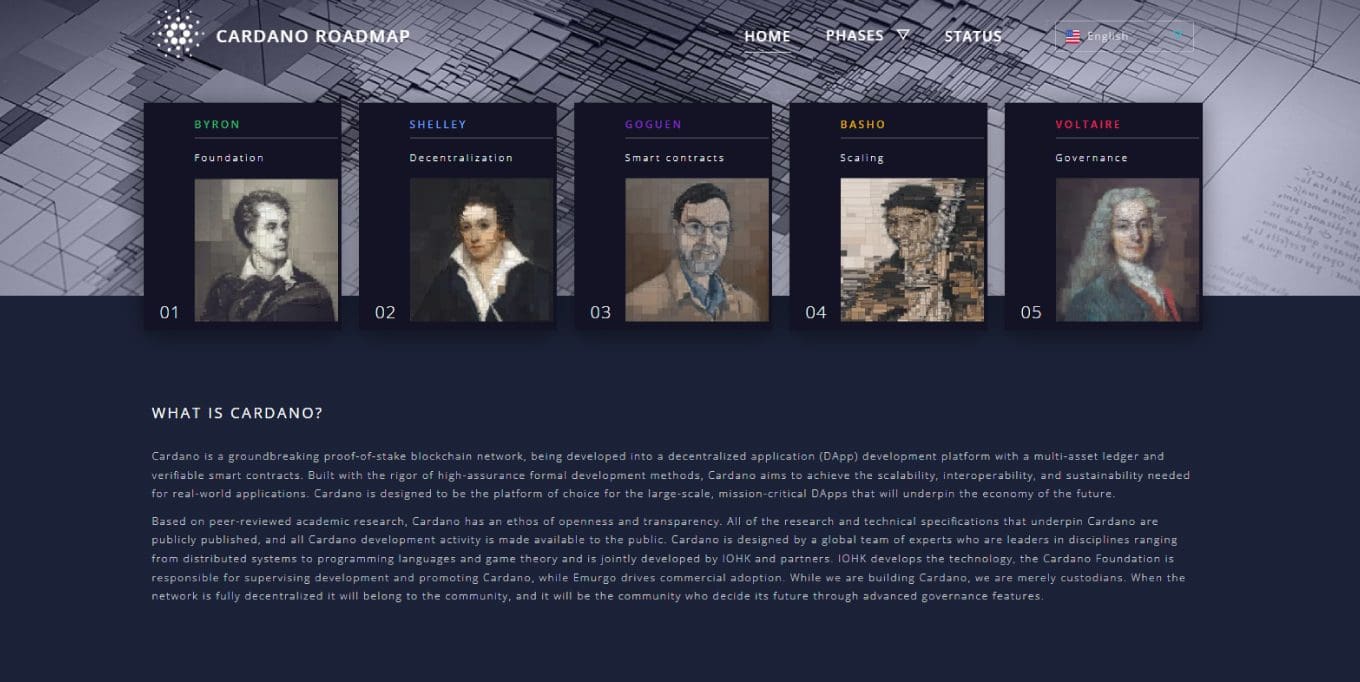

To achieve these goals, development has five different phases:

- Foundation (Byron era): launch of the project and the Cardano coin ADA, as well as the famous Cardano wallet Daedalus;

- Decentralization (Shelley era): period devoted to consolidation and decentralization;

- Smart Contracts (Goguen era): phase in which smart contracts come to life (and with them the related dApps);

- Scaling (Basho era): period of optimization in which the culmination will be the addition of sidechains that will make Cardano increasingly scalable;

- Governance (Voltaire era): the introduction of governance and treasury will create a totally independent and self-sufficient system.

The phases just listed represent the key periods of the entire project. Updates of various types are planned in each of them: from small changes to major hard-forks such as Alonzo (in September 2021, act to integrate smart contracts) and the aforementioned Chang (September 2024, governance).

Ouroboros: the Cardano consensus mechanism.

We mentioned that this chain relies on the Proof-of-Stake algorithm to process transactions. The mechanism adopted by Cardano is called Ouroboros; it is designed to provide security and speed as well as greater efficiency than average. How does it work?

First, the algorithm processes the various blocks of transactions by dividing the blockchain into epochs. These are in turn divided into temporal slots, in which a leader slot is elected, responsible for adding a block to the chain. A system is in place to ensure the correctness of events, preventing any manipulation.

Slot leaders receive a stake pool and get the reward for their work.

Cardano ADA holders , which we will discuss in a moment, can stake the coin in this pool, increasing the probability that the relevant leader is elected and receiving a reward in return.

Ouroboros is an energy-efficient, secure, and fastalgorithm. It is also the first of its kind to be studied in academia.

Through this mechanism, Cardano succeeds in the points mentioned at the beginning of the paragraph:

- it is a scalable chain, without the typical limitations of those based on Proof-of-Work algorithms;

- it is efficient in that it is fast and not energy and computationally demanding;

- it is environmentally and operationally and developmentally sustainable. Moreover, through future treasury and governance plans, efficiency will become total self-sufficiency for the entire ecosystem.

In short, the potential behind it is very much there; it should not be denied or hidden.

However, it must become something concrete, otherwise it would remain a promise and nothing more. As we have said, however, it seems that the long-awaited time has come.

Before discussing intrinsic value and future, let’s find out about the Cardano coin ADA.

Cardano ADA: the native coin

Cardano's intrinsic value and projects

In words, Cardano was always a project with good intrinsic value. The main problem was the translation of what was said into deeds.

Smart contract and DeFi are there, whereas they used to be absent. First positive note.

The community represents another plus point: while in itself it should not be a yardstick (a project can be valuable even if it lacks a following) being able to count on such loyal people creates a decidedly solid base, because it allows the most difficult moments to be overcome with fewer problems.

The features of how this blockchain works we have seen, and we know how they give rise to a secure, scalable, adaptable and interoperable environment.

In addition, Cardano’s future involves continuous consolidation and improvement. The team is well in place and constantly working.

The stage we are in now is critical to the ultimate success of the project, because the competition is just as busy, and now Cardano lacks almost nothing.

The creation of governance and treasury will go a long way toward making the ecosystem fully autonomous and sustainable. By “sustainable” we mean efficient and able to stand on its own feet. We are therefore entering a particularly delicate and importanto phase.

Expanding the focus to IOHK and EMURGO, a reflection.

This is perhaps the main strength of the project: having two profit-seeking companies behind it. Since Cardano plays a key role in the business proposition of these companies, there has to be value and continuous development, otherwise the product could not be sold well.

This gives rise to collaborations and business partnerships with leading academic institutions and famous brands, reinforcing the bullish cause.

So Cardano is a project that is finding its much heralded place: will its strengths be enough to bridge the gap with other players?

Is Cardano a good investment?

Trying to be as neutral as possible, let us consider whether an investment on the coin ADA might make sense.

At first glance, one would be inclined to say no. Cardano has lost ground to other networks, surpassed even by TON and Tron. One can see that the project is struggling to keep up.

However, let us not forget the many positive points. Cardano (and coin ADA) have all the resources to recover positions and return to prominence, but will they be able to do so?

When in doubt, we believe that investing in Cardano crypto is rather risky. Only those with a high tolerance for danger, combined with good confidence in the project, might consider investing in it.

Cardano: the Ethereum killer

We would like to conclude this in-depth study with a provocative headline.

Cardano has often been referred to as the Ethereum killer, the project that would surpass (and annihilate?) Vitalik Buterin‘s creation.

To date, we are far from this ambitious goal. In fact, we do not find regardless the point of such a statement: if Ethereum were to cease to exist, it would certainly not be at the hands of Cardano.

Perhaps this headline has contributed to excessive expectations. Cardano needs to grow for itself, not to annihilate other projects.

Coming back to us, 2022 was not the year of truth, given the strongly bearish phase. Same for 2023, although the coin held up to difficult market conditions. 2024 did not offer great insights; in fact, it rather disappointed. We will have to wait before we can give a final and reliable assessment of possible developments.

At the moment, everything is still uncertain. Perhaps that is why we have been both good and bad in these lines, as it is not clear in which direction we will go: will it still be many words with little action or will we get to see Cardano in all its abundantly announced splendor? We hope for the second scenario.