Bitpanda in brief

Bitpanda is a European exchange, secure and regulated by the MiFID II directive, which precisely regulates financial markets in theEuropean Union. It is a well-established entity, able to create a prominent space for itself right from the Old Continent.

Founded in 2014 in Vienna, the company was initially known as Coinimal, only to be renamed to “Bitpanda” in 2016, when it expanded its suite of capabilities.

By 2021 Bitpanda surpassed 2.5 million users and also grew to more than 400 employees, with a core team represented by founders Eric Demuth and Paul Klanschek, plus CTO Christian Trummer.

As of 2024, there are more than 5 million customers. Bitpanda also has 16 European licenses and registrations, proving to be one of the most careful and committed companies on the compliance side.

Index

Bitpanda review: introduction

If you want to take a look for yourself and are wondering “how to sign up for Bitpanda?”, register here.

The trading platform offers the ability to move in the cryptocurrency market as well as stocks and metals, with a wide range of products suitable for traders of all experience levels.

In addition, Bitpanda provides special tools that make it stand out from the competition. For example, cryptoindices, which are baskets of cryptocurrencies that are diversified and rebalanced each month. This removes all the operational burden of active management and portfolio optimization.

BEST, the platform’s native token, offers various discounts on transactions, further adjusted according to a VIP tier, determined by the amount of BEST held.

As for the fees, they are relatively low and certainly competitive with the competition. They are, however, not particularly intuitive in their identification, which depends directly on the type of asset.

In addition, besides the possibility of taking advantage of the basic version, the exchange also has Bitpanda pro, equipped with a different interface and different commission prices, but with a single account and the same credentials. In this way, users can approach trading of different difficulty, but dictated by them and without structural impositions.

It is therefore worth taking acloser look at the platform, analyzing step by step how it is structured.

"Bitpanda offers the ability to move in the cryptocurrency market as well as stocks and metals"

What is Bitpanda used for?

Bitpanda offers an extreme variety of assets, divided between cryptocurrencies, stocks, and metals, thus making it possible forexcellent portfolio diversification on a single platform.

The BEST native token is integrated with the exchange to the extent that it determines the fees on various transactions. In addition, depending on the amount of tokens owned, one can take advantage of different levels of treatment, on a scale called VIP.

Bitpanda fees also depend directly on the version of the exchange you want to use. The “basic” variant allows you to buy or sell a specific type of asset. Bitpanda Pro, on the other hand, allows for more advanced types of orders, starting with a classic but not simple (for the average user) order book.

Being primarily oriented toward European countries, Bitpanda supports (in addition to the dollar) legal currencies such as euro (EUR), pound (GBP), Swiss franc (CHF), and Turkish lira (TRY). The platform supports deposits via bank transfer (including instant), which is not a given when looking at competitors; a convenient option if you want to avoid credit card fees.

The variety of assets, as mentioned in the introduction, is Bitpanda’s real highlight and distinguishing feature. This is not only because the alternation between cryptos, stocks, and metals is already a great starting point for those who want to diversify their portfolios, but because it actually offers unique financial products, especially when compared to the major exchanges in operation.

Bitpanda Crypto Index

Let’s delve in and find out how Bitpanda works.

The flagship product is the cryptoindex, which is available in several variants. These are packages that allow you to invest in certain baskets of cryptocurrencies divided by industry, type or capitalization. For example, cryptoindices include the one on memecoins, the one on smart contracts or the famous 5, 10 or 25, which contain the 5, 10 and 25 most capitalized cryptos in the market, respectively.

Since the index automatically adjusts the portfolio weighting over time, it represents a passive cryptocurrency investment strategy. Thanks to partner VanEck, each month the crypto indices are rebalanced according to a logic that follows the purpose of exposure to the various cryptos based on their capitalization.

The composition of the indexes varies according to market trends, with active portfolio management. They are collateralized, which means, from the user’s perspective, that they are exposed to an underlying. In addition, accumulation plans can also be created for indexes by including them in periodic purchase programs.

However, there is a difference from ETFs: by operating on crypto-indices, the user will directly hold the coins contained in it, and from month to month, they will be updated directly by the manager.

Cryptoindexes are a good way to invest in specific crypto sectors or on the larger entities in a simpler and faster way, but without giving up asset ownership.

Stocks and metals on Bitpanda

Turning to individual assets, shares can be purchased from the value of one euro and are therefore fractional. Therefore, it is not necessary to buy a stock in its entirety, as is the case when making such transactions at a bank or through traditional brokers. Consequently, this product, too, is a derivative, which has the stocks themselves as its underlying.

Although the stock is a derivative, Bitpanda regularly pays out any dividends. This is an interesting and not taken for granted aspect when dealing with these instruments. This is because Bitpanda regularly holds the stocks in question and generates the related dividends, thus being able to pay them to clients as is the case when operating with real stocks.

The proposition is great and it is possible to trade h24, 7 days a week. In addition, there are no commissions involved.

In addition to the stock market, Bitpanda finally offers investments in major ETFs, baskets of different stocks such as indices of the world stock exchange, emerging or developed countries, but most importantly it allows users to approach the metals market.

Specifically, the exchange allows exposure to gold, platinum, silver, and palladium, again without a minimum entry barrier, but with a substantial difference. In this case, the investment is spot, on physical metals held by Bitpanda through partners who maintain them.

For this category, there are no custody and storage fees. Instead, we find fees for buying and selling activities, which vary according to the metal:

- Gold: 0.5% of the amount purchased; 1% of the amount sold;

- Silver: surcharge of 2.5% for buying and 2% for selling;

- Palladium: surcharge of 2.2% when buying, 1.8% when selling;

- Platinum: same as for silver.

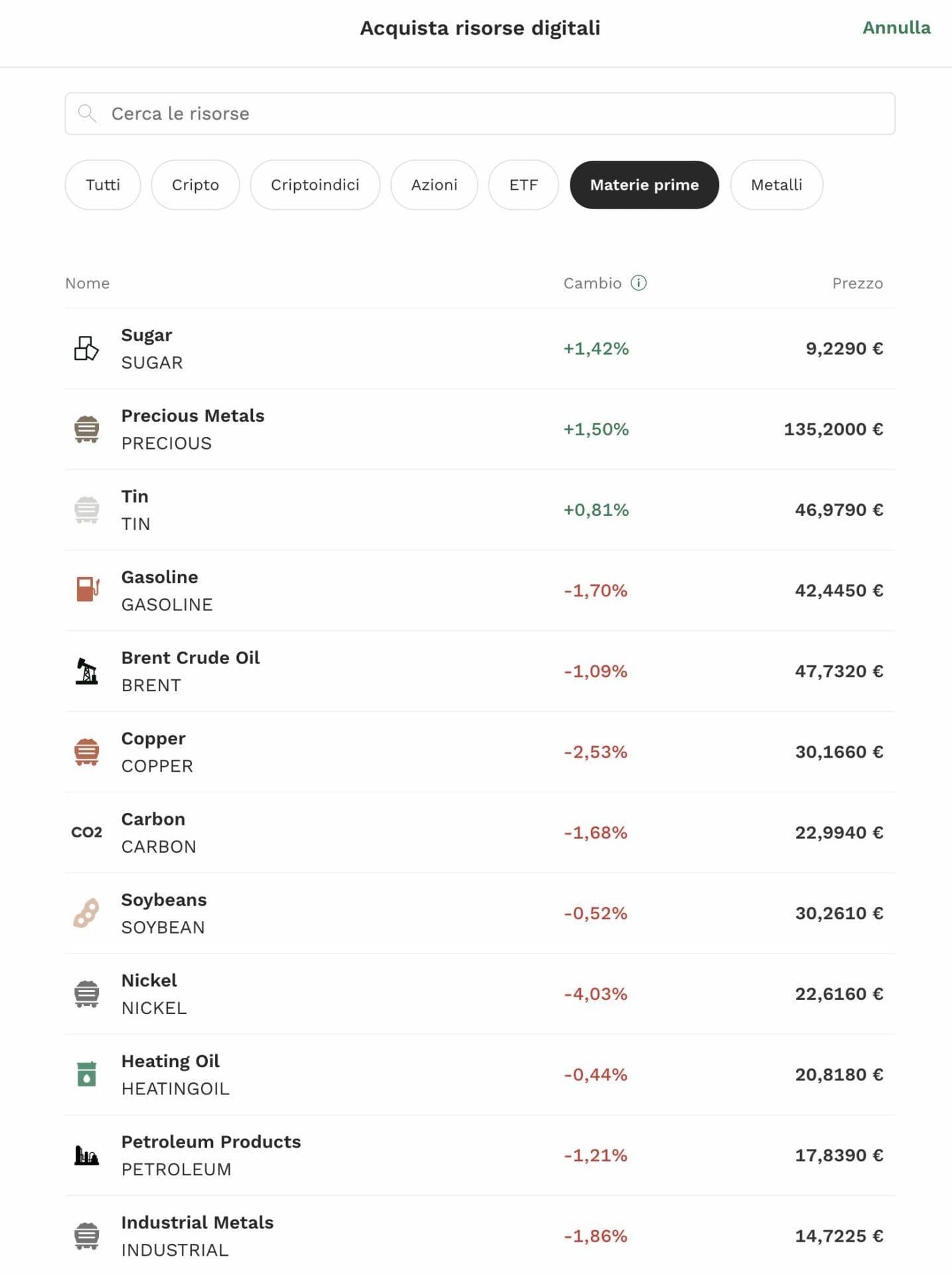

Bitpanda Commodities

Bitpanda’s latest addition is the ability to buy and sell commodities directly from the platform. This has expanded the range of instruments on offer, pursuing the mission of becoming an all-in-one platform from which you can invest in any asset.

Dozens of commodities are available, in which one can invest from as little as €1. The product offered is a fractional share with the underlying related ETC (Exchange Traded Commodity) provided by WisdomTree. Since it is a fractional instrument, a minimum amount of €1 can be invested, without necessarily having to buy entire units of ETC.

Commodities that can be purchased include gasoline, oil, natural gas, cotton, corn, coal, and many others. Such a variety of instruments allows the construction of a well-diversified portfolio.

If you want to learn more, you can see all the details and commodities available here: Bitpanda Commodities.

How does Bitpanda work?

For starters, in order to use the platform, an account must be created with classic login credentials and KYC. Once the account is verified, the dashboard will allow you to make a deposit, whether in crypto or fiat currency.

How to deposit on Bitpanda?

After creating your account it will be very easy to add funds. To understand how to proceed in practice, please watch the video at the end of the article (there is a section dedicated just to depositing).

You can deposit via several methods including PayPal, bank transfer, credit or debit cards, and third-party services. The good thing about Bitpanda is that whatever method you choose involves no fees, unlike many other platforms. Beware, however, of any extra fees charged directly by the payment provider.

How to withdraw from Bitpanda

Parenthesis on withdrawal, which is equally simple and quick. Again from your personal area just select the item EUR Withdrawal, indicate your bank details and Bitpanda will proceed to process your request. The same withdrawal and deposit mechanism can also be applied to cryptocurrencies.

How to make money with Bitpanda?

There are various ways to make money with Bitpanda: from planning for a long-term investment by building a well-diversified portfolio to making an annuity by staking, through eventual dividends.

Earning requires experience and strategy, things that cannot for obvious reasons be explained in two lines. To all those who wish to embark on this path, we recommend that you learn more about it starting with our article devoted precisely to portfolio construction.

Let us now turn to staking, that is, the possibility of making a return on one’s crypto Proof-of-Stake. On Bitpanda this is possible and very simplified compared to native staking.

The main advantage is that you can deposit and withdraw at any time, while sometimes staking involves a 21-day unlocking period. Rewards are distributed weekly and are immediately withdrawable. You can find out all about staking here: Bitpanda staking.

Finally, it is possible to earn dividends on stocks. If you buy and hold shares that entitle you to a dividend, it will be paid out to us on Bitpanda without having to do anything.

Bitpanda Cash Plus

Deserving a separate section is the Bitpanda Cash Plus program, which allows you to earn income on the deposited fiat currency (euro, dollar or British pound).

The annual interest is variable but very attractive (between 3 and 4 percent). One wonders, however, where this annuity comes from: let’s find out.

By joining the program you are exposed to a derivative instrument where the underlying asset is a money market fund. Specifically, for all three fiat currencies mentioned just above, the fund is BlackRock‘s Euro Liquidity Fund, Dollar Liquidity Fund or Sterling Liquidity Fund. The annuity is derived from interest rates set by central banks, minus a small fee.

The client can therefore also annuitize fiat currency in a safe and convenient way, without having to lock it in for a minimum time.

"Easy and secure income on your own fiat currencies? Thanks to Bitpanda Cash Plus you can"

How much does Bitpanda cost?

The topic of fees on Bitpanda may be particularly tricky. As it turns out, there are many variables that determine them, starting with the VIP level one has reached via the BEST token, moving on to the variant of the exchange one has decided to use (basic or pro), and finally to the type of asset on which the fee calculation is to be applied.

We could start by saying that maintaining a Bitpanda account is 100 percent free. However, there are surcharges for buying and selling each asset. For bitcoin, for example (and generally for other cryptocurrencies as well), the fee is1.49%.

For stocks and ETFs, there are no fixed deposit fees, no overnight transaction fees or surcharges, and no minimum fees. However, the spread, or the difference between Bid ( or selling prices), and Ask ( or buying prices) prices is adjusted according to one’s trading amount, current market situation, and price adjustments.

As for metals, the matter is specific to each type of asset, as we saw earlier in the dedicated section.

Please note: the figures just given may vary over time: inquire directly with the source for certainty about costs.

"Many assets, different commissions: best to check them when buying or selling"

How reliable is Bitpanda?

In light of what happened with FTX, many are wondering which exchanges are now safe.

Bitpanda, being headquartered in Europe, is subject to very stringent regulations. It also acts as a Trust with respect to its users’ cryptocurrencies.

This means that even in the event of bankruptcy or bankruptcy of the platform itself, the coins remain the property of the user, who is not a mere creditor, as is often the case, but the actual beneficiary, with Bitpanda as trustee of the funds. This is regulated by Austrian trust laws. In a nutshell: you are entitled to 100% of your funds back.

All this is well explained in this in-depth discussion in the Bitpanda blog.

In addition, Bitpanda is periodically subjected to external audits by KPMG, one of the world’s leading auditors. This ensures that clients’ funds have 100% coverage on the platform.

"Bitpanda is among the most compliant in the industry"

Final Bitpanda Reviews

Bitpanda is a comprehensive exchange with unique tools. Commissions are competitive on every front, while as far as cryptoindexes are concerned these offer a unique solution for those who care about effortless portfolio diversification.

Obviously with associated commissions, justified by a product saves time and allows for portfolio balancing that is difficult to achieve with a self-processed product.

In addition, the ability to concentrate such diverse assets through a single broker is no small opportunity.

To get more Bitpanda reviews, you can watch the video below, updated to 2024.

If you are curious to find out more, register for free at Bitpanda and take advantage of the proposed bonuses.