Blockchain layer 0, layer 1 and layer 2: a brief introduction

Layer 0, layer 1 and layer 2: in this in-depth article we’ll talk about blockchain architecture.

When operating in the world of cryptocurrencies, different types of structures are constantly used, each with its own peculiarities, strengths and possible weaknesses.

Understanding the difference between the various layers is essential to be able to reason more comprehensively about the potential of a given reality. By doing so, you will be able to identify the most profitable coins and ecosystems for your investments.

Don’t worry: we will avoid getting into technicalities and super complex reasoning. The ultimate goal is to gain more awareness about the blockchains used, so that you can really evaluate their potential and opportunities.

Before dealing with the various layers one by one, let’s put them in context.

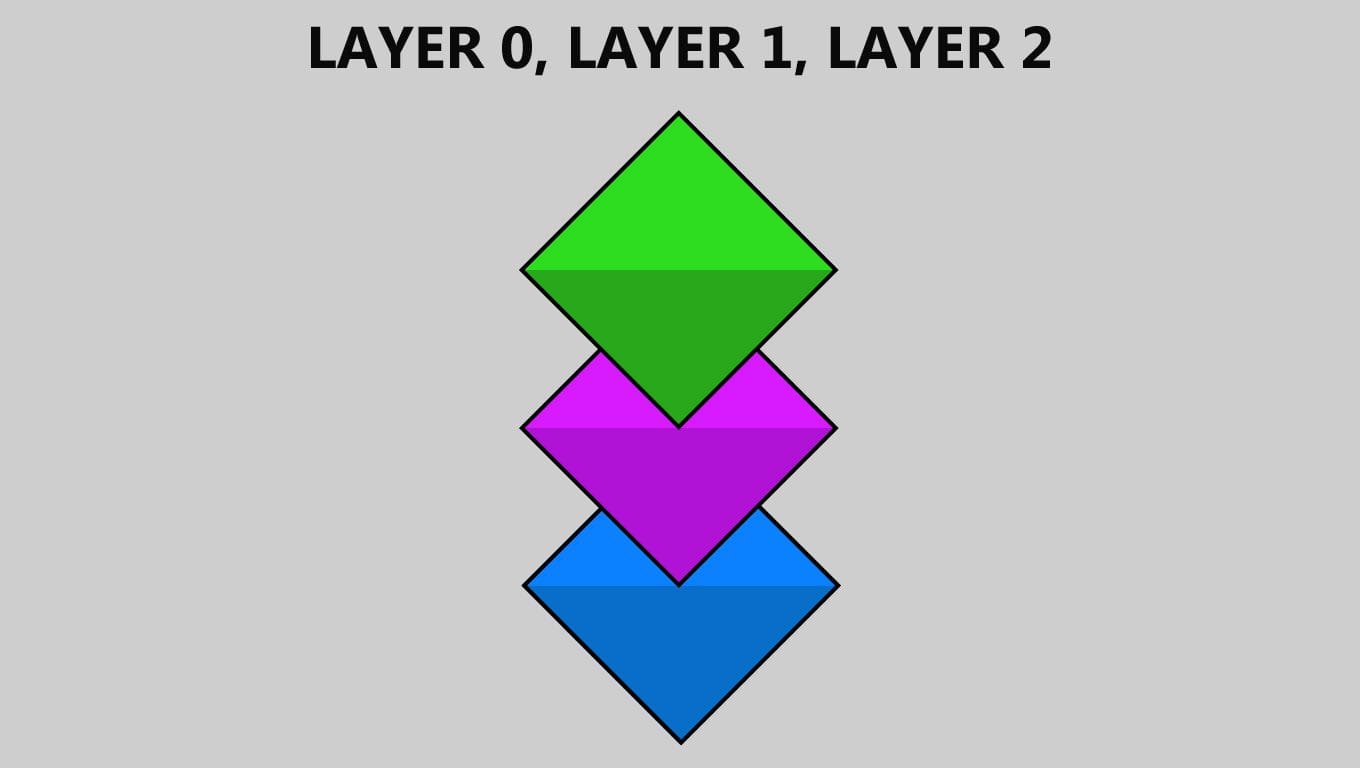

Let’s imagine a pyramid: at the base there will be layer 0, one step above layer 1 and at the top layer 2. It is not to be excluded that in the future further upper layers may be created, depending on the applications and developments of the whole sector.

A project doesn’t have to have all these levels and only layer 1 is really essential.

Very good, now we can move on to the next point with just one piece of advice: let’s keep the subdivision firmly in mind.

Index

What is a layer 0?

Let’s start with the basics with layer 0, that is, the structure that deals with three aspects:

- Security: that is, every technical solution and aspect concerning the security of the blockchain (correctness of transactions, impenetrability from external attacks and so on).

- Framework: that is, a “frame” that makes the development of additional components, applications, chains and much more agile and simple.

- Interoperability: the ability of various blockchains built on the same layer 0 to interact and cooperate.

For example, Cosmos is a layer 0 structure and deals with all the points just mentioned:

- Each chain based on it relies on it to guarantee its own security.

- The Cosmos SDK framework makes it easy to create blockchains and modules, avoiding having to start from scratch.

- Since there is a common ground at the base, each project linked to Cosmos can be connected to the others (almost) effortlessly.

Cosmos is responsible for the birth of giants such as Cronos Chain. This is no coincidence: it is a tested, used and secure environment.

Layer 0 is really identical to the base of a pyramid, on top of which we can add many blocks that take advantage of its solid support.

However, as you can imagine, this type of structure is almost useless on its own. After all, what good would an unfinished pyramid base be? What use would the foundations be without a house?

Let’s think again about Cosmos or Polkadot: they wouldn’t make much sense without the whole world based on them.

Starting from this observation, we arrive at the fundamental aspect from an investment point of view: what gives value to a layer 0? How is it possible to understand which project to choose in the long term?

It depends on several aspects that change according to the reality under study.

The fundamental element to consider is the coin of the layer. We will have to evaluate its usefulness and use cases, trying to eliminate speculation or crystal ball gazing. Justifying its potential with a simple “in my opinion it will grow” could lead us to make a big mistake.

Instead, analyzing its applications and characteristics is the right way to make a well-considered investment. For example, let’s ask ourselves questions like “Is coin used to pay gas fees?” “How is it issued?” “Are there other uses on the platform?”

The value of a layer 0 also lies in current and future projects. Let’s think about Polkadot: the arrival of parachains has provided a lot of intrinsic value to the entire infrastructure.

Obviously, any improvement affects the main coin, as well as potentially the others in the ecosystem. Being up to date with the latest news is the road to success.

We have mentioned Cosmos several times and we want to bring it up again to sum up. There is little to say about it: it is one of the best structures around.

However, there is a weak link in all this: ATOM, the native coin. In fact, outside the stake it is almost impossible to find applications and elements that boost its intrinsic value. The problem has been dragging on for some time and no effective solution has been found.

In conclusion, we repeat what we said a few lines above: each layer 0 needs an even more personalized and detailed evaluation than layers 1 and 2.

"Layer 0 serves as the basis for building large and complex blockchain ecosystems"

What is a layer 1?

Let’s move on to layer 1, a type that includes the most important crypto networks such as Bitcoin, Ethereum and Solana.

Layer 1 is the most widespread standard, used without the aid of other layers, especially in more “dated” blockchains.

This category deals mainly with two tasks:

- Execution: the processing of all transactions and operations.

- Consensus: the mechanisms and rules dedicated to block validation. This is where we enter the world of consensus algorithms such as proof-of-work and proof-of-stake. Closely linked and dependent on this is governance.

While layers 0 and 2 are optional, layer 1 is always mandatory. Without it, no type of operation could take place.

Where there is no layer 0, layer 1 performs some of its functions, especially in terms of security.

Ethereum is one of the best known and most widely used examples of this category.

This blockchain guarantees the security, regularity and correctness of transactions. It also manages smart contracts, which are fundamental for the development of the DeFi and NFT world. We can therefore guess that there is a lot of value behind it. How can we discover the value of the other layer 1s?

Again, it is imperative to evaluate each case independently. However, we may have more elements to consider than with a layer 0.

First of all, the considerations for the native coin are the same: what are the use cases for the coin? Is it used for validation and therefore put into stake? Is it inflationary or deflationary?

It will also be necessary to carry out careful research on the potential of blockchain and future developments.

Here, however, we can take a step further and examine other elements: does the chain support smart contracts? If so, is DeFi flourishing? Are there any important companies or investors working to integrate it and improve what it offers?

It’s also interesting to keep an eye on the liquidity deposited on the blockchain, as well as the daily trading volumes. Growing numbers are a strong indicator of expansion.

For example, thinking about Ethereum it’s obvious to assign a huge intrinsic value to the entire ecosystem:

- It is a benchmark in the sector.

- It has a high capitalization and is used daily by millions of people.

- The tokenomics of Ether are moving in an increasingly less inflationary direction; the supply is rather limited.

- It obviously supports smart contracts.

- DeFi was born on Ethereum and there are hundreds of projects.

- NFTs move huge amounts of capital.

- Companies and other players are developing ideas and integrating Ethereum to an increasing extent.

All this translates into an enormous intrinsic value of this blockchain. In turn, this means that Ether is increasingly in demand: as demand increases, with supply not keeping pace, the price rightly increases.

What has been said in this example could apply to many other situations, each with specific observations and notes. However, as the saying goes, all that glitters is not gold.

Let’s consider the trilemma of blockchain, mentioned by Ethereum founder Vitalik Buterin.

When it was first conceived, it was considered impossible for a chain to provide decentralization, security and scalability at the same time.

Ethereum is in fact decentralized and very secure. However, as it is based on the proof-of-work protocol (things are about to change!), this blockchain cannot guarantee scalability: the number of transactions per second is limited, it is not possible to process more than a certain number.

The most recent chains have partially resolved this dilemma.

Solana is a highly scalable, secure and fairly decentralized reality. However, compromises are still made: it is really difficult to combine these three elements in a clean way. For example, what is the number of validators beyond which a chain can be defined as decentralized? Even if there were an answer, how could they be combined with scalability and security?

While waiting for answers, the “older” blockchains have little to say: you can’t have everything. However, an excellent solution has been found that allows this problem to be solved without having to disrupt an entire ecosystem: layer 2.

"Layer 1 is the indispensable structure for the blockchain universe: without it, we could do nothing"

What is a layer 2?

Layer 2 is the most recent development and allows for a considerable improvement in the performance and functions of layer 1.

Among the various names, Arbitrum for Ethereum and Lightning Network for Bitcoin stand out.

The tasks of a layer 2 are varied but can be grouped into two categories:

- Scalability: where layer 1 can’t go, this type comes to the rescue. Layer 2 takes care of offloading the weight of normal transactions from layer 1, which is only responsible for ensuring security and consensus.

- Additional functionality: a whole new world opens up here and everything depends on what the development team wants to achieve.

Let’s go back to Ethereum to understand better.

We know that it is a secure layer 1 but it has a lot of problems with scalability: the number of transactions is limited and the number of users is enormous. Waiting times are getting longer and gas fees are skyrocketing.

Arbitrum is designed to solve this problem. Ethereum guarantees everything related to security and consensus, while Arbitrum is responsible for processing the various transactions. This way, many more operations can be carried out and costs are significantly reduced.

As already mentioned, having a layer 2 is not mandatory: it is an option available to developers to overcome any limitations of layer 1.

A layer 2 cannot exist without layer 1, there is no question about that.

A very interesting aspect is the cryptocurrency used to pay the gas fees. A layer 2 doesn’t have its own currency but uses that of its layer 1. Therefore, this is an element to be taken into account when considering the value of a given project. For example, the Ether coin acquires intrinsic value thanks to the Ethereum layer 2.

A brief digression on the Polygon network.

This blockchain has its own coin (MATIC), its own consensus mechanisms and specific validators. However, Polygon periodically checks with Ethereum, to guarantee security. Therefore, it is a hybrid solution. In fact, we can define it as a more independent sidechain.

In terms of investment, layer 2s “limit themselves” to giving more value to layer 1s.

"A layer 2 improves and enhances the related layer 1, decreasing its workload"

Blockchain layer 0, layer 1 and layer 2: conclusions

We have discovered what layers 0, 1 and 2 are, identifying their characteristics, purposes and differences.

Layer 0 builds a solid foundation on which to develop even very complex ecosystems, where interoperability is at home.

When well thought out, these structures are of high value and can be a valid investment. Taking Polkadot, for example, the DOT coin is used for parachain auctions.

Layer 1, on the other hand, is the indispensable element and can exist without the other two. Examples abound and it is here that the best opportunities can be found on which to base a long-term strategy.

Layer 2 has the role of improving the mother structure, expanding its offer and increasing its intrinsic value.

We must always remember to eliminate any component linked to speculation during the analysis. On the other hand, it is fundamental to concentrate on concrete aspects, use cases and future applications.