Leggi questo articolo in Italiano

Gold is now the only store of value against debt. What about bitcoin?

By Daniele Corno

Bank of America warns, “Gold is the only store of value against the huge increase in U.S. Debt.” What about Bitcoin?

Gold's value, always the best store of value

“Gold is the only store of value against the huge increase in U.S. debt, “ Bank of America (BOA) says in a note, as the price of ‘gold marks a further ATH, breaking the $2,700 per ounce price level.

Todaygold once again proves its value, becoming, according to BOA, more attractive than U.S. Treasury bonds.

Following the first RATE CUT by the Federal Reserve, the market is beginning to price a falling dollar in the medium/long term. This encourages, as seen in previous days, an increase in the value of all assets priced in dollars, such as Standard & Poor’s 500 and Gold, which respectively are at their highest price levels EVER.

After nearly three years of restrictive policies, the change in direction of all major central banks is driving a HUGE new flow of liquidity. Withfiat currencies becoming cheaper, the economic machine of the debt system is being reactivated at an unprecedented speed.

The debt machine

With the return to expansionary policies, the economy can only increase the nominal value of overall global debt. Now more than ever, the market and analysts have begun to put the option of the “DEBT CRISIS” on the table.

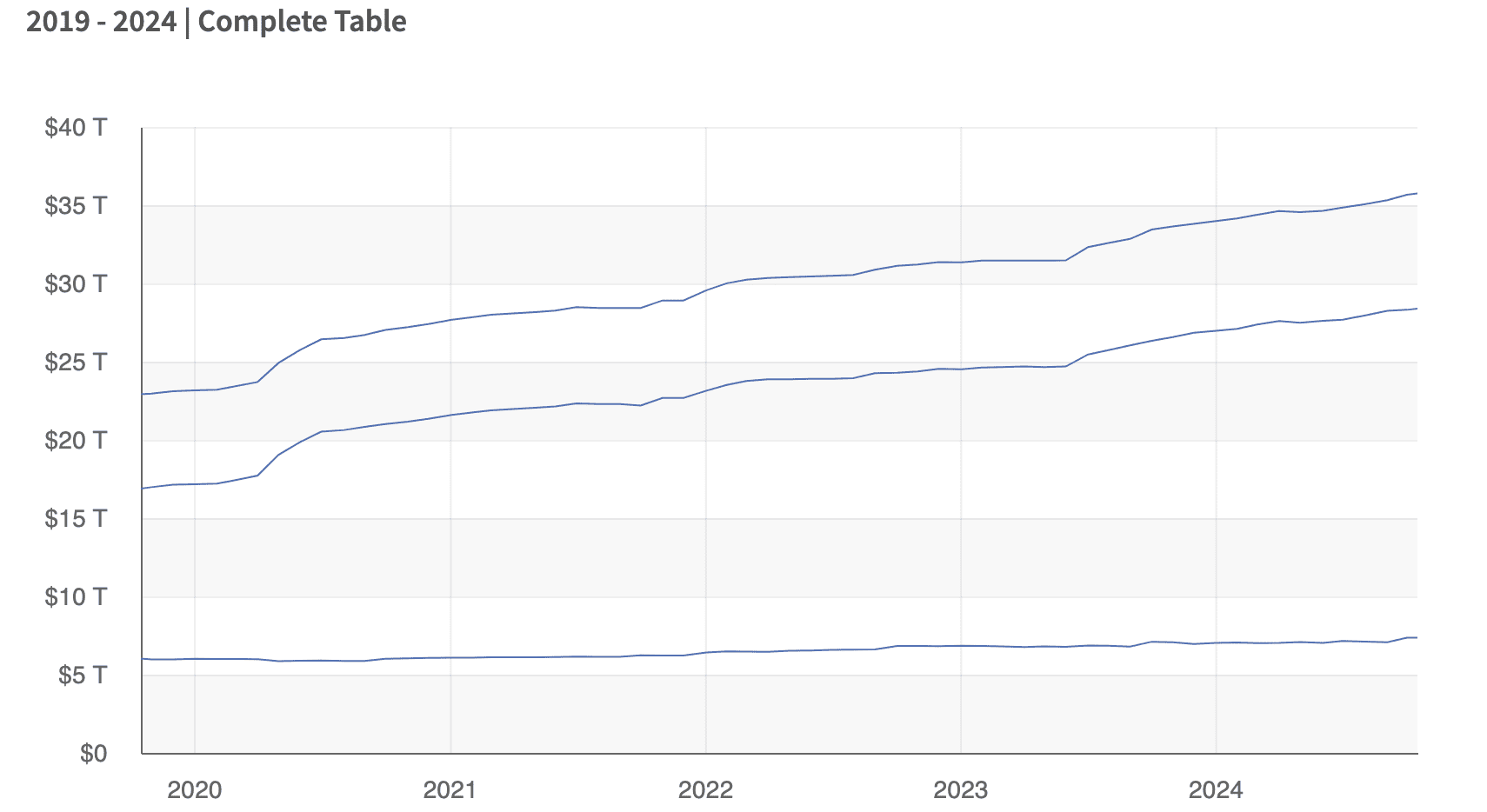

Indeed, U.S. government debt continues to expand at an unprecedented rate. On January 1 of this year, the debt had a face value of $33.9 trillion. As of today, two months into 2024, the debt has reached a RECORD value of $35.73 trillion, up 5.5 percent on the year. In the last quarter alone, the growth was over $650 billion.

This continuous increase highlights what precisely analysts believe is the next crisis, that of DEBT.

This dynamic, is part of what has allowed central banks, to increase gold reserves over the past 10 years from 3 percent to a current percentage close to 10 percent.

Bitcoin, future store of value?

The question remains at this point whether in the more or less near future, the number one asset in the crypto landscape, BITCOIN, can also act as a store of value against the debt crisis.

Stating what is assumed is still far from reality, as Bitcoin’s main driver is precisely the global money supply, the result of debt.

Indirectly then, Bitcoin could act as a useful asset as a reserve, precisely because of the direct correlation between debt growth and the global money supply. The nature of Bitcoin thus allows for this future utility, however, the answer can only be confirmed by the market and the actors that govern it.