Solana: la blockchain che unisce velocità e sicurezza

Di Gabriele Brambilla

Nata nel 2018 da un'idea del programmatore Anatoly Yakovenko, Solana è una delle blockchain dal maggior potenziale grazie a velocità e sicurezza delle transazioni

Solana: un po' di storia

Nell’immenso panorama crypto, Solana è uno dei progetti più splendenti e in continua crescita.

Questa blockchain è infatti dotata di diverse peculiarità che la rendono molto interessante; a breve le andremo a scoprire.

Attualmente, Solana è uno dei protagonisti della nostra nicchia, il mondo delle criptovalute.

Negli anni a venire è lecito aspettarsi che questa chain andrà divenendo uno dei principali attori in diversi settori, dal gaming ai sistemi di pagamento, grazie soprattutto alla sua scalabilità e velocità.

L’idea di Solana prese vita a fine 2017 grazie a Anatoly Yakovenko, programmatore nell’ambito delle telecomunicazioni, impiegato presso la Qualcomm e con esperienze lavorative anche presso Dropbox e Mesosphere.

Fu proprio questo background professionale che portò alla grande intuizione: l’ideazione dell’algoritmo di consenso Proof-of-History.

Yakovenko sapeva bene come in un network sia indispensabile il sincronismo: in questo modo, ogni movimento diviene efficiente e la velocità ne beneficia a dismisura.

Osservando attentamente gli attori principali dell’epoca, come Bitcoin ed Ethereum, il “papà” di Solana evidenziò come la mancanza di sincronia comportasse lentezza nelle transazioni, oltre a limitarne il numero a poche per secondo.

Le criptovalute vengono da sempre viste come il futuro dei sistemi di pagamento. Come si poteva procedere in questo senso se le chain potevano processare così pochi movimenti contemporaneamente? Come applicare la blockchain ad esempio a Visa, i cui picchi arrivano a 65.000 transazioni per secondo? Infine, come garantire comunque elevati standard di sicurezza e decentralizzazione?

La risposta, seppur ancora senza il nome attuale, era una: Solana.

Yakovenko iniziò a lavorare sull’idea, cercando di perfezionarla sempre di più. A egli si unirono altre menti dal background simile, primi fra tutti gli amici di vecchia data Greg Fitzgerald e Stephen Akridge.

Già nel febbraio 2018, il primo prototipo fu operativo. Entro poco tempo, Yakovenko e soci fondarono un’azienda denominata Loom.

In seguito, complice l’arrivo di un progetto su Ethereum chiamato Loom Network, il nome cambiò, prendendo quello della località dove i tre amici passarono alcuni anni a cavalcare le onde dell’oceano col surf: Solana beach. Di lì a poco, la rivoluzionaria chain divenne realtà.

Indice

Che cos'è Solana?

Iniziamo con due domande: cosa rende Solana così speciale? perché il background in ambito telecomunicazioni del team è stato così determinante?

La blockchain di Bitcoin lavora secondo l’algoritmo Proof-of-Work, ovvero quello che comporta il processo di mining.

Ogni transazione richiede un certo numero di verifiche per essere validata, così da evitare che un malintenzionato possa falsare i dati a suo vantaggio.

Questo processo richiede la soluzione di complessi problemi matematici da parte di computer molto potenti. In origine, il mining era per tutti; oggi invece vi sono centri specializzati che se ne occupano (le cosidette farm).

Il dispendio energetico è enorme e crea complicazioni anche a livello di impatto ambientale.

La sicurezza è elevata. A farne le spese sono però velocità e scalabilità: essendo il Proof-of-Work una procedura complessa, la chain è lenta e poco scalabile.

Il sistema non è quindi molto efficiente.

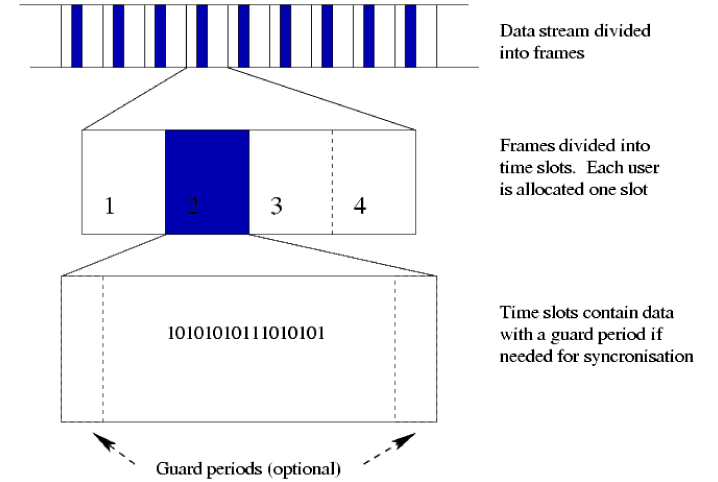

Per rimediare a questi limiti, Yakovenko trovò il modo di applicare alla blockchain il TDMA, di cui vediamo un’illustrazione presa in prestito da Wikipedia.

Il Time-Division Multiple Access è un metodo di operatività del mondo delle telecomunicazioni che consente a numerosi attori di utilizzare la stessa frequenza.

Cercando di rendere tutto il più semplice possibile:

- le diverse antenne del network vengono sincronizzate.

- a ogni utente viene assegnato uno slot temporale.

- ogni operazione viene portata a compimento.

- alla fine, ognuna di esse viene messa al posto giusto, rispettando il corretto ordine.

Il TDMA applicato alla blockchain offre questi vantaggi:

- Decentralizzazione: i nodi validatori sono numerosi e operano sulla stessa chain. Un “orologio interno” li mantiene tutti sincronizzati tra loro, garantendo la correttezza delle operazioni.

- Velocità: essendoci tanti nodi, le transazioni non devono seguire un percorso rigido, guadagnandone tantissimo in velocità. Si parla di decine di migliaia di transazioni al minuto!

- Scalabilità: sempre per merito di questo sistema, la chain può crescere e offrire un’elevata scalabilità.

- Sicurezza: la sincronizzazione rende possibile elevati standard di sicurezza.

Solana è una blockchain che sfrutta quanto appena visto e funziona utilizzando l’algoritmo Proof-of-Stake with delegation, oltre al Proof-of-History basato sul TDMA.

Questo sistema rende possibile a “chiunque” di diventare un validatore. Infatti, se da un lato vi sono comunque dei paletti elevati su hardware e velocità della connessione internet, dall’altro non è richiesta nessuna quantità minima di Solana in stake.

Altre blockchain utilizzano il Delegated Proof-of-stake: di fatto uguale, pone però degli altissimi quantitativi minimi di stake della criptovaluta nativa per essere dei validatori. Questo sistema rende quindi l’ambiente decisamente centralizzato.

Ad agosto 2024, i nodi validatori di Solana erano 3400: un numero alto, soprattutto considerando l’estrema velocità per ciascuna transazione. Da notare che il dato è cresciuto di molto negli ultimi anni, più che raddoppiando.

Inoltre, gli algoritmi Proof-of-Stake sono di base decisamente più performanti di quelli Proof-of-work. Nel caso di Solana, il divario diviene ancor più elevato.

La capacità di crescere e adattarsi alle necessità rende questa chain fra le più scalabili della scena. Il raffinato meccanismo di consenso rende Solana uno degli ambienti più sicuri in cui operare nel mondo delle criptovalute.

Infine, nota importante: il costo delle transazioni è irrisorio!

Solana: coin SOL

Protagonista di Solana è la sua coin SOL. Esaminiamone i suoi casi d’uso ed il suo valore.

Innanzitutto, ogni transazione viene pagata in SOL. Trattandosi di una chain molto utilizzata e in crescita, la domanda di questa coin va di pari passo.

SOL viene anche delegata presso i validatori per rendere l’ambiente più stabile e sicuro. Lo stake della coin garantisce ritorni discreti, soprattutto utilizzando piattaforme come Marinade Finance.

La supply massima è infinita, ma al momento della scrittura (marzo 2025) è di circa 509 milioni di esemplari

La crescita negli ultimi anni è stata esponenziale: dai 4 centesimi di dollaro dell’aprile 2018, la coin ha raggiunto i 258 $ nel novembre del 2021…fortunati gli early investor!

Dopo il bear market del 2022, ha subito una notevole contrazione di prezzo, complice anche il caso FTX/Alameda, annoverabili tra i principali investitori.

Nonostante ciò, lo sviluppo continua imperterrito e il 2023 è stato all’insegna della ripresa. Infine, a inizio 2025 si toccarono i nuovi massimi storici a quasi 300 dollari, complice l’esplosione delle memecoin della famiglia Trump.

Come sempre, a ognuno le opportune ricerche del caso.

Tutto ciò rende SOL una delle criptovalute su cui vale la pena tenere gli occhi puntati e seguirla.

Quanto costa Solana?

Di seguito il grafico SOL/USDT in tempo reale, offerto come sempre da TradingView:

I punti di forza di Solana

Solana ha diversi punti di forza traducibili in questi tre concetti: sicurezza, scalabilità e decentralizzazione. Quali sono le migliori applicazioni possibili?

In tutta onestà, non vi è un ambiente ideale per Solana: i numerosi pregi la rendono infatti adatta ad ambiti molto differenti tra loro.

Tuttavia, il mondo dei pagamenti è forse il campo dove questa chain potrebbe sfruttare al meglio le sue potenzialità:

- La velocità garantirebbe un’enorme mole di transazioni per secondo;

- La scalabilità assicurerebbe la fattibilità di ampliamenti in caso di crescente diffusione;

- La sicurezza coprirebbe le spalle a tutti, dalle aziende agli utilizzatori finali.

Sì, probabilmente Solana darebbe il meglio di sé proprio in questo ambito. Pensiamo a una carta di credito che sfrutta la sua blockchain al posto dei circuiti tradizionali (o magari che si integra, così da offrire più sicurezza e rapidità).

Tuttavia, non ci si ferma qui. Solana è anche uno degli ambienti più favorevoli al mondo del gaming.

Nel corso degli anni, i giochi che propongono microtransazioni sono aumentati a dismisura. È ormai comune trovare titoli di alta qualità gratuiti, in cui l’azienda sviluppatrice ottiene profitti dalla vendita di oggetti, mezzi di trasporto, armi, personaggi e livelli aggiuntivi. Qualche nome illustre? Fortnite, Rocket League, World of Tanks.

Solana si presta benissimo a questa realtà, sfruttando anche la possibilità di spostare non solo coin ma anche NFT.

Sono in via di sviluppo progetti interessantissimi, tra cui la grande promessa Star Atlas: un gioco open world ambientato nello spazio, creato utilizzando il motore grafico Unreal Engine e che sfrutta la blockchain Solana. Purtroppo c’è da dire che questo titolo, nato come un potenziale tripla A, è stato ridimensionato… incidenti di un percorso tutt’altro che semplice.

Le applicazioni di questa chain non sono ultimate: essa si presta bene anche per la compravendita di NFT e per l’operatività in trading. Nel prossimo paragrafo vedremo qualche progetto su cui concentrarsi.

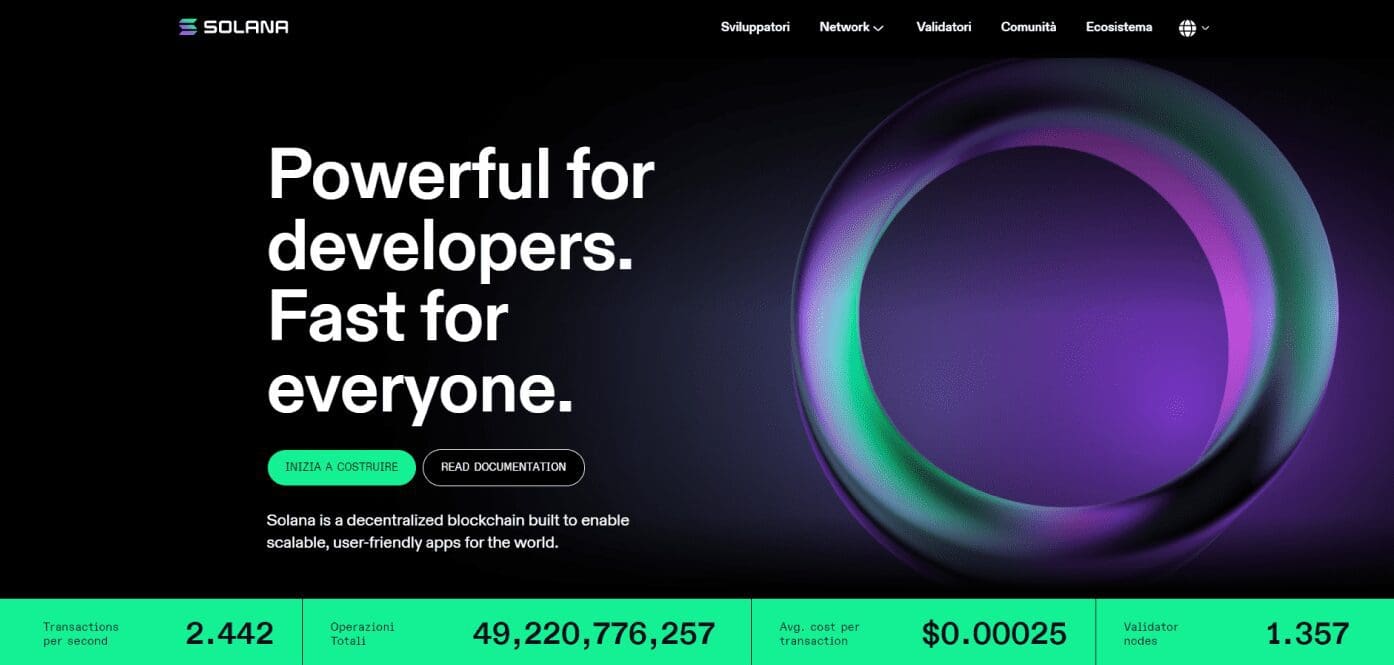

Solana è già un pilastro del mondo crypto. Sembra però che sia ancora tutto agli inizi: il potenziale è enorme e sembra suggerire un futuro assolutamente da protagonista. Ecco il link al sito ufficiale per approfondire ancor di più il progetto.

"Solana è una chain senza limiti e si presta a numerose applicazioni"

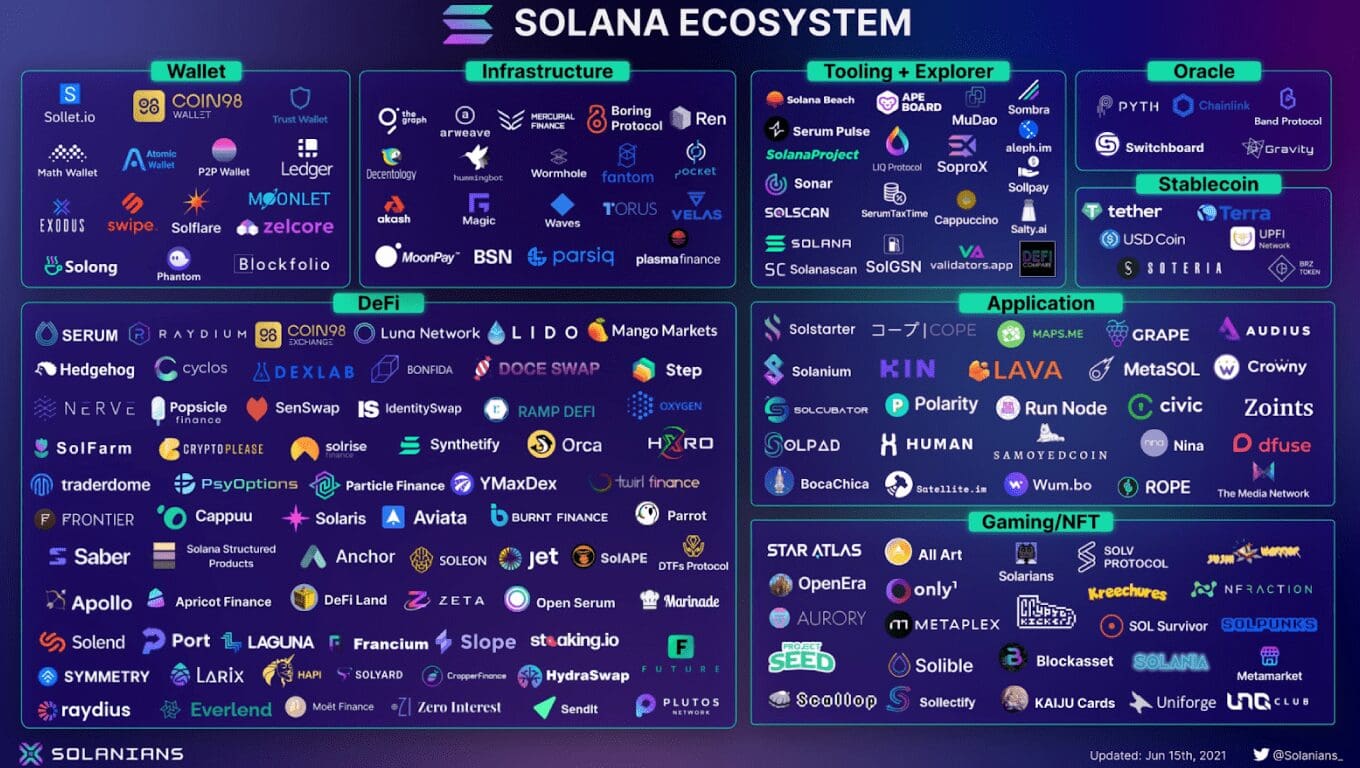

I progetti più interessanti su chain Solana

Vediamo insieme qualche piattaforma e progetto su cui concentrarsi.

Solana propone un ambiente ricco di opportunità. Alcune di esse sono di qualità assoluta e sarebbe un peccato non approfittarne.

Di Star Atlas ne abbiamo già parlato: salviamolo per il futuro, soprattutto se si è appassionati di gaming.

Raydium è un protocollo DeFi molto interessante dove è possibile mettere a rendita le proprie criptovalute con facilità.

Inoltre, l’abbondante liquidità e il team attento garantiscono elevata sicurezza.

Sempre su questa piattaforma vi è anche l’opportunità di acquistare e vendere NFT: la scelta è ricca e per tutti i gusti!

Restando nel mondo dell’arte digitale, da menzionare Solanart e Solsea. Si tratta di marketplace di Non Fungible Tokens molto utilizzati e che vedranno probabilmente crescere il numero di utenti in futuro.

Marinade Finance è il protocollo DeFi che propone uno stake più efficiente. Basta ai fondi bloccati: Marinade emette un token sintetico per ogni SOL messo in stake, così da poter adottare una strategia multilivello e che amplifica le rendite.

Che dire poi di Saber, Orca, Larix, Port e Atrix? Progetti DeFi validissimi, sicuri e utilizzati da numerosi utenti, anche se i numeri sono calati vertiginosamente per tutta la DeFi nel bear market del 2022.

Saber è un pilastro dell’ecosistema Solana ed è interamente dedicato ai token sintetici: da Bitcoin a ETH, si trova davvero di tutto. La particolarità di questo protocollo è quella di offrire pool di liquidità tra token ancorati allo stesso asset, come cSOL-cmSOL. Così facendo, il rischio di impermanent loss viene eliminato.

Orca è il DEX user-friendly di Solana: semplice da utilizzare, propone strumenti e rendite interessanti.

Larix è un protocollo DeFi basato sul metaverso, il primo della categoria di questo ecosistema. I capitali vengono gestiti in maniera più efficiente e i rischi minimizzati.

Infine Port Finance, un noto decentralized money maker di questa blockchain. Se l’utente ha necessità di prendere in prestito delle coin (o fornirle) qui troverà ciò che cerca.

Quelle appena citate sono solo alcune delle ottime proposte dell’ecosistema Solana. Nuovi protocolli vedono la luce in continuazione: alcuni interessanti, altri meno ma comunque a testimonianza di un crescente interesse verso questa chain.

Leggi di più: che cos’è Bitcoin

Solana: la blockchain definitiva?

Solana è una blockchain che ha tanto da offrire in numerosi ambiti.

Essa pone rimedio alle criticità del Proof-of-Work e alla centralizzazione del Delegated Proof-of-Stake.

Inoltre, si tratta di un progetto open source: chiunque può visualizzarne il codice, studiarlo e lavorare su dei fork. La trasparenza è qualcosa di fondamentale, soprattutto quando ci sono di mezzo i nostri soldi.

Questi aspetti rendono Solana una delle migliori realtà in circolazione.

Si tratta quindi della scelta definitiva? Non possiamo dirlo: saranno gli utilizzatori a decretarlo.

Gli avversari non stanno di certo a guardare. Ad esempio Ethereum, passata all’algoritmo Proof-of-Stake, migliorando la velocità e abbassando le gas fee. Tuttavia, Solana ha le sue caratteristiche e non nasce come Ethereum-killer: la convivenza è possibile.

Solana può quindi proseguire il suo fantastico viaggio senza preoccuparsi degli altri attori: lo sviluppo raggiunto è tale da lasciare un certo margine di tranquillità.

L’adozione crescente della blockchain e delle criptovalute farà il resto: se tutto andrà come pensiamo, i progetti migliori vedranno aumentare a dismisura gli utenti e le collaborazioni con grandi società e aziende.

Solana sarà certamente una delle protagoniste in questo processo di cambiamento: farne parte sarà decisamente eccitante!