Dai futures al copy trading

Tieniti forte: stiamo per conoscere Bitget, uno degli exchange più completi in circolazione, tra i primi 5 al mondo per volumi di trading, open interest e liquidità sui derivati.

Per operare in modo profittevole non contano solo l’analisi degli asset e il monitoraggio dell’andamento. Trader e investitori particolarmente attivi necessitano infatti della giusta piattaforma. Scegliere l’exchange sbagliato potrebbe essere limitante o comportare spese ingenti; ecco perché si dovrebbero sempre confrontare le principali alternative prima di iniziare a muovere capitali.

Bitget si presenta come un exchange dalla proposta completa. Il punto di forza principale sta nel trading di derivati, oltre a un ottimo sistema di copy trading, disponibili anche in Italia.

Nei prossimi paragrafi presenteremo le funzionalità di Bitget nel dettaglio, dal mercato spot agli strumenti di rendita passiva. Ampio spazio anche alle domande più comuni e gettonate. Al termine, ognuno potrà valutare correttamente se questo exchange crypto è adatto alle proprie necessità.

Vuoi iscriverti a questo exchange ottenendo dei vantaggi? Utilizza il nostro referral Bitget

Indice

- Bitget exchange: panoramica

- Come iscriversi a Bitget?

- Bonus attivi

- Bitget è sicuro?

- Come fare un deposito su Bitget?

- Come prelevare i soldi da Bitget?

- Commissioni, fee di trading e prelievo

- Bitget token: BGB

- Come funziona Bitget? Mercato crypto spot

- Trading futures

- Trading bot Bitget

- Bitget copy trading

- Earn e rendita passiva

- Bitget Card

- Bitget recensioni: un exchange crypto completo

Bitget exchange: panoramica

L’exchange Bitget si presenta con un’interfaccia pulita ma di certo non inedita. D’altra parte è ormai prassi di molti player impostare il portale in un certo modo, così da rendere la vita più semplice agli utenti.

Dal menu posizionato nella parte alta dello schermo si accede rapidamente a tutto o quasi. In aggiunta, le voci sono chiare e non generano confusione. Eccole:

- Buy Crypto per acquistare criptovalute o depositarle da un wallet esterno;

- Futures per operare su questi strumenti derivati;

- Spot per scambiare crypto direttamente sul mercato spot;

- Markets, pensato per analizzare l’andamento di coin e token in tempo reale;

- Copy Trading, il servizio che consente di copiare l’operatività di altri trader;

- Earn, dedicato alle proposte per generare rendita con le proprie criptovalute.

Nella parte destra della barra superiore troviamo invece i collegamenti a impostazioni e area personale. Da qui potremo anche variare la modalità da light a dark, un altro elemento presente ormai come il prezzemolo!

A completare la barra, subito a destra del logo è collocata un’icona a forma di quadrato; posizionandoci sopra visualizzeremo altri link e pagine utili del sito.

Bitget dà il meglio di se quando utilizzato da trader e investitori esperti, attivi e magari che operano tramite i bot. Nonostante ciò, l’ottima interfaccia consente di avvicinarsi a qualsiasi tipo di utente, compreso il meno navigato.

Proprio per i principianti è presente la funzionalità demo trading. Un modo perfetto per “giocare” e imparare senza rischiare nemmeno un centesimo.

Le presentazioni le abbiamo fatte. Spostiamoci quindi sul concreto iniziando dalle basi: come registrarsi a Bitget.

Come iscriversi a Bitget?

Potrà sembrare un quesito banale, ma il neofita del mondo crypto potrebbe trovarsi in difficoltà e non sapere come iscriversi a un exchange. Nel corso di questo breve articolo, scopriremo come creare un proprio account gratuito su Bitget, tra i più importanti CEX (Centralized Exchange) in circolazione.

Quando si tratta di investimenti in criptovalute, su Bitget si può fare praticamente di tutto. Partendo dalla semplice compravendita di coin e token pagando direttamente in euro, saliamo fino ai prodotti più complessi dedicati alla rendita passiva o al trading automatico. Questo exchange rappresenta quindi una buona scelta a 360°, date anche le commissioni contenute e la particolare attenzione verso il cliente.

Quindi, come iscriversi a Bitget? L’operazione è facilissima, vediamola punto per punto:

- Clicca su questo link referral per andare nella pagina di iscrizione. Grazie a esso, avrai diritto a ricevere dei bonus fino a 8.000$;

- Inserisci un tuo indirizzo mail e una password a scelta;

- Dopo aver confermato riceverai un’e-mail che darà inizio alla tua avventura con questo exchange; tutto qui!

Ricorda che dovrai effettuare la procedura KYC (identificazione mediante un documento) per effettuare delle operazioni. Se preferisci non rivelare alcun dato personale, dovresti considerare soluzioni alternative come Relai.

Raccomandiamo inoltre di settare l’autenticazione a due fattori dalle impostazioni per aumentare la sicurezza del tuo account.

Leggi di più: depositare euro su Bitget

"Bitget: registrazione rapida e vantaggi per i nuovi utenti"

Bonus attivi

Se sei un nuovo utente, interessato a registrarsi per la prima volta a Bitget, la piattaforma ti regala dei lauti bonus se ti registri con questo link dedicato.

La promozione attuale prevede fino a 8000$ di trading bonus in regalo e uno sconto A VITA del 15% sulle già competitive commissioni di trading.

Il trading bonus è una somma che ti viene accreditata sull’account e con la quale puoi aprire delle posizioni di trading a tua scelta. Qualora esse dovessero andare in profitto, i guadagni sarebbero tutti tuoi e prelevabili.

Se invece le tue posizioni dovessero andare in perdita, stop loss o liquidazione, non perderai fondi reali perché il bonus coprirà le perdite.

Insomma: un ottimo modo per fare i tuoi primi trade a rischio zero e incassando anche i potenziali profitti!

Leggi di più: Bitget bonus

Bitget è sicuro?

Apriamo una parentesi sulla sicurezza, una delle tematiche più delicate quando si ha a che fare con un exchange centralizzato.

Innanzitutto, non possiamo avere delle certezze riguardo alla tenuta della società. Sappiamo che Bitget è sano e tra le piattaforme più utilizzate, ma non possiamo sapere di più. Detto questo, il CEX prende sul serio la questione sicurezza mediante diverse iniziative.

Innanzitutto, esiste il Fondo di Protezione Bitget, una sorta di cuscinetto nel caso dovessero esserci delle problematiche di qualche genere. Al momento i depositi sfiorano i 400 milioni di dollari e sono consultabili su questa pagina.

Vi sono poi le Proof of Reserves secondo il rodato metodo del Merkle Tree. Il rapporto sulle riserve della piattaforma è aggiornato su base mensile. Quest’ultimo è sempre di molto superiore al 100% e talvolta è stato anche del doppio. La pagina ufficiale sulle riserve Bitget è accessibile da chiunque.

Spostando il focus sull’informatica, l’exchange è all’avanguardia, ma come sempre i rischi non possono essere eliminati al 100%.

Nel complesso, Bitget è un ottimo luogo dove comprare e vendere crypto in sicurezza.

Come fare un deposito su Bitget?

A registrazione avvenuta potremo effettuare il Bitget login e procedere con il primo deposito. Questo potrà essere sia in criptovalute che in euro.

Per il versamento di valuta tradizionale con bonifico SEPA, abbiamo preparato un tutorial ad hoc. L’iter è semplice e non richiede più di un paio di minuti.

Se invece volessi depositare crypto, ecco come procedere.

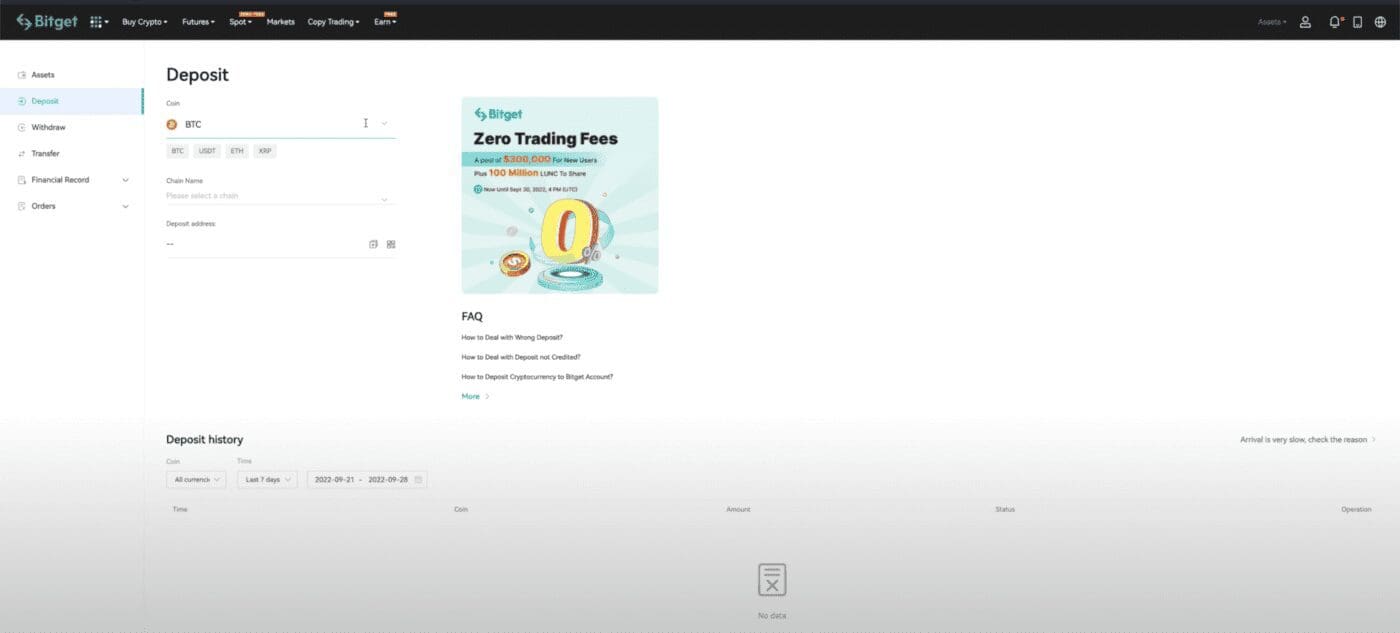

Dalla barra del menu posizionata in alto allo schermo, clicchiamo sulla scritta Assets, sita sulla destra. Si aprirà un menu a tendina in cui troveremo la scritta Deposit: pigiamoci sopra per accedere alla pagina dedicata.

Aiutandoci con l’immagine posizionata al termine del paragrafo, vediamo quali sono i passaggi da completare per depositare criptovalute su Bitget.

Nel riquadro Coin, il primo, selezioniamo l’asset da depositare. Prendiamo come esempio bitcoin (BTC).

Subito sotto, cliccando su Chain Name dovremo indicare quale sarà la blockchain di provenienza. Nel nostro caso potremmo scegliere tra due alternative: Bitcoin e BSC (BNB Smart Chain). Chiaramente, cambiando la coin da depositare variano anche i network proposti.

A questo punto, nell’area Deposit Address comparirà un indirizzo a cui dovremo inviare le crypto che desideriamo versare su Bitget. Riprendendo il nostro esempio, i bitcoin da depositare andrebbero inviati a questo indirizzo.

Fatto ciò dovremo solo attendere l’accredito sul conto Bitget. Le tempistiche variano in base alla coin e al network selezionato.

Come sempre occhio alle gas fee: sappiamo bene che ogni blockchain applica costi sulle transazioni molto diversi tra loro.

Come prelevare i soldi da Bitget?

Quanto al prelievo, la procedura è identica a quella vista nel paragrafo precedente.

Dovremo solo accedere dalla sezione Withdraw e selezionare asset desiderato con relativa chain di destinazione.

Nel campo Address scriveremo l’indirizzo del wallet a cui vogliamo inviare i fondi. Tutto qui!

Desideri prelevare in valuta fiat? Trovi quello che ti serve nel tutorial menzionato nel paragrafo precedente.

Commissioni, fee di trading e prelievo

Commissioni e fee di Bitget sono consultabili dall’apposita pagina appena linkata. Raccomandiamo di fare affidamento a questi dati in quanto vengono aggiornati di frequente.

I costi sono suddivisi in tre categorie: operatività Spot Trading, operatività Futures e prelievo.

Bitget Fee Spot trading

La commissione di ingresso è dello 0,1% sia per Maker che per Taker, un dato già competitivo e non eccessivamente impattante.

Detenendo BGB, il token di Bitget, i costi possono essere ridotti parecchio. Questo aspetto positivo si scontra però con una nota negativa, ovvero l’esposizione all’asset. Diventa quindi importante un’attenta analisi di questa crypto, valutando se i benefici in termini di risparmio sulle fee superano i rischi.

Un ulteriore metodo per abbassare le commissioni è il referral link di Bitget già menzionato in precedenza.

Bitget Fee Futures trading

Commissioni migliori della maggior parte della concorrenza anche per quanto riguarda i Futures, uno dei pilastri di questo exchange.

La fee di partenza sono dello 0,020% Maker e 0,060% Taker. Anche in questo caso, i possessori di BGB possono abbattere i costi.

Resta valido anche il referral con l’ormai nota riduzione del 15%.

Bitget Withdrawal Fee

Le fee di prelievo sono variabili in funzione della coin e del network interessati.

Questi costi si allineano a quelli dei principali competitor.

"Nel complesso, Bitget si dimostra un exchange piuttosto conveniente in termini di commissioni"

Bitget token: BGB

BGB è un token ERC-20 della blockchain Ethereum, rilasciato nell’estate del 2021.

L’offerta totale è di 2 miliardi di esemplari, di cui il 25% è stato scambiato con gli holder di BFT. Per il resto, è previsto un piano di distribuzione che segue queste percentuali:

- 20% per il team principale;

- 15% per coinvolgimento utenti e community;

- 15% per branding e sviluppo;

- 15% per i fondi di investimento ecologici;

- 10% per il fondo di protezione degli investitori (che al momento dell’aggiornamento ammonta a circa 350 milioni di dollari).

Il token BGB dà diritto a diversi vantaggi.

Innanzitutto, vi è la possibilità di accedere ai launchpad e launchpool dell’exchange. Seguono poi delle agevolazioni riguardo le commissioni spot (che vengono scontate) e un prelievo gratuito al giorno.

I grandi holder possono diventare VIP e accedere a fee di trading progressivamente ridotte in funzione dei BGB detenuti.

I vantaggi non si fermano qui, perché ne sono previsti di ulteriori nel futuro, come la possibilità di ricevere rendite maggiorate dal programma Earn.

Dove acquistare BGB?

Il canale migliore è ovviamente l’omonimo exchange, che mette a disposizione tre metodi per acquistare BGB.

La prima modalità è la compravendita mediante il mercato spot. Il token BGB è scambiabile con le stablecoin USDT e USDC, più ETH e BTC.

Per chi non disponesse di criptovalute, o non intendesse passare dal trading spot, vi è poi la possibilità di comprare BGB pagando in valuta fiat come l’euro o il dollaro.

Infine, la terza modalità è la conversione di piccoli saldi. Nello specifico, gli importi crypto inferiori a 5 USDT possono essere convertiti in BGB direttamente dalla piattaforma, pagando una commissione del 2%.

Come alternativa, al momento dell’aggiornamento il token è disponibile anche sul CEX Bitfinex.

Investire in BGB conviene? Dipende da persona a persona. L’utente Bitget molto attivo, che svolge tante operazioni, potrebbe ottenere dei vantaggi interessanti; chi invece effettua operazioni con minor frequenza non avrebbe grande convenienza.

Il punto però è un altro: vogliamo esporci a questa criptovaluta? Se la risposta è sì, allora sappiamo già cosa fare, a prescindere dai volumi che muoviamo sull’exchange. Dopotutto, acquistare una crypto di questo genere significa anche credere nel progetto e investirci indirettamente. Al contrario, passiamo ad altro senza pensarci troppo.

Leggi di più: come comprare USDT su Bitget

Come funziona Bitget? Mercato crypto spot

Operando sul mercato spot si comprano e vendono criptovalute di vario tipo. Ma come acquistare crypto su Bitget? Lo vediamo subito.

Dal menu, clicchiamo prima su Spot e in seguito su Spot Trading. Avremo accesso alla sezione riservata.

Nella parte destra della schermata è ben visibile l’order book, così da poter seguire in tempo reale l’evolversi di domanda e offerta.

All’opposto, sulla sinistra, possiamo selezionare la coppia su cui operare. Nell’immagine si tratta di BTC/USDT, quella di default. Noteremo che la proposta è enorme, difficile non trovare la coppia che stiamo cercando.

Al centro troneggia invece il grafico. Le opzioni proposte sono due:

- Original, più semplice e meno personalizzabile.

- TradingView (consigliato e selezionato come principale) ricco di funzionalità.

Al di sotto è invece posizionata l’area da cui effettivamente potremo eseguire gli ordini, suddivisi in tre tipologie: Market, Limit, e Trigger.

I primi due li conosciamo piuttosto bene. Stesso discorso per i Trigger, di fatto degli ordini Stop Loss o Take Profit. Per ripassare o approfondire il tema, ecco un nostro articolo dedicato alle tipologie di ordini nel trading.

Qualunque sia la nostra operatività, dopo aver impostato i vari parametri dovremo confermare l’ordine tramite i pulsanti Buy o Sell.

"Mercato spot ricco di coin e token, completo e intuitivo: promosso!"

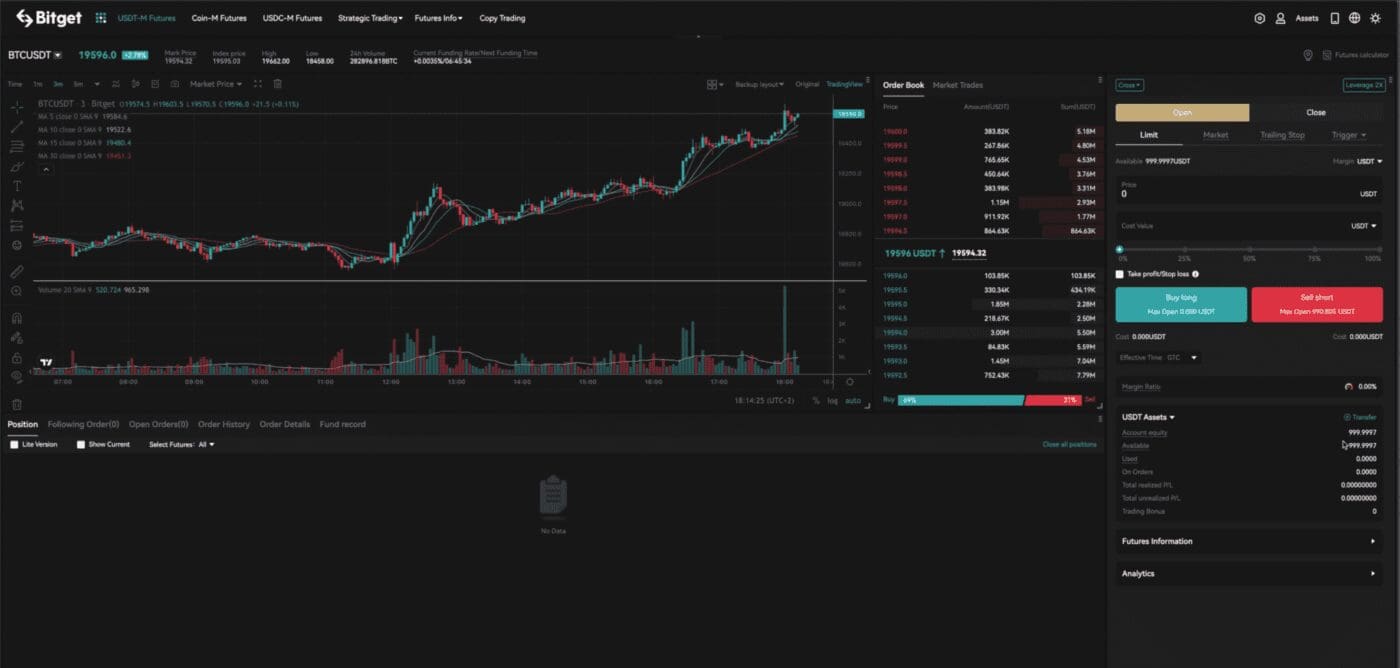

Trading futures

I futures sono strumenti derivati complessi e potenzialmente pericolosi. Si consiglia quindi di operare solo se si possiede il giusto mix di esperienza e preparazione, pena il rischio di subire perdite anche consistenti.

In ogni caso, i principianti possono farsi le ossa con il conto demo di Bitget: un buon modo per imparare le basi senza mettere a repentaglio il proprio capitale. Lo possiamo trovare sotto la voce Futures del menu (Demo Trading).

Fatta la premessa, vediamo in che cosa consiste la proposta di Bitget riguardo ai Futures. Consigliamo di guardare con attenzione il video al termine dell’approfondimento; infatti, per quanto cercheremo di essere esaustivi nel raccontare, nulla è meglio di un filmato con annessa spiegazione.

Bitget consente di operare su tre differenti Futures:

- USDT-M FUTURES, cioè dei perpetual il cui margine è in USDT, la stablecoin di Tether.

- USDC-M FUTURES, dove il margine è in USDC, prodotto di punta dell’azienda Centre.

- Coin-M FUTURES, perfetti per strategie come lo short di copertura.

Nei primi due casi, il margine viene assicurato mediante una stablecoin. Perciò saremo esposti solo alle variazioni di prezzo del sottostante del future stesso, nulla di più.

Invece, nei Coin-M FUTURES avremo da considerare un fattore in più : oltre ai saliscendi del futures, dovremo infatti pensare anche a quelli della coin-margine.

Ad esempio: creando uno short di copertura su bitcoin, in caso di salita o discesa varierà sia il valore del future che quello del margine.

Qualsiasi sia la scelta, cliccando su una voce accederemo alla pagina operativa.

Le differenze con il mercato spot si notano immediatamente. Andiamo con ordine.

Il grafico ora si posiziona a 2/3 partendo da sinistra, con subito sotto lo storico degli ordini effettuati.

Proseguendo verso destra incontriamo prima l’order book e poi l’area operativa da cui aprire e chiudere posizioni.

Quando si imposta un ordine, prestiamo molta attenzione alla modalità di margine prescelta. Nell’area operativa, clicchiamo sul pulsante più in alto a sinistra; può avere la scritta Isolated o Cross.

A questo punto potremo scegliere la modalità di margine più in linea con le nostre esigenze:

- Isolated è la più prudente in quanto verrà impiegato come margine solo quello iniziale. Per esempio, aprendo un futures con 500 USDT di margine, il massimo che potremo perdere sarà proprio questa cifra.

- Cross impiega invece tutto il margine presente sul nostro conto, in base ovviamente al tipo di futures.

Immaginiamo di aprire un futures USDT-M con 500 USDT; poniamo però di avere altri 1500 USDT sul conto. Indipendentemente dalla partenza, tutti i nostri USDT (500 + 1500) potrebbero essere impiegati come margine se le cose dovessero mettersi male. Inutile sottolineare quanto questo potrebbe impattare sul nostro capitale, massima attenzione.

Trattandosi di derivati, su Bitget è disponibile l’operatività in leva finanziaria fino a 125x.

La leva è uno strumento che necessità di ancor più esperienza e studio. Se è vero che i guadagni possono aumentare vertiginosamente, è altrettanto vero che la leva può prosciugare i fondi in caso di errore.

Una leva ben studiata e in linea con il nostro profilo è senza dubbio utile. Anzi, talvolta diventa indispensabile per rispettare i parametri di rischio e rendimento.

Nel Corso di Trading consapevole, disponibile gratuitamente sulla nostra piattaforma di formazione TCG Learn, abbiamo trattato ampiamente della questione.

A prescindere da tutto, teniamo sempre d’occhio il margine. Nel caso ci avvicinassimo pericolosamente all’area di liquidazione, agiamo di conseguenza chiudendo la posizione o incrementando il margine stesso. Ricordiamo: la liquidazione va evitata in quanto comporta delle penali piuttosto salate; meglio incassare una perdita che una perdita più la liquidazione.

Ok, ora possiamo passare alle varie tipologie di ordine dei futures di Bitget.

Market, Limit e Trigger li abbiamo già conosciuti e nulla cambia dal mercato spot.

C’è poi anche il Trailing Stop, un ordine che si attiva a un certo limite da noi deciso (es. “acquista BTC a 20.000$” o “vendi ETH a 1500$”).

Si aggiunge però un’altra impostazione: lo spostamento dell’ordine dal prezzo di mercato di una certa percentuale, per poi seguirlo. Vediamo un esempio, così da comprendere meglio il concetto.

Apriamo una posizione trailing stop long su bitcoin; impostiamo lo spostamento del 5%. Bitcoin sale e beneficiamo di guadagni crescenti; il trailing stop si modifica in continuazione, seguendo l’andamento di BTC, restando il 5% al di sotto del mercato; così facendo, quanto guadagnato finora viene tutelato da eventuali perdite. Nel momento in cui il trend dovesse interrompersi e invertirsi, dopo il 5% di ribasso la posizione verrebbe chiusa automaticamente.

Che dire, uno strumento perfetto per coprirsi senza rinunciare a seguire il trend.

Dopo aver provato i futures di Bitget si capisce perché l’exchange sia così apprezzato per questi strumenti: completi e personalizzabili, sono tra i migliori in circolazione.

"Futures di Bitget: senza dubbio tra i migliori in circolazione."

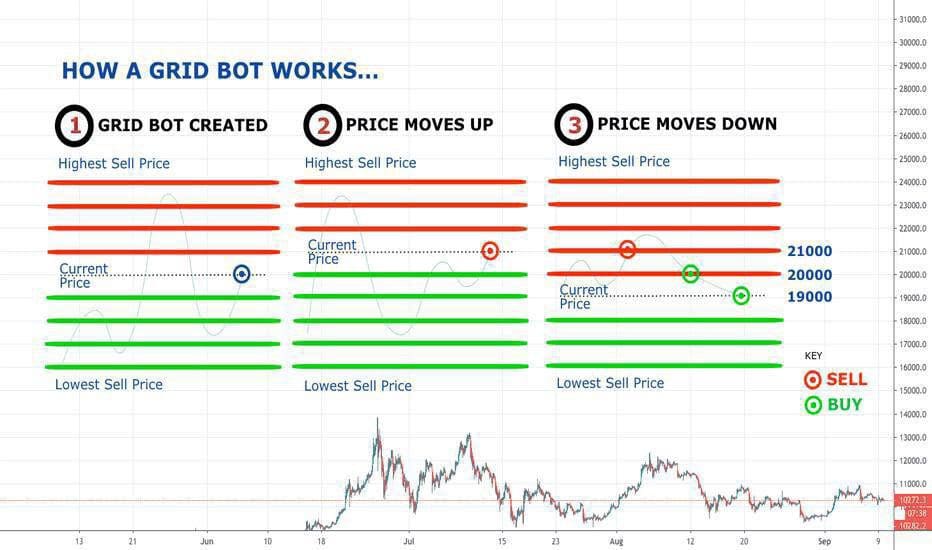

Trading bot Bitget

Spostiamo il focus sul trading automatizzato di Bitget.

Troviamo due tipologie: il Grid Bot classico, di cui parleremo in breve adesso; il Copy Trading, su cui ci concentreremo nel prossimo paragrafo.

Il Grid Bot è la tipologia di trading automatizzata più diffusa.

Esistono diversi Grid Bot, fra cui i più comuni sono quelli specifici per i movimenti rialzisti, ribassisti e laterali. Alcuni sono più semplici, altri invece mettono in campo strategie che alzano i rischi (come il Martingala bot).

In parole molto semplici, il bot costruisce una fitta griglia intorno all’andamento dell’asset in questione. Ogni soglia fa scattare un ordine di acquisto o vendita, ovviamente in base alla strategia. Per esempio, un Grid Bot per fasi laterali giocherà in continuazione su comprare basso e vendere alto, approfittando anche delle più piccole variazioni.

Bitget propone le tre classiche tipologie di Grid Bot, tutte molto efficienti. Teniamo però presente che il guadagno non è mai garantito: un bot può ottimizzare al massimo l’operatività ma le perdite sono assolutamente possibili.

Dato l’elevato numero di eseguiti, è sempre consigliato scegliere un exchange dalle basse commissioni per impostare strategie di trading automatizzato. Avendo costi decisamente contenuti, Bitget rappresenta quindi una valida scelta in questo senso.

Su Bitget, questo servizio è disponibile sia sul mercato spot che sui futures. La scelta è personale ma ricordiamo che la liquidità è sempre maggiore sui secondi.

Passiamo ora al Copy Trading, un’altra funzione interessante e adatta a tutti.

Leggi di più: guida al grid bot di Bitget

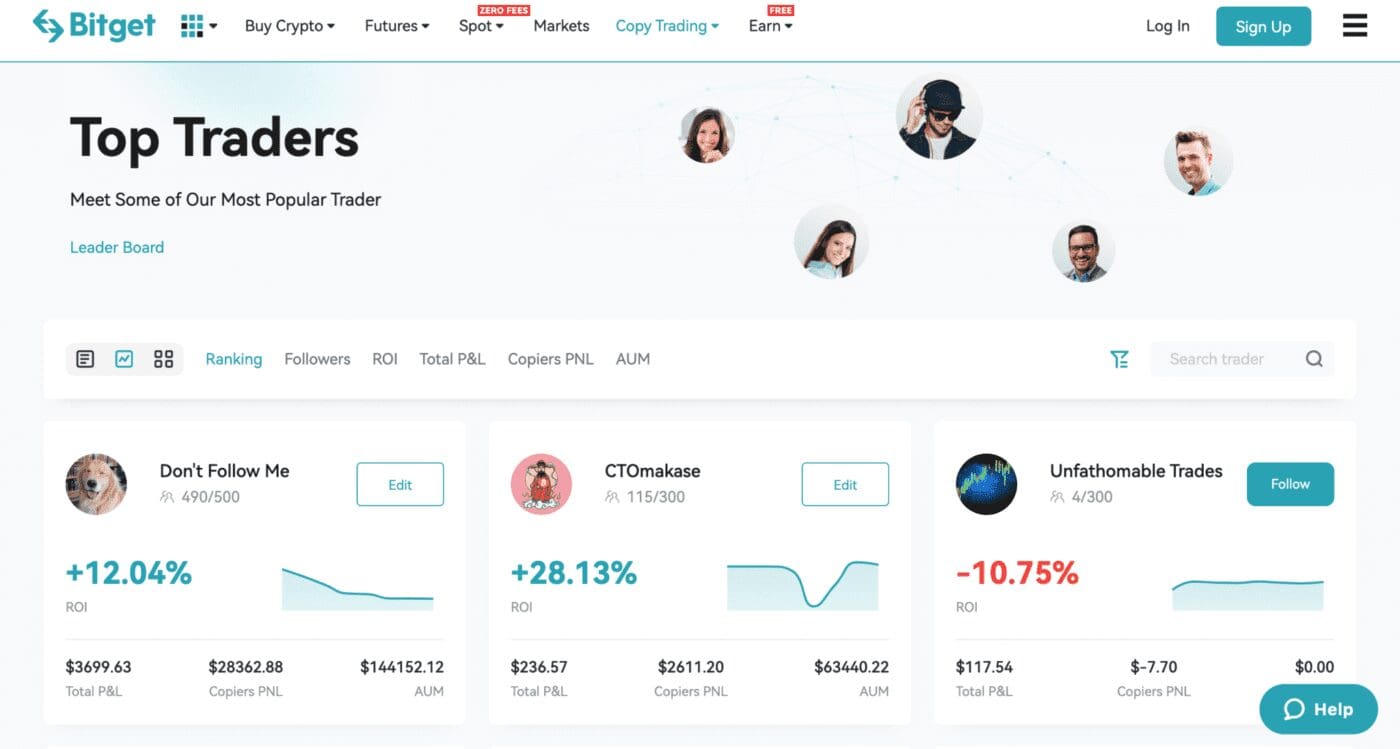

Bitget copy trading

Come suggerisce il nome, tramite il copy trading possiamo copiare pari-pari l’operatività di altri trader iscritti all’exchange.

Accedendo all’area dedicata (link Copy Trading sulla barra del menu) compare l’elenco dei potenziali “mentori”.

Avremo modo di visualizzare da subito la performance complessiva; cliccando su uno specifico personaggio, ecco che avremo accesso a dei dati più esaustivi.

Ogni trader dispone di uno slot di follower limitato. Se il numero di posti è esaurito dovremo per forza di cose cercare un’alternativa, magari mettendoci in lista di attesa. I trader di successo sono gettonatissimi ed è difficile riuscire a seguirli da subito, occorre un po’ di pazienza.

Il copy trading è un metodo valido per non rinunciare a questa operatività anche quando non si dispone di tempo o delle giuste conoscenze. Però, al tempo stesso si agisce seguendo qualcun altro, rinunciando quindi ad avere controllo e consapevolezza delle nostre azioni.

Consigliamo il copy trading? Senz’altro ma a due condizioni:

- Scegliendo il giusto trader da copiare; esso dovrà avere una lunga esperienza sul campo, così da tutelarci il più possibile da chi sta solo avendo un periodo fortunato.

- Proseguendo con lo studio e l’affinamento delle nostre conoscenze. Il copy trading è infatti qualcosa in più, non un’alternativa all’operatività personale.

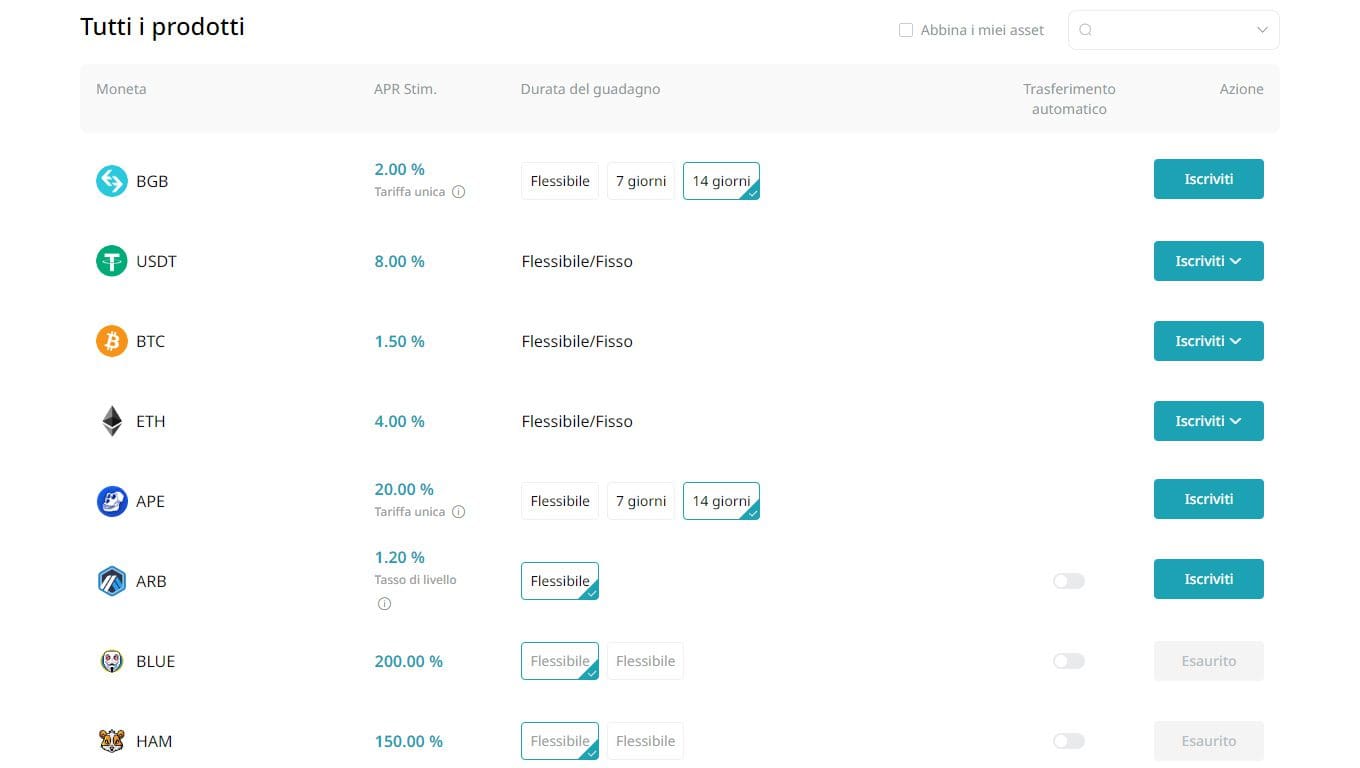

Earn e rendita passiva

Come ogni exchange crypto che si rispetti, Bitget offre diversi metodi per mettere a rendita le proprie criptovalute.

Partiamo con i Savings: depositiamo coin e token su cui vogliamo accumulare interessi e riceviamo in cambio una certa percentuale annua.

Flessibili o bloccati per periodi limitati, i Savings sono piuttosto sicuri e profittevoli.

Proseguendo, i possessori di BGB possono metterlo a rendita nell’area dedicata (Menu –> Earn –> BGB Earn).

Non facciamoci ingolosire dagli APY e investiamo solo se il token è di nostro reale interesse.

Chi volesse girare capitali su progetti nuovi e in rampa di lancio troverà ciò che cerca nei Launchpad. Cambia l’exchange ma non la sostanza: si tratta di un prodotto pressoché identico ai famosi Binance Launchpad.

Infine i Launchpool, dove si versa una crypto per guadagnarne un’altra. Anche in questo caso, il prodotto è simile a quello del exchange ideato dal nostro amico CZ.

Concludendo, la maggior parte degli utenti sarà attratta perlopiù dalla sezione Savings. Diamo comunque uno sguardo anche al resto: le opportunità non mancano, mettendo però sempre davanti a tutto la valutazione dei rischi.

"Bitget si conferma completo con una buona proposta dedicata alla rendita sulle criptovalute"

Bitget Card

Anche l’exchange Bitget ha una sua carta dedicata che il cliente può utilizzare per compiere gli acquisti e ricevere un cashback.

La Bitget Card non è al momento disponibile per tutti gli utenti, ma solo per quelli di grado VIP e su invito.

La card è una carta di credito, ma richiede un saldo sufficiente sul conto per poter essere utilizzata. Opera su circuito Visa ed è quindi accettata pressoché dovunque ci sia un POS. L’unica valuta al momento accettata e utilizzata per compiere le operazioni è Tether USDT; secondo la documentazione ufficiale, presto saranno comprese altre crypto quali bitcoin, Ethereum, BGB, USDC…

Se cerchi delle alternative puoi dare un’occhiata alle seguenti:

"Almeno per ora, Bitget propone una card solo ai clienti VIP"

Bitget recensioni: un exchange crypto completo

Dopo averlo esplorato e testato possiamo affermare che Bitget è un exchange molto completo.

La proposta è ampia e in linea con le esigenze sia degli investitori che dei trader.

Le commissioni sono inferiori a molti competitor, il che è un ulteriore punto a favore.

In Italia, l’exchange ha acquisito popolarità dopo che si è venuta a creare la partnership Bitget Juventus. Da allora, ricerche e interesse sono costantemente aumentate, nonostante la sponsorizzazione si sia conclusa.

A nostro avviso, Bitget è sicuro, valido e adatto a tutti gli investitori in criptovalute. Prestando attenzione a non lasciare depositati fondi ingenti, come si dovrebbe sempre fare con i CEX, la nostra opinione è assolutamente positiva.