Crypto.com: come funziona crypto com? Aggiornato 2025

Di Luca Boiardi

Crypto.com è un exchange di criptovalute diventato popolare tra gli investitori grazie a innovazione e marketing. Scopriamo come funziona!

Crypto.com: un po' di storia

Crypto.com è un exchange di criptovalute fondato nel 2016 da Kris Marszalek e il suo team.

Dopo un rebranding nel 2018 (il nome iniziale era Monaco), la compagnia si è portata sotto i riflettori entrando in competizione con i più importanti player del settore.

L’idea vincente di Crypto.com è stata quella di dare la possibilità ai propri clienti di poter spendere criptovalute attraverso una carta di debito VISA, ancor oggi prodotto richiestissimo dagli utenti della piattaforma.

Un passo dopo l’altro, crypto com si è fatta strada tra exchange che erano ben più famosi e robusti. Uno scontro tra Davide e Golia in cui il debole finisce con diventare anch’esso un gigante.

Fondamentali in questo senso le iniziative di marketing orientate soprattutto a partnership con il mondo dello sport. Tra i nomi citiamo UFC, Formula 1 e TIME, fino all’acquisto dei diritti dell’ex Staples Center di Los Angeles, ora Crypto.com Arena.

Il rapporto con lo sport è stato una mossa vincente per portare le criptovalute nella quotidianità, divenendo argomento mainstream.

Seppur partita in svantaggio, la compagnia è riuscita a recuperare il terreno e diventare uno dei punti di riferimento nello scenario degli exchange centralizzati di criptovalute.

Oggi Crypto dot com non si ferma più e si prepara a evolversi ulteriormente. Infatti, dal 2025 l’azienda inizierà a offrire anche la possibilità di scambiare ETF, azioni, materie prime, ForEx e derivati. Ma la vera bomba è il fatto che diventerà una vera e propria banca, proponendo anche ai clienti europei un conto multivaluta, interessi sulle monete fiat e tanto altro ancora.

In attesa che tutte queste novità diventino effettive, scopriamo di più sull’exchange. Continua a seguirci per non perderti neppure un aggiornamento!

Indice

- Che cos'è un exchange crypto?

- Funzionalità di Crypto.com

- Crypto.com exchange criptovalute

- Coin CRO di Crypto.com

- SuperCharger Crypto.com

- Crypto.com Card

- Crypto.com Earn: come funziona?

- Recurring Buy su Crypto.com

- Crypto.com Wallet

- Crypto com NFT Marketplace

- Crypto Credit: ottenere un prestito

- Conclusioni

Che cos'è un exchange crypto?

Un exchange crypto è un luogo di scambio in cui le persone possono comprare e vendere criptovalute.

In cambio del servizio, la piattaforma applica una piccola commissione su ciascuna transazione di vendita o acquisto.

Per approfondire questo tema, ecco un articolo dedicato agli exchange: dagli una lettura, troverai tutte le informazioni più importanti riguardo queste società.

Funzionalità di Crypto.com

Crypto.com è un exchange di criptovalute che ha sviluppato un’applicazione per smartphone ricca di servizi, anche se talvolta un po’ macchinosa da utilizzare.

Tra le proposte, la Crypto App consente di:

- Acquistare e vendere criptovalute;

- Mettere in earn le monete digitali e guadagnare un interesse variabile;

- Spendere le crypto attraverso la carta di debito Visa, di cui parleremo in seguito;

- Partecipare al Crypto.com Supercharger;

- Ottenere dei prestiti dando come collaterale le proprie coin.

L’applicazione di Crypto.com è scaricatissima e utilizzata quotidianamente da milioni di persone. Nel corso dell’approfondimento torneremo su diverse funzionalità che essa offre, scoprendone le caratteristiche.

Spostiamo per un attimo il focus sull’exchange vero e proprio, dedicato agli utenti avanzati che desiderano affacciarsi al trading crypto.

Come dicevamo, nel 2025 Crypto.com è chiamata a introdurre molte novità, tra cui i servizi bancari e gli investimenti su asset finanziari tradizionali come le azioni e gli ETF. la roadmap è densissima: se vuoi sapere subito alcuni dei più importanti cambiamenti in corso e futuri, ecco un articolo dedicato alle novità di Crypto.com. Oppure, puoi guardare il video che segue.

Crypto.com exchange criptovalute

Crypto.com Exchange, proprio come avviene per Coinbase (e accadeva per Coinbase Pro), è una seconda versione dell’applicazione principale che presenta funzionalità pensate per gli utenti più esperti.

Sulla piattaforma troviamo infatti un elevato numero di coppie di scambio, più funzionalità inerenti all’acquisto e vendita di criptovalute e commissioni più basse. In questo modo, professionisti e operatori avanzati possono fare trading crypto in libertà, sapendo di poter contare su uno strumento potente e ricco.

Crypto App ed exchange nascono per andare incontro a esigenze diverse.. Le criptovalute restano un mondo inesplorato per molti utenti. Di conseguenza, chi muove i primi passi necessità di soluzioni semplici e intuitive.

Al contrario, gli utenti più navigati ed esperti vorranno avere a disposizione funzioni altrettanto avanzate, nonché più spazio di manovra per i propri trade ed investimenti.

Da queste osservazioni nascono due applicazioni separate in cui troviamo un’ulteriore differenza sostanziale: nella versione più semplice vengono richieste fees più alte… la comodità si paga!

Le due piattaforme dispongono di wallet separati e distinti; quindi, per spostare le nostre coin dall’uno all’altro sarà necessario agire manualmente. Da notare che questa operazione non richiede commissioni aggiuntive.

I costi si basano sui volumi di trading mossi nei 30 giorni precedenti. Si passa da una commissione minima dello 0,15% maker (che raddoppia da taker). Attenzione: i dati potrebbero variare nel tempo.

Dato che l’abbiamo appena menzionata, conosciamo meglio la coin CRO, la criptovaluta di Crypto.com!

Coin CRO di Crypto.com

CRO è l’utility token della piattaforma Crypto.com, da detenere se vogliamo godere di alcune funzionalità e sconti di questo exchange.

Dopo il burn del 70% degli esemplari, avvenuto nel 2021, la sua massima supply è di 30,000,000,000 di esemplari, di cui 26,6 sono in circolazione al momento della scrittura.

I casi d’uso di questa moneta all’interno dell’applicazione Crypto.com sono molteplici, tra cui:

- Bloccare i CRO in staking per almeno 6 mesi, così da ottenere la carta Visa per poter spendere le proprie monete detenute nell’exchange ed ottenere un cashback. In base alla quantità di coin, potremo accedere a carte più esclusive e dai vantaggi superiori;

- Partecipare al Supercharger, dove vengono messi in staking CRO per generare rendita;

- Sottoscrivere i servizi earn;

- Comprare e vendere NFT;

- Pagare le commissioni sull’acquisto e la vendita di valute, così da ottenere uno sconto sulle fee.

Oltre a ciò, la coin CRO rappresenta in parte anche l’andamento dell’azienda Crypto.com. Di conseguenza, migliori saranno le performance della compagnia, più teoricamente dovrebbe aumentare il valore della coin. Detenere CRO diventa quindi un modo per investire nell’azienda, un po’ come accade per BNB e Binance.

Tra i vari progetti di Crypto.com, impossibile non menzionare la chain Cronos, di cui CRO è la coin nativa.

Su questo network, CRO è la valuta coin cui si pagano le gas fee. Cronos ospita un interessante ecosistema DeFi che presenta occasioni spesso molto appetitose per li investitori in criptovalute.

Attenzione poi ai progetti in via di sviluppo. La coin CRO avrà infatti enorme importanza non solo per quanto riguarda la blockchain, ma anche per bonus e vantaggi legati alle carte, al trading, al conto bancario e altro ancora. Insomma, una criptovaluta centrale e onnipresente nei progetti di Crypto.com, dotata quindi di parecchi casi d’uso che la rendono interessante.

SuperCharger Crypto.com

Il SuperCharger di Crypto.com è un modo per mettere a rendita delle proprie monete, inserendole in un programma di liquidity mining creato dalla piattaforma.

Per chi non lo sapesse, il liquidity mining non è altro che un pool in cui un utente può depositare le proprie criptovalute per generare un rendimento che viene pagato in un’altra valuta scelta dalla piattaforma stessa, come bitcoin. Nel caso della Crypto App, la coin da versare è CRO.

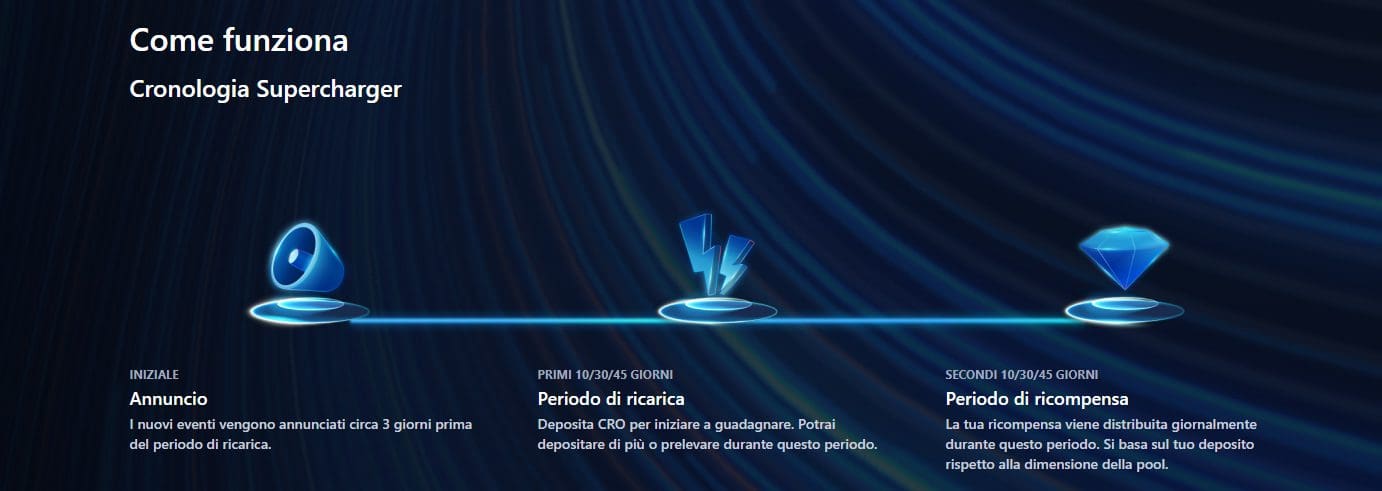

Il funzionamento è abbastanza semplice e si divide in due fasi:

Supercharger Crypto.com: periodo di ricarica

Si tratta della fase iniziale del SuperCharger di Crypto.com, la cui durata è variabile.

Durante questo periodo, gli utenti dovranno versare le coin nel pool dedicato. La procedura è semplice e la voce Supercharger è disponibile nel menu principale dell’applicazione di Crypto com.

Per tutta la durata della fase saranno calcolate le percentuali medie di deposito sulle criptovalute dell’utente per ogni ora. Più ore teniamo vincolate le coin, maggiore sarà la ricompensa ottenuta.

Nota: durante il periodo di ricarica l’utente può prelevare e depositare le proprie coin in qualsiasi momento.

Supercharger Crypto.com: periodo di ricompensa

Nel corso di questa fase, l’utente che ha fornito liquidità durante il periodo di ricarica otterrà una ricompensa giornaliera. Come dicevamo, essa sarà calcolata in base a quanto tempo sono state lasciate a rendita le monete.

Importante ricordarsi di accettare la ricompensa fin dal giorno prima dell’inizio della fase 2, pena la perdita parziale delle reward a cui si ha diritto.

Per ulteriori curiosità, ecco la pagina dedicata al Supercharger direttamente dal sito Crypto.com.

Crypto.com Card

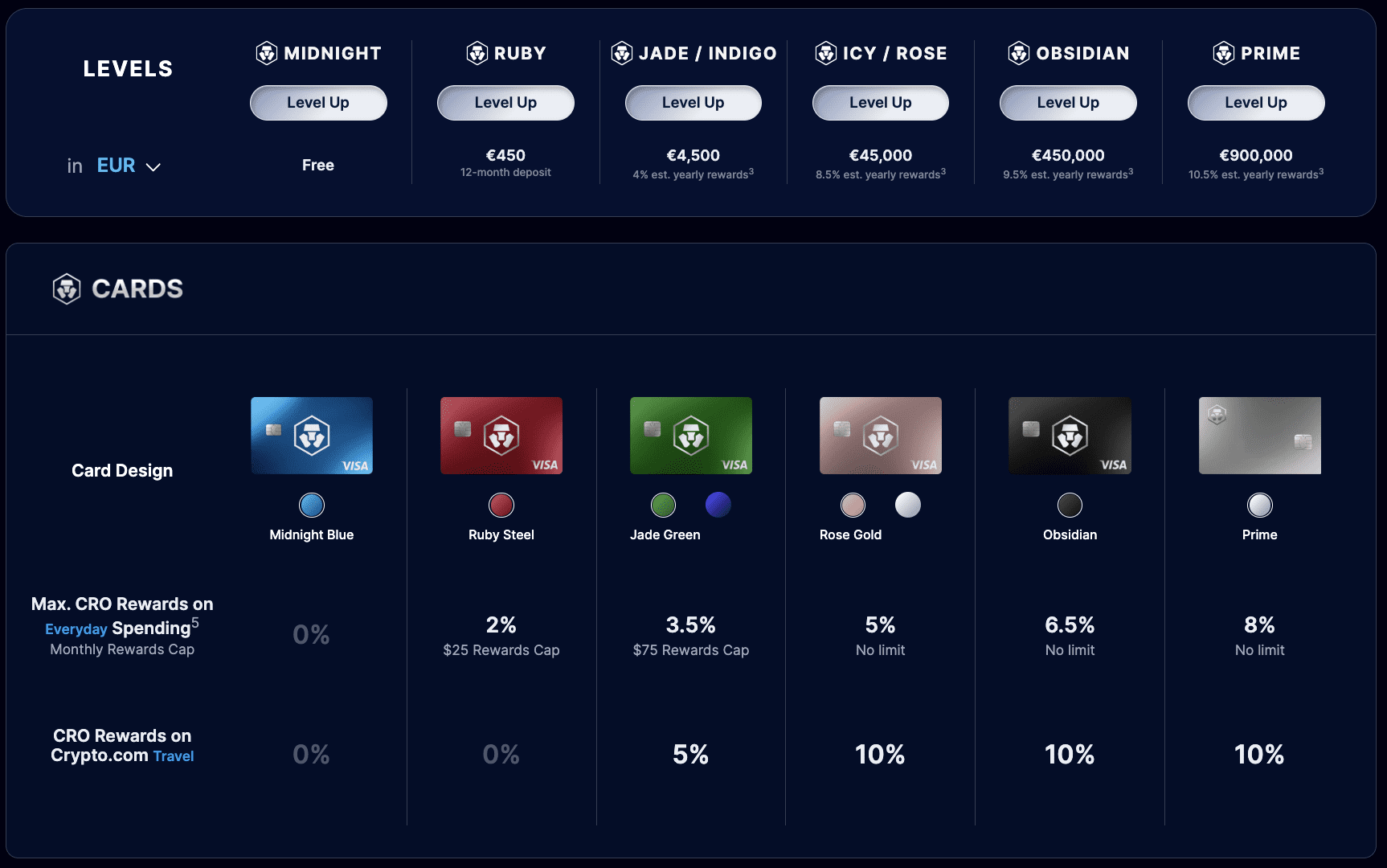

La carta di debito di Crypto.com si appoggia ai circuiti di pagamento VISA. Bella da vedere e completamente in metallo, ci permette di ricevere un cashback variabile in base al livello.

Le carte VISA di Crypto.com sono diverse e richiedibili in funzione dei CRO versati in staking sull’applicazione. Teniamo presente che il vincolo di deposito corrisponde a sei mesi: per tutto quel periodo saremo esposti alla coin e non avremo modo di prelevarla, né tantomeno venderla.

Al termine del periodo, saremo in grado di sbloccare il capitale e valutare il da farsi. Ricordiamo però che la rimozione dei fondi dallo stake implica la perdita dei benefici connessi alla carta.

Oltre al cashback su quasi tutti gli acquisti (ci sono alcune eccezioni come i siti di scommesse e gli exchange), la Crypto.com card porta altri vantaggi come Spotify gratis, disponibile però solo per alcuni tier. Ancora, salendo di livello carta accederemo a vantaggi superiori come il cashback totale su Netflix, sconti, fino alla lounge in aeroporto per sé e un ospite a scelta.

Nel tempo, i vantaggi offerti dalle carte Crypto.com erano stati ridimensionati. Però, grazie alla roadmap 2024/2025, tornano tante agevolazioni e cashback molto interessanti, che richiameranno parecchi nuovi clienti. Approfondiamo le caratteristiche nello specifico in questo articolo sulle carte di debito di Crypto.com.

Crypto.com Earn: come funziona?

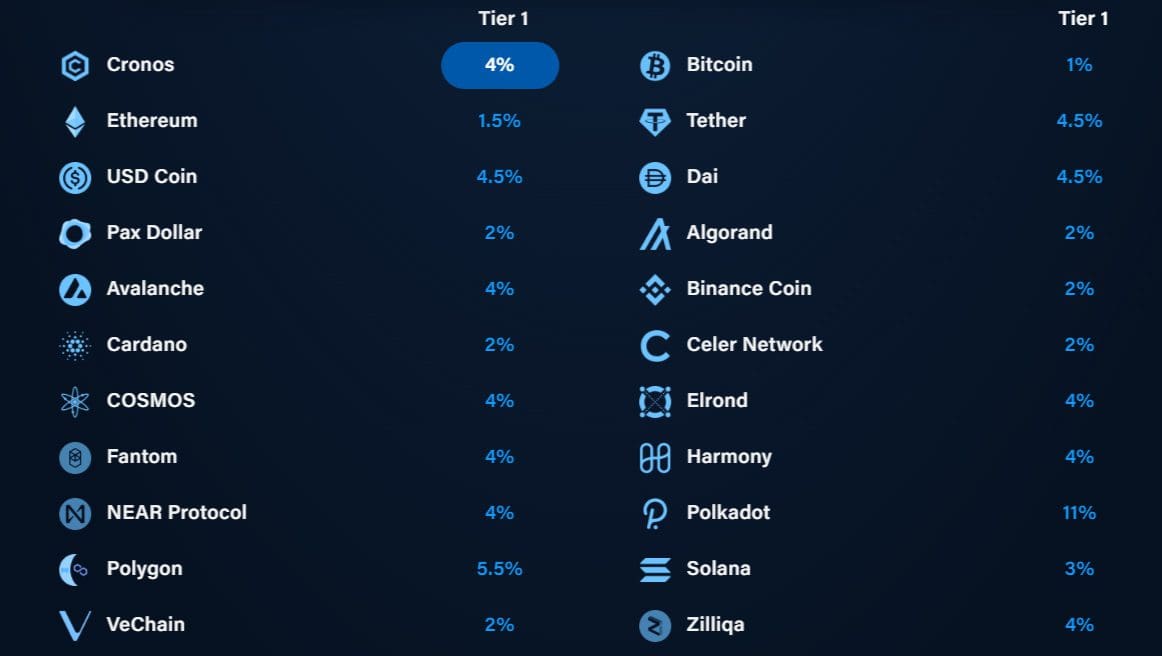

Crypto.com Earn ci permette di mettere in staking alcune delle nostre coin e generare una certa rendita passiva. Questa sarà pagata in CRO o nella stessa valuta depositata.

Il guadagno varia sia in base all’asset, sia in funzione della durata. Nello specifico, i termini previsti sono tre: Flexible, 1-Month Term e 3-Month Term. All’aumentare dell’orizzonte temporale crescono anche i guadagni.

Come suggerisce il nome, Flexible ci offre la massima libertà e non impone alcun blocco. Di contro, gli interessi a cui avremo diritto saranno inferiori.

Le altre due opzioni ci faranno guadagnare di più, dovendo però tenere bloccate le criptovalute per un certo periodo. Una volta sottoscritto il vincolo non si può tornare indietro: dovremo attendere e rispettare i termini.

Come possiamo immaginare, lo svantaggio principale sta nel rischio di esposizione all’asset. Optiamo per la soluzione in linea con le nostre esigenze, considerando soprattutto la propria propensione al rischio.

Nell’immagine che segue sono visibili i ritorni annui con blocco a tre mesi e meno di 4000 CRO in stake. Nella pagina dedicata al prodotto è possibile simulare i potenziali interessi.

Per saperne di più su rischi e vantaggi, abbiamo parlato di Crypto Earn in questo articolo. Le cifre riportate dall’immagine che segue possono variare anche di molto nel tempo, perciò invitiamo a verificarle alla fonte per avere a disposizione il dato reale e aggiornato.

Recurring Buy su Crypto.com

Il Recurring Buy è una funzione fornita dall’applicazione di Crypto.com per poter compiere acquisti automatici a intervalli programmati. Le scadenze previste sono giornaliero, settimanale, bisettimanale e mensile.

Questa funzione nasce con lo scopo di portare avanti il piano di accumulo di una valuta digitale senza dover necessariamente eseguire l’operazione di acquisto manualmente. Un bella comodità sia per risparmiare tempo che per essere certi di seguire il proprio piano.

La tipologia di coin da acquistare può essere visualizzata nella Crypto App. Troviamo ovviamente tutte le principali coin e token: difficile non restare soddisfatti.

L’acquisto può essere fatto sia dal wallet di cripto com che attraverso la propria banca, anche mediante carta di credito/debito. Attenzione alle fee: si raccomanda di optare per il bonifico bancario: la carta di credito impone una commissione piuttosto elevata.

"Il Recurring Buy è un modo semplice per portare avanti piani di accumulo senza pensieri"

Crypto.com Wallet

Il Crypto.com Wallet è il non-custodial wallet creato dagli sviluppatori della piattaforma. Grazie a questo strumento, gli utenti possono tenere al sicuro le proprie chiavi private e, di conseguenza, le criptovalute in possesso.

Un wallet viene definito non-custodial quando le coin che conserva rimangono al 100% in nostro possesso.

Questa specificazione può sembrare banale ma spesso siamo portati a pensare che le criptovalute siano qualcosa che ci appartiene per definizione. In realtà, detenendo le nostre coin su un exchange, nella maggior parte dei casi stiamo di fatto delegando la responsabilità delle coin a una terza parte, ovvero l’exchange stesso. In questi casi, il wallet fornito dalla piattaforma prende il nome di custodial.

Questo meccanismo è paragonabile a quello delle banche tradizionali e comporta dei rischi: in caso di problemi di liquidità, o peggio fallimenti, potremmo non rivedere i nostri fondi.

Invece, tramite il Crypto.com Wallet le crypto sono nostre a tutti gli effetti. Ciò comporta anche una serie di rischi specifici da non sottovalutare, primo fra tutti la custodia della seed phrase.

"Not Your keys, not Your Coins - Andreas Antonopoulos"

Crypto com NFT Marketplace

Il negozio di NFT di Crypto.com ci permette di acquistare o vendere opere NFT.

In breve, gli NFT (Non Fungible Token), i cosiddetti token non fungibili, rappresentano un bene unico o a tiratura limitata in versione digitale.

L’NFT permette di certificare facilmente autenticità, unicità e proprietà dell’opera d’arte grazie alla blockchain.

Dopo la frenesia iniziale, questi asset stanno diventando sempre più utilizzati dalle aziende. I casi d’uso si moltiplicano e il settore vive un momento di consolidamento privo della FoMO di un tempo.

Sul marketplace NFT di Crypto.com è possibile trovare numerose tipologie di arte o collezionismo, come ad esempio:

- Opere d’arte di artisti conosciuti e non;

- Brevi snap di azioni dell’IIHF World Championship;

- Altri NFT da collezione.

L’offerta è in costante espansione, segno di gradimento da parte degli utenti.

Tuttavia, i portali di riferimento per gli NFT restano Blur e OpenSea, disponibile su Ethereum, Polygon e altri network. Se sei un appassionato di arte digitale, oppure desideri creare NFT, devi assolutamente conoscere queste piattaforme!

Crypto Credit: ottenere un prestito

Il servizio Crypto Credit ci permette di ottenere un prestito dalla piattaforma senza dover sbrigare tutte le pratiche solitamente richieste.

La procedura è semplice: basterà fornire del collaterale per ricevere la somma richiesta. Esso fungerà da garanzia e resterà bloccato finché non avremo ripagato l’intero importo ricevuto in prestito, più gli interessi (riducibili grazie allo staking di CRO).

Solitamente vengono messe utilizzare come collaterale delle valute con prezzo variabile, prendendo invece in prestito delle stablecoin. Questo modus operandi ci permette di restare posizionati sulla coin, senza però rinunciare ad avere liquidità da spendere; oppure, ancora, potremo sviluppare strategie di investimento multilivello.

Riflettori sul 2025: Crypto.com ha annunciato che lancerà una sua stablecoin. Considerando la redditività del settore (vedi i bilanci di Tether) e l’ecosistema dell’exchange, possiamo immaginare che anche questo prodotto riscuoterà un certo successo.

Non c’è che dire: l’azienda sta puntando fortissimo sul fornire sempre più servizi, cercando di imporsi come nuovo player nel settore finanziario anche tradizionale, andando oltre al “semplice” ruolo di exchange.

Conclusioni

Arrivati alla fine di questo articolo possiamo finalmente tirare le conclusioni e confrontare Crypto.com con gli altri exchange competitor.

La piattaforma ha fatto indubbiamente notevoli passi avanti e stretto collaborazioni molto importanti. Fin qui, le idee e i traguardi di Crypto com danno fanno sì che molti utenti lo scelgano, siano essi di livello principiante o avanzato.

Le commissioni sono la nota stonata in quanto più elevate di altri player. Tuttavia, restano comunque sostenibili considerando il servizio.

Le carte crypto-com sono intertessanti e offrono buoni cashback. Come è prassi, per detenere una carta dovremo però essere disposti a esporci a un certo quantitativo di CRO.

In conclusione, Crypto.com è un buon exchange di criptovalute, dotato di tanti servizi e che ha dimostrato la sua affidabilità. Ma definirlo exchange, come abbiamo capito, è ormai molto limitante: c’è davvero tantissimo in arrivo.

Ricordiamo di consultare questo articolo per tutte le novità Crypto.com in arrivo nel 2025.