DeFi Analysis with DefiLlama

DefiLlama is an indispensable platform for every cryptocurrency investor. Indeed, the flood of free and up-to-date data is the starting point for analyzing a project, whether it is small or already structured and famous.

The blockchain is an open environment in the sense that anyone can consult transactions, amounts, wallets involved and so on.

However, this process is easier said than done. A tool such as DefiLlama aggregates the huge amount of data, processes it and presents it in a way that is quick and easy to reference. The user can then immediately focus on what is really important.

The platform we are going to discover is a benchmark in the decentralized environment. We are almost certain that anyone has consulted the proposed charts and data at least once.

Since there really is so much information, sometimes DefiLlama can be a little tricky to understand. So here we are with this in-depth study designed precisely to explore its main functions.

Although we know it by now, let’s start the article by finding out what DefiLlama is, and then delve into the various sections.

Index

What is DefiLlama?

DefiLlama is a blockchain analysis platform, focused on DeFi and related protocols (DApps).

As of the date of writing, data from over 140 networks are available . Among them we are free to range from giants such as Ethereum, Polygon and Cronos, to smaller entities.

DefiLlama is an excellent starting point for conducting more or less in-depth analysis on the decentralized landscape, on a specific chain or on a single protocol of our interest.

However, the portal does not have super specific numbers. In fact, here we will find the basic data, after which it will be up to us to go into more detail.

For this reason, it lends itself well to being consulted in combination with other well-known realities. That’s right: each service corresponds to a specific expertise.

In the next paragraphs we will discover the functions offered by some of the individual menu items. First, however, let’s devote a few lines to settings and social.

On the former, there is no dedicated page. At the bottom of the menu we will find two icons, depicting sun and moon, through which to change the color combinations of the portal. We will not find anything else to geek out with.

As for social, the Defi Lama team is quite active on Twitter, where 120 thousand followers have been exceeded.

Also present is the Discord channel, definitely less dense with participants but still useful for those looking for particular information.

For those with the skills, the DefiLlama API Docs entry contains all the references for bringing DefiLlama information to a website of their own.

Finally, the more daring can press Download Data. Handle with caution: the sheer volume of data could cause a big headache!

"DefiLlama is something indispensable for those working in decentralized finance"

Monitoring blockchains

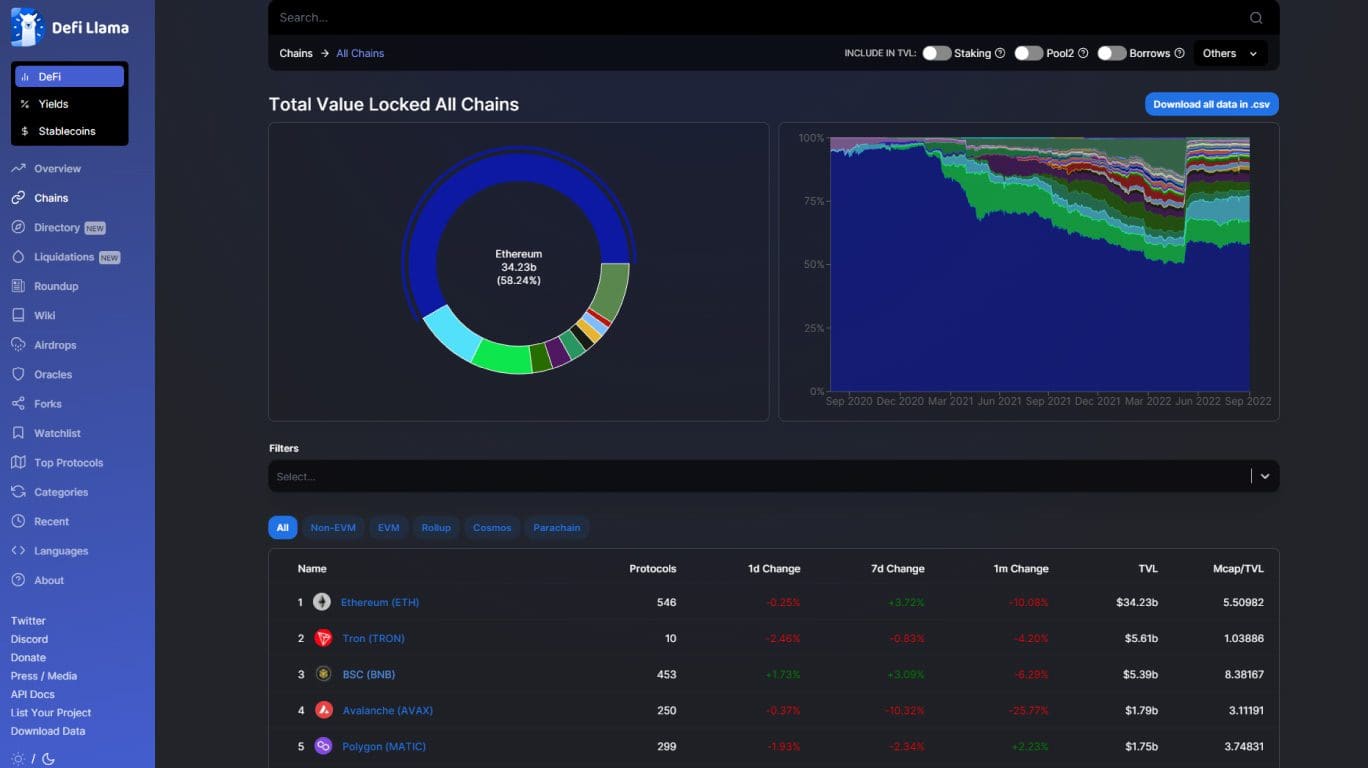

It all starts from the website defillama.com. Welcoming us will be the Overview page with all the data related to the general situation of decentralized finance.

From the menu placed on the left we will be able to select the view of our interest:

- DeFi: will show the list of protocols, sorted by total deposited liquidity.

- Yields: we will display liquidity pools and can sort them by APY, TVL or confidence.

- Stablecoin: measurements on stablecoins, that is, those cryptocurrencies with the value tied (pegged) to another asset, usually a fiat currency such as the U.S. dollar.

Based on the choice just made, the menu will adapt. We will then be able to open pages reserved for certain information. Whatever our intent, we will probably find what we are looking for.

DefiLlama is an excellent portal, rich in data but never confusing. You only need to know just a few terms like APY and APR to be able to understand all the numbers available. This makes this site a suitable choice even for those new to decentralized finance.

Directory: direct links to DeFi protocols

Here is a seemingly unhelpful but actually well thought out section.

In Directory we will find a list containing all the DeFi protocols tracked by DefiLlama. By clicking on an entry we will be redirected to the relevant official site. This feature is perfect for avoiding scams. In fact, by googling the name of a decentralized finance platform we may come across scam portals.

By falling into the trap and approving a transaction in the wallet, here we would be leaving our cryptocurrencies at the mercy of the malicious people behind the fictitious site.

All it takes to avoid this risk is a simple expedient: save the DeFi protocols we use in our browser’s bookmarks and avoid searching for them on Google and other search engines. Or be sure that the result link is the correct one.

Alternatively, the Directory section of DefiLlama is suitable for reaching any portal with total peace of mind.

"Beware of scams: never click on Google results without being sure the link is correct"

DefiLlama Liquidations

There is also a section on the portal devoted to liquidations called Liquidations. These measurements are an additional cue for conducting the most accurate research possible.

We always take a look at the various data available, even if they seem useless for our situation. Always better to abound than to find ourselves in trouble later.

DefiLlama crypto airdrops

Let’s face it: one of the greatest achievements is to take a niceairdrop, perhaps of a token that will perform over time. There is nothing better than being entitled to some free money (okay, maybe a 10X is more welcome…).

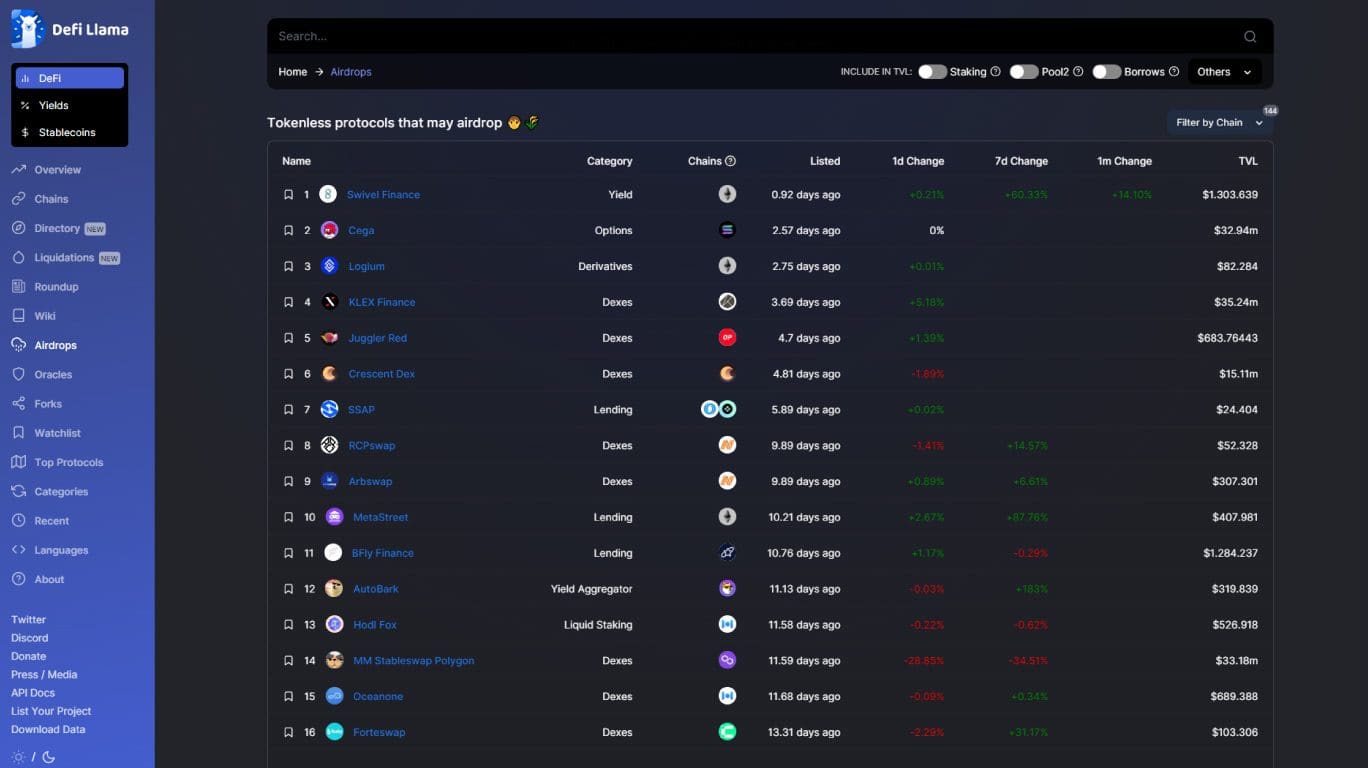

DefiLlama offers a section just called Airdrops. Be careful, however, because it is neither a calendar nor a collection of information about future and/or already ongoing airdrops.

Reporting what is written on the site, here we will find “ tokenless protocols that may airdrop”, that is, DeFi tokenless protocols that may airdrop in the future.

No certainty, mind you. But history teaches us that a decentralized finance platform often creates its own token, and it does.

Crypto airdrops are generally targeted at those who have previously employed that particular portal. In fact, the team thanks old customers with a varying amount of the newly released token. The airdrop may also be aimed at new users, incentivizing their participation. If we are on the hunt for opportunities, this feature of Defi Lama will be very welcome.

One recommendation remains to be made: many of the protocols listed are brand new. So be careful when using them because the riskiness is quite high. Let us therefore carefully consider whether the game is worth the candle.

Platforms and forks

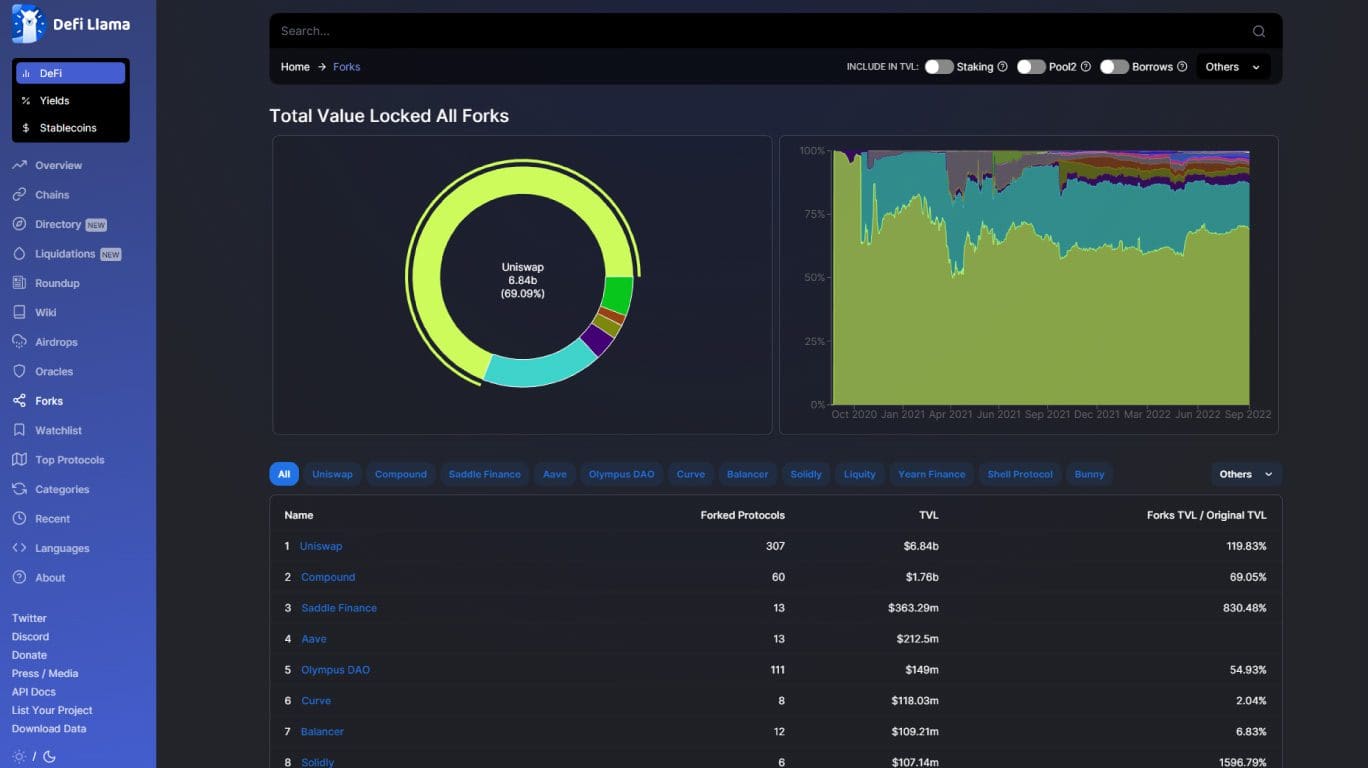

Those who invest and operate in DeFi crypto are familiar with the practice of forking.

Many DeFi protocols are open source, which means that the code is freely searchable, modifiable, and duplicable. This feature then gives rise to fork, which is the practice of taking an existing platform, modifying it more or less markedly, and publishing it under another name.

The famous decentralized exchange Uniswap is the most forked reality. Among its “children” appear names such as PancakeSwap, SushiSwap and VVS Finance.

The practice of forking does not only involve DEX. In fact, the lending portal Compound occupies second place in this special ranking that we might call “Most Copied.”

However, we do not think that to fork a protocol means to imitate in a derogatory sense. Since these are open source portals, this way of doing things is perfectly normal.

At the same time, however, there is no shortage of clashes, especially between protocols that live on the same blockchain. This was the case with SushiSwap and the vampire attack against Uniswap. For those who do not know, the vampire attack aims through various incentives to “suck” the liquidity deposited on another protocol, effectively damaging it.

A fork may arise on the same blockchain, giving rise precisely to possible clashes. Or, the forked protocol may operate on another network. We mentioned VVS Finance: born from Uniswap, it however operates on Cronos Chain, the famous network created by Crypto.com. In this way, no one steps on the other’s toes.

Returning to DefiLlama, in the Forks section it is possible to view “who’s fork whose.”

This feature is very interesting but also definitely useful. By knowing that one portal is forked by another, we can investigate any critical issues it may have inherited. For example, seeing that the AAA protocol is derived from BBB, with the latter known to have suffered various exploits, we would be wary of investing in it.

Top Protocols Defi Lama

In Top Protocols we will find out which DeFi platforms have the most liquidity at that particular time.

We will find a table of which each row represents a blockchain. The columns, on the other hand, will be dedicated to the type of platform (CDP, Liquid Staking, DEX, Lending, and so on).

Like several other features, Top Protocols has both a purely informational value and a usefulness of its own.

While in the former case the more curious will find what they are looking for, in the latter one will get an immediate snapshot of the situation. We will be able to identify at a glance the trends of the moment as well as the performance of the longest-lived platforms.

Data, data and more data: DefiLlama is truly a decentralized finance enthusiast’s paradise.

Details of a protocol on DefiLlama

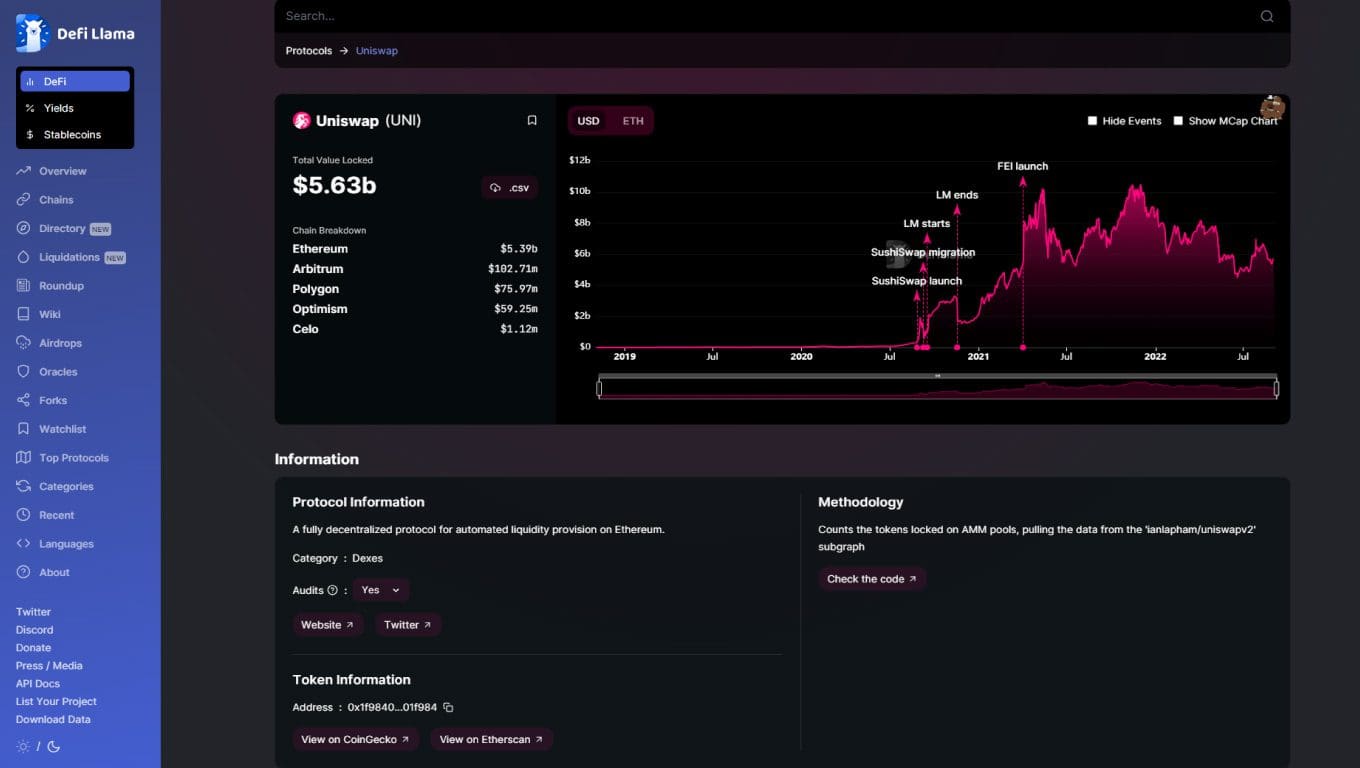

Let us pretend that we have searched for Uniswap in the search bar, or that we have clicked on its name in one of the lists scattered around the site.

The screen that will appear before our eyes can be seen in the image at the end of this paragraph. Let’s see what items make it up.

First of all, the chart. Thanks to it we will be able to get an immediate idea of the trend of the deposited liquidity over time. Also marked are particularly relevant events that have in some way had an impact.

Immediately to the left we will see the Total Value Locked of the moment, as well as its breakdown on the various supported blockchains (obviously if the protocol is published on multiple networks).

Going down we will find some information including a brief description of the reality and its category. In the case of Uniswap, it is placed in Dexes, that is, among the decentralized exchanges.

Not only that: also of relevance is the entry Audits, as well as the contract number(s) of tokens and coins related to the protocol in question.

Another thing to note is the Website link , another way to avoid running into scam sites after Google & company searches. We repeat: never search for a DeFi platform on search engines.

To close an additional graphic, larger than the previous one and a minimum customizable.

DefiLlama: final considerations

DefiLlama is one of our certainties when it comes to analyzing individual protocols or the entire DeFi environment.

Small note: those looking for cryptocurrency pricing will be disappointed. This site does not analyze any price trends; that is not its goal.

The data offered are reliable and perfect for doing all the research you need to do. However, to be really specific we will have to match this portal with others; among them, Dune Analytics is one of the best known and most appreciated names.

If you then want to get really serious, Nansen is the ultimate when it comes to analytics. The cost is not insignificant, but the functionality reaches extreme levels of specificity and accuracy.

How do you develop your research? Do you start with DefiLlama and then go deeper or do you prefer something else? We look forward to your feedback on our social channels.